Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter7: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Liquidity ratios: current ratio; quick, or acid test,...

Related questions

Question

Please donot provide solution in image format provide solution in step by step format and fast solution

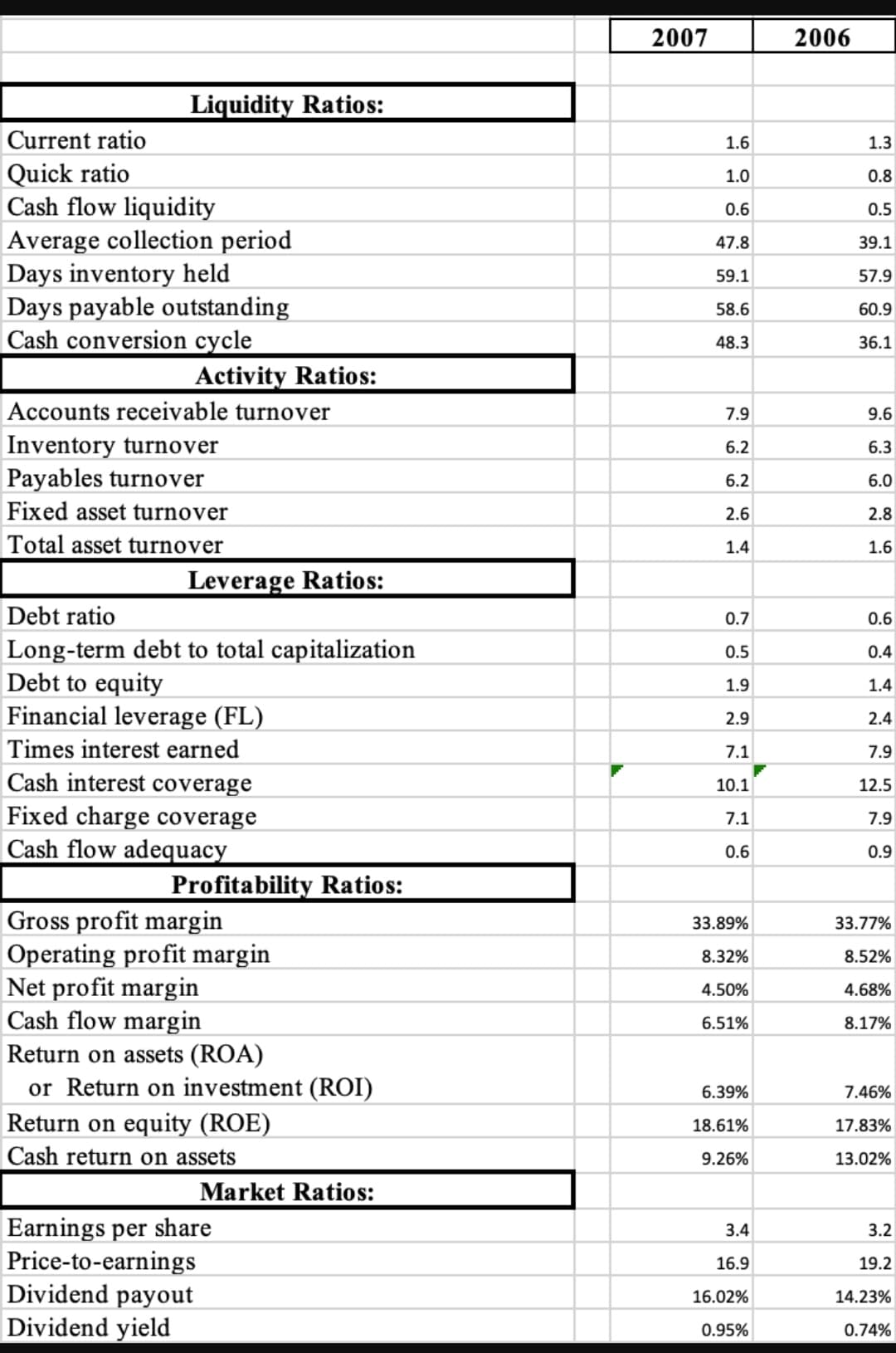

Using the information from Part I, comment on the following financial elements of Target Corporation:

Transcribed Image Text:Liquidity Ratios:

Current ratio

Quick ratio

Cash flow liquidity

Average collection period

Days inventory held

Days payable outstanding

Cash conversion cycle

Activity Ratios:

Accounts receivable turnover

Inventory turnover

Payables turnover

Fixed asset turnover

Total asset turnover

Leverage Ratios:

Debt ratio

Long-term debt to total capitalization

Debt to equity

Financial leverage (FL)

Times interest earned

Cash interest coverage

Fixed charge coverage

Cash flow adequacy

Profitability Ratios:

Gross profit margin

Operating profit margin

Net profit margin

Cash flow margin

Return on assets (ROA)

or Return on investment (ROI)

Return on equity (ROE)

Cash return on assets

Market Ratios:

Earnings per share

Price-to-earnings

Dividend payout

Dividend yield

2007

1.6

1.0

0.6

47.8

59.1

58.6

48.3

7.9

6.2

6.2

2.6

1.4

0.7

0.5

1.9

2.9

7.1

10.1

7.1

0.6

33.89%

8.32%

4.50%

6.51%

6.39%

18.61%

9.26%

3.4

16.9

16.02%

0.95%

2006

1.3

0.8

0.5

39.1

57.9

60.9

36.1

9.6

6.3

6.0

2.8

1.6

0.6

0.4

1.4

2.4

7.9

12.5

7.9

0.9

33.77%

8.52%

4.68%

8.17%

7.46%

17.83%

13.02%

3.2

19.2

14.23%

0.74%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning