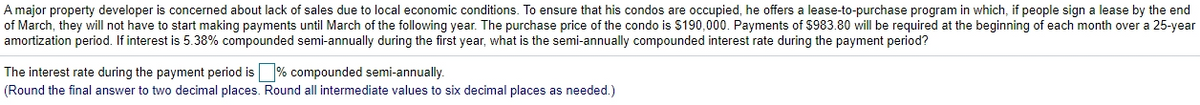

A major property developer is concerned about lack of sales due to local economic conditions. To ensure that his condos are occupied, he offers a lease-to-purchase program in which, if people sign a lease by the end of March, they will not have to start making payments until March of the following year. The purchase price of the condo is $190,000. Payments of $983.80 will be required at the beginning of each month over a 25-year amortization period. If interest is 5.38% compounded semi-annually during the first year, what is the semi-annually compounded interest rate during the payment period? The interest rate during the payment period is % compounded semi-annually. Round the final answer to two decimal places. Round all intermediate values to six decimal places as needed.)

A major property developer is concerned about lack of sales due to local economic conditions. To ensure that his condos are occupied, he offers a lease-to-purchase program in which, if people sign a lease by the end of March, they will not have to start making payments until March of the following year. The purchase price of the condo is $190,000. Payments of $983.80 will be required at the beginning of each month over a 25-year amortization period. If interest is 5.38% compounded semi-annually during the first year, what is the semi-annually compounded interest rate during the payment period? The interest rate during the payment period is % compounded semi-annually. Round the final answer to two decimal places. Round all intermediate values to six decimal places as needed.)

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Help me fast.....I will give good rating....

Transcribed Image Text:A major property developer is concerned about lack of sales due to local economic conditions. To ensure that his condos are occupied, he offers a lease-to-purchase program in which, if people sign a lease by the end

of March, they will not have to start making payments until March of the following year. The purchase price of the condo is $190,000. Payments of $983.80 will be required at the beginning of each month over a 25-year

amortization period. If interest is 5.38% compounded semi-annually during the first year, what

the semi-annually compounded interest rate during the payment period?

The interest rate during the payment period is % compounded semi-annually.

(Round the final answer to two decimal places. Round all intermediate values to six decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT