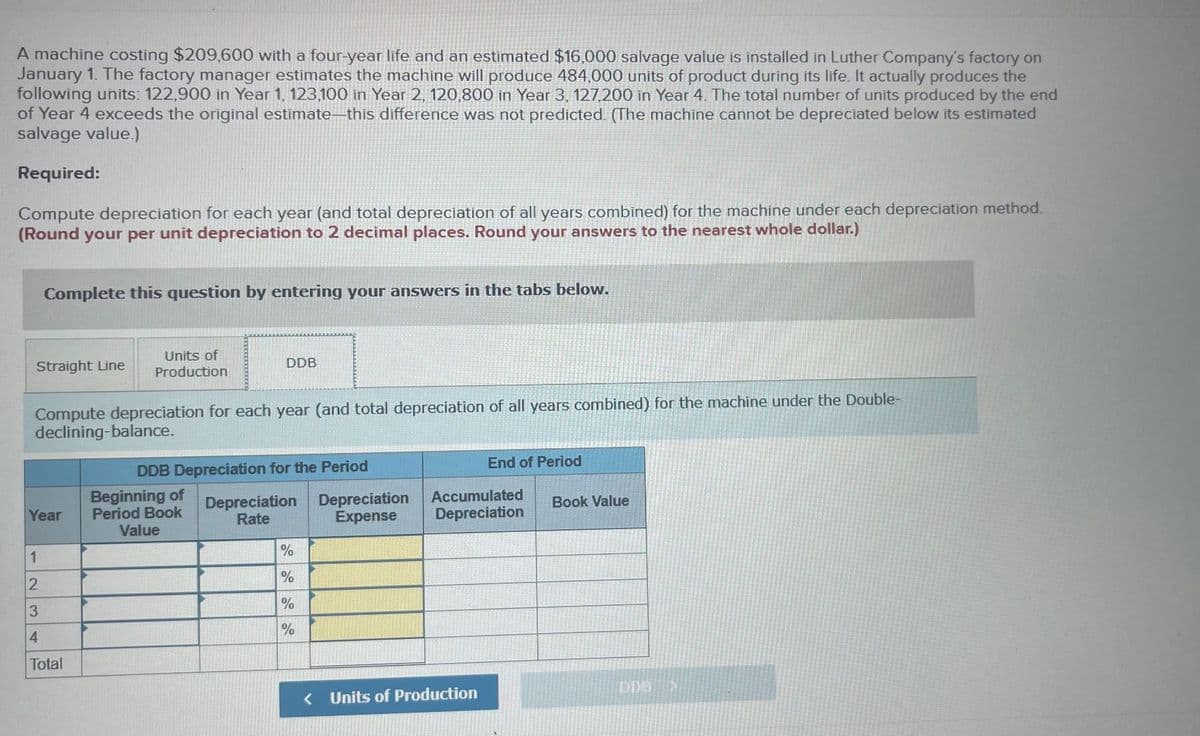

A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127.200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate–this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Units of Production Straight Line DDB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double- declining-balance. End of Period DDB Depreciation for the Period Beginning of Period Book Value Depreciation Depreciation Rate Accumulated Book Value Year Expense Depreciation % 1 % % 3 Total < Units of Production

A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127.200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate–this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Units of Production Straight Line DDB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double- declining-balance. End of Period DDB Depreciation for the Period Beginning of Period Book Value Depreciation Depreciation Rate Accumulated Book Value Year Expense Depreciation % 1 % % 3 Total < Units of Production

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter9: Depreciation (deprec)

Section: Chapter Questions

Problem 1R: Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an...

Related questions

Question

100%

Transcribed Image Text:A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on

January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the

following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127,200 in Year 4. The total number of units produced by the end

of Year 4 exceeds the original estimate–this difference was not predicted. (The machine cannot be depreciated below its estimated

salvage value.)

Required:

Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

(Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.)

Complete this question by entering your answers in the tabs below.

Units of

Production

Straight Line

DDB

Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double-

declining-balance.

End of Period

DDB Depreciation for the Period

Beginning of

Period Book

Value

Depreciation Depreciation

Rate

Accumulated

Book Value

Year

Expense

Depreciation

1

3.

%

4.

Total

< Units of Production

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning