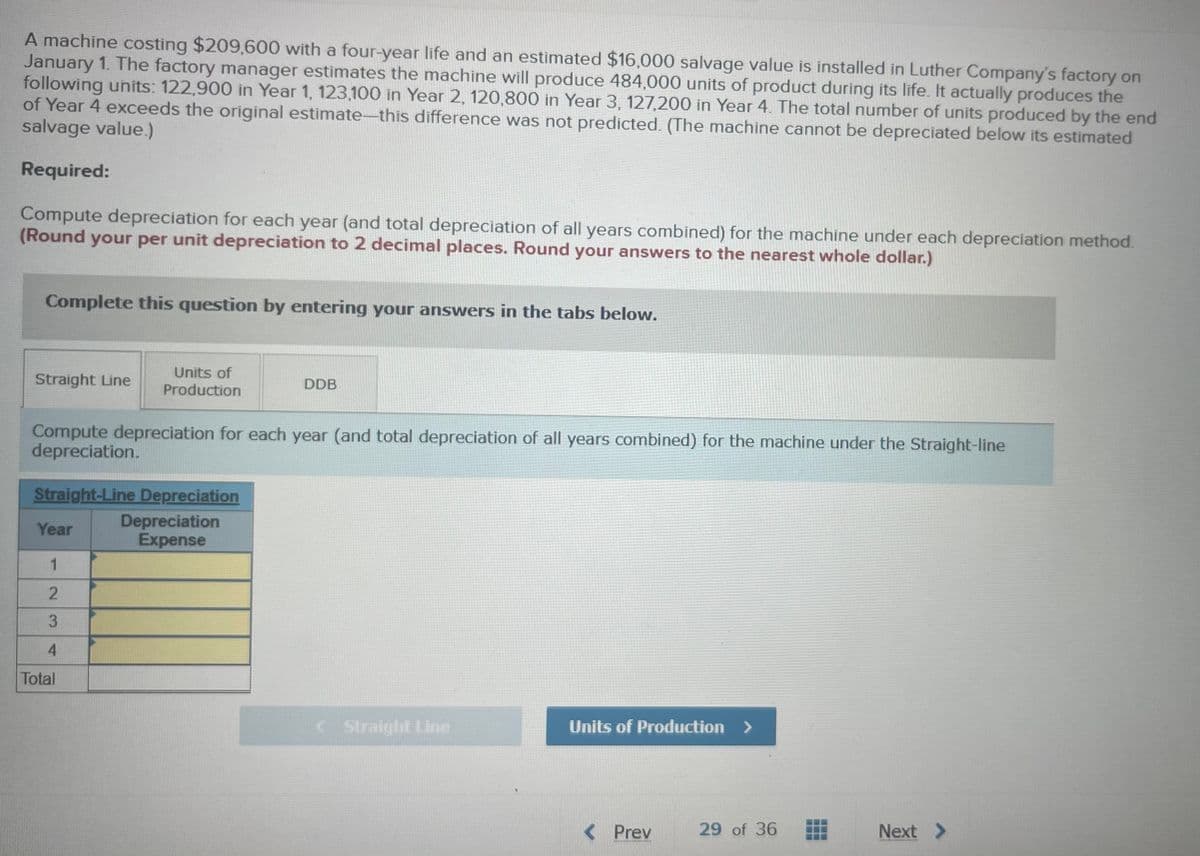

A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.)

A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

Transcribed Image Text:A machine costing $209,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on

January 1. The factory manager estimates the machine will produce 484,000 units of product during its life. It actually produces the

following units: 122,900 in Year 1, 123,100 in Year 2, 120,800 in Year 3, 127,200 in Year 4. The total number of units produced by the end

of Year 4 exceeds the original estimate-this difference was not predicted. (The machine cannot be depreciated below its estimated

salvage value.)

Required:

Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

(Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.)

Complete this question by entering your answers in the tabs below.

Units of

Production

Straight Line

DDB

Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line

depreciation.

Straight-Line Depreciation

Depreciation

Expense

Year

3.

4.

Total

Straight Line

Units of Production >

< Prev

29 of 36

Next >

口

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning