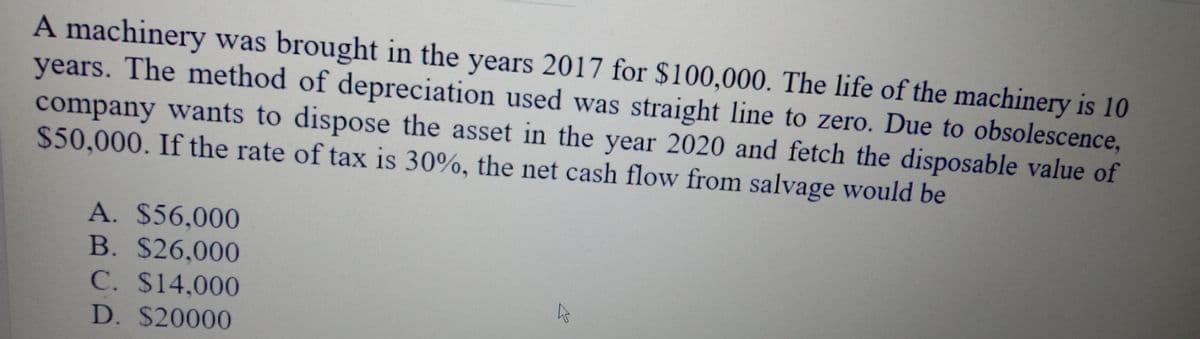

A machinery was brought in the years 2017 for $100,000. The life of the machinery is 10 years. The method of depreciation used was straight line to zero. Due to obsolescence, company wants to dispose the asset in the year 2020 and fetch the disposable value of $50,000. If the rate of tax is 30%, the net cash flow from salvage would be A. $56,000 B. $26,000 C. $14,000 D. $20000

Q: Wildhorse Corporation purchased an asset at a cost of $60,000 on March 1, 2020. The asset has a…

A: Depreciation refers to the decline in the value of an asset over a due course of time because of the…

Q: The Collins Corporation purchased office equipment at the beginning of 2014 and capitalized a cost…

A: 1.

Q: Coppola Company purchased a machine on January 1, 2016, for $20,000 cash. In addition, Coppola paid…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: Irwin, Inc. constructed a machine at a total cost of $79 million. Construction was completed at the…

A: Depreciation - It the amount reduce from the assets due to usage of the same over a period of time.…

Q: On July 1, 2015, Karen Company purchased equipment for $325,000; the estimated useful life was 10…

A: Annual Depreciation = (Cost of the assets - Salvage value) / life of the assets = ($325000 - $40000)…

Q: Around Jan 1, 2022, Coach Whip Corporation paid P5,000 for a piece of machinery. The same was…

A: A revaluation is an upward adjustment of a country's official exchange rate compared to a…

Q: January 1, 2021, NUBD Co. purchased a new machine for P100,000 with an estimated useful life of five…

A:

Q: During 2018, Starbucks purchased fixed assets costing approXximately $1.8 billion. Assume that the…

A: Book value of the asset at the end of the period is the value after depreciation. Depreciation is…

Q: At the beginning of 2009, Glass Manufacturing purchased a new machine for its assembly line at a…

A: Formula:

Q: On January 1, 2016, Denver Company bought a machine for $60,000. It was then estimated that the…

A: The depreciation expense can be calculated as depreciable cost divided by the useful life.

Q: On January 1, 2018 Crane Company will acquire a new asset that costs $400,000 and that is…

A: Calculate the old equipment’s after-tax sales value.

Q: On January 1, 2016, the Key West Company acquired a pie-making machine for $50,000. The machine was…

A: Depreciation - It is the fall in the value of the fixed asset due to various reasons like accident,…

Q: Burrell Company purchased a machine for $10,000 on January 2, 2019. The machine has an estimated…

A: DEPRECIATION UNDER DOUBLE DECLINING METHOD Rate =100%5 =20% Double declining rate = 20×2=40%

Q: On January 1, 2021, NUBD Co. purchased a new machine for P100,000 with an estimated useful life of…

A:

Q: Orange Corp. constructed a machine at a total cost of $70 million. Construction was completed at the…

A: Sum-of-the-years'-digits = 1+2+3+4+5+6+7+8+9+10 = 55 years…

Q: Yellow River Ltd purchased a machine on 1 July 2016 at a cost of $1280,000. The machine is expected…

A: Timing Difference: It is the differences between accounting income and taxable income due to…

Q: Irwin, Inc., constructed a machine at a total cost of $35 million. Construction was completed at the…

A:

Q: Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is expected to…

A: Calculation of company’s taxable profit Particular Amount (in $) Profit for the year…

Q: In the beginning of 2021, Ciento Company purchased equipment worth P250,000. It is estimated to be…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Hardy Man, Inc., acquired a machine in 2021 for P 400,000 and erroneously charged the cost to an…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage ,…

Q: On July 1, 2019, Nuuty Inc., a calendar-year company, purchased a machine for a cash price of…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On December 31, 2020, a company invested $2,150,000 in an asset. The company estimates that…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: On January 1, 2015, a corporation purchased a factory for P3,600,000 and machinery for P5,000,000.…

A:

Q: Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is expected to…

A: Tax is the liability which has to be paid by the individual and the corporation to the Federal…

Q: In 2020, Bailey Corporation discovered that equipment purchased on January 1, 2018, for $50,000 was…

A: Pass necessary rectification entries in the books of Bailey Corporation.

Q: Irwin, Inc. constructed a machine at a total cost of $35 million. Construction was completed at the…

A: Total sum = 1+2+3+4+5+6+7+8+9+10 = 55 Accumulated depreciation for 3 years= (Cost - Salvage…

Q: A machinery was brought in the years 2017 for $100,000. The life of the machinery is 10 years. The…

A: Cash flow after taxes (CFAT) is a measure of financial performance that shows a company's ability to…

Q: On April 1, 2018, Magnum Company purchased a delivery equipment for $88,000, with an expected useful…

A: The depreciation is an expense charged on fixed asset as the reduction in the value of fixed asset…

Q: Vincent Limited paid $100,000 to purchase equipment at the beginning of 2020. Vincent Limited…

A: Given: Equipment purchased $100,000 Estimated useful life is 5 years or 200,000…

Q: On January 2, 2018, Lem Corp. bought machinery under a contract that required a down payment of…

A: Depreciation is the method of accounting which is used for allocating the cost of physical or…

Q: On Jan. 1, 2021, Mother, Inc., whose financial year end is every Dec. 31, purchased a unit of…

A: Solution:- a)Calculation of the depreciation expense for 2021 using the straight line depreciation…

Q: On January 1, 2016, D Company acquires for $100,000 a new machine with an estimated useful life of…

A: The correct answer is Option (c).

Q: A machinery was brought in the years 2017 for $100,000. The life of the machinery is 10 years. The…

A: Net cash flow = sale value +tax shield from loss

Q: A machinery was brought in the years 2017 for $100000. The life of the machinery is 10 years. The…

A: After-tax salvage value is the net salvage value of an asset after taking the effect of a capital…

Q: Mortal Company acquired a machine for P3,200,000 on August 31, 2017. The machine has a 5-year useful…

A: Annual Depreciation = (Cost of the assets - residual value) / life of the assets =…

Q: On January 1, 2022, the Vallahara Company purchased machinery for P 650,000 which it installed in a…

A: Given, Purchase price of machine = P 650,000

Q: On January 1, 2022, the Vallahara Company purchased machinery for P 650,000 which it installed in a…

A: Impairment is a term used in accounting to characterize a lasting decrease in the value of a…

Q: ABC Corporation bought an equipment with a total cost of P4,000,000 on Jan. 1, 2016. It was…

A: A sudden decline in the value of an asset is called an impairment loss.

Q: Oriole Corporation purchased a machine on January 2, 2020, for $4300000. The machine has an…

A: Deferred tax liabilities (DTL) represent the current obligation of assessed tax which is not yet…

Q: Required: 1. Prepare schedules to determine whether, at the end of 2019, the machinery is impaired…

A: Requirement 1:

Q: Irwin, Inc. constructed a machine at a total cost of $39 million. Construction was completed at the…

A: Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset due to its…

Q: Irwin, Inc., constructed a machine at a total cost of $35 million. Construction was completed at the…

A: Change in depreciation method: A change in depreciation methods are considered as a change in…

Q: Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is expected to…

A: Deferred tax can be defined as the basis of allocating tax charges to particular accounting periods.…

Q: Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is expected to…

A: Definition: Journal entry: Journal entry is a set of economic events that can be measured in…

Q: Show the calculation of the amount of gain or loss to be recognized by Susan Co. from the exchange.

A: Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset due…

Q: On January 1, 2014, Barbed Company purchased an equipment for P900,000, with an estimated useful…

A: 1. Recoverable value is higher of fair value less cost of sale and value in use fair value -…

Q: Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is expected to…

A: Journal: Recording of a business transactions in a chronological order.

Q: A machinery was brought in the years 2017 for $100,000. The life of the machinery is 10 years. The…

A: A depreciation is a non-cash expenses for the company. The depreciation expenses is charged because…

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000