A manufacturing equipment costs $7800 and has no salvage value. Maintenance costs are expected to be SO for the first year but increases by $500 every year after that. Operating costs are expected to be $1400 every year machine will last 8 years and the interest rate is 10%, calculate the machine's economic life that minimizes the EUAC. only the following equations for the calculations to complete the table. AC of Capital recovery cost = 7800(A/P, 10%, t) AC of Maintenance costs 500 (A/G, 10%, t) mplete the following Table: Table of EUAC

A manufacturing equipment costs $7800 and has no salvage value. Maintenance costs are expected to be SO for the first year but increases by $500 every year after that. Operating costs are expected to be $1400 every year machine will last 8 years and the interest rate is 10%, calculate the machine's economic life that minimizes the EUAC. only the following equations for the calculations to complete the table. AC of Capital recovery cost = 7800(A/P, 10%, t) AC of Maintenance costs 500 (A/G, 10%, t) mplete the following Table: Table of EUAC

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

Mj

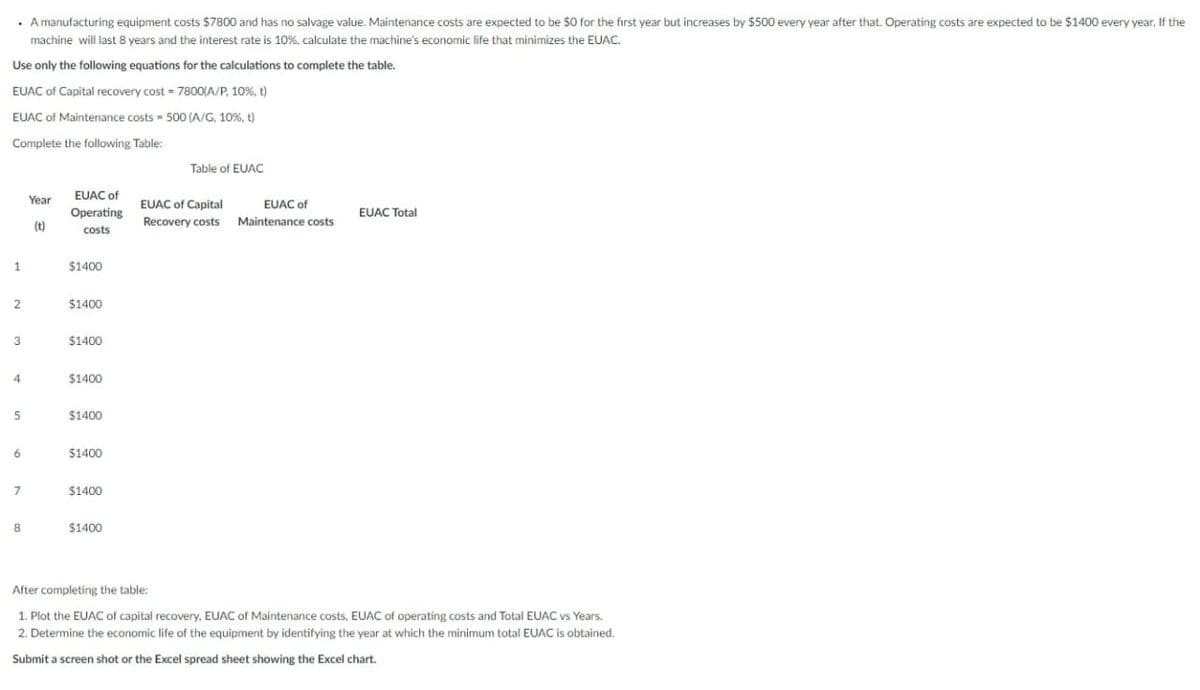

Transcribed Image Text:. A manufacturing equipment costs $7800 and has no salvage value. Maintenance costs are expected to be $0 for the first year but increases by $500 every year after that. Operating costs are expected to be $1400 every year. If the

machine will last 8 years and the interest rate is 10%, calculate the machine's economic life that minimizes the EUAC.

Use only the following equations for the calculations to complete the table.

EUAC of Capital recovery cost = 7800(A/P, 10%, t)

EUAC of Maintenance costs = 500 (A/G, 10%, t)

Complete the following Table:

1

2

3

4

5

6

7

8

Year

(t)

EUAC of

Operating

costs

$1400

$1400

$1400

$1400

$1400

$1400

$1400

$1400

Table of EUAC

EUAC of Capital

Recovery costs

EUAC of

Maintenance costs

EUAC Total

After completing the table:

1. Plot the EUAC of capital recovery, EUAC of Maintenance costs, EUAC of operating costs and Total EUAC vs Years.

2. Determine the economic life of the equipment by identifying the year at which the minimum total EUAC is obtained.

Submit a screen shot or the Excel spread sheet showing the Excel chart.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College