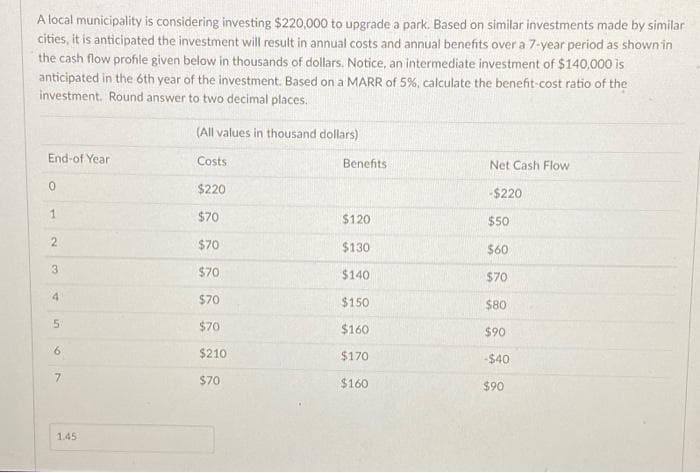

A local municipality is considering investing $220,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will result in annual costs and annual benefits over a 7-year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $140,000 is anticipated in the 6th year of the investment. Based on a MARR of 5%, calculate the benefit-cost ratio of the investment. Round answer to two decimal places. (All values in thousand dollars) End-of Year Costs Benefits Net Cash Flow $220 -$220 $70 $120 $50 2. $70 $130 $60 3. $70 $140 $70 4 $70 $150 $80 $70 $160 $90 6. $210 $170 $40 7. $70 $160 $90

A local municipality is considering investing $220,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will result in annual costs and annual benefits over a 7-year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $140,000 is anticipated in the 6th year of the investment. Based on a MARR of 5%, calculate the benefit-cost ratio of the investment. Round answer to two decimal places. (All values in thousand dollars) End-of Year Costs Benefits Net Cash Flow $220 -$220 $70 $120 $50 2. $70 $130 $60 3. $70 $140 $70 4 $70 $150 $80 $70 $160 $90 6. $210 $170 $40 7. $70 $160 $90

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 4P

Related questions

Question

Transcribed Image Text:A local municipality is considering investing $220,000 to upgrade a park. Based on similar investments made by similar

cities, it is anticipated the investment will result in annual costs and annual benefits over a 7-year period as shownin

the cash flow profhle given below in thousands of dollars. Notice, an intermediate investment of $140,000 is

anticipated in the 6th year of the investment. Based on a MARR of 5%, calculate the benefit-cost ratio of the

investment. Round answer to two decimal places.

(All values in thousand dollars)

End-of Year

Costs

Benefits

Net Cash Flow

$220

-$220

$70

$120

$50

$70

$130

$60

$70

$140

$70

4

$70

$150

$80

$70

$160

$90

$210

$170

-$40

7.

$70

$160

$90

1.45

2.

in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub