A new vintage clothing store began operating within 2020. It is organized as a corporation, operates over a calendar year tan period, and opened its doors (began business) on April 1, 2020. Assume the total amount of start-up costs for the company was $42.200 and for organizational expenditures was $32,300. What amount of these organizational expenditures can be immediately expensed in 2020? Of the portion of these organizational expenditures that could not be immediately expensed, how much amortization expense can the business claim for 20307 O1. For organizational expenditures: $0 immediately expensed and $1,615 in amortization expense in 2020 OI. None of the answers given here. Simmediately expensed and $3,589 in amortization expense in 2020.

A new vintage clothing store began operating within 2020. It is organized as a corporation, operates over a calendar year tan period, and opened its doors (began business) on April 1, 2020. Assume the total amount of start-up costs for the company was $42.200 and for organizational expenditures was $32,300. What amount of these organizational expenditures can be immediately expensed in 2020? Of the portion of these organizational expenditures that could not be immediately expensed, how much amortization expense can the business claim for 20307 O1. For organizational expenditures: $0 immediately expensed and $1,615 in amortization expense in 2020 OI. None of the answers given here. Simmediately expensed and $3,589 in amortization expense in 2020.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Topic Video

Question

Transcribed Image Text:Question 20

Question 20 of 28

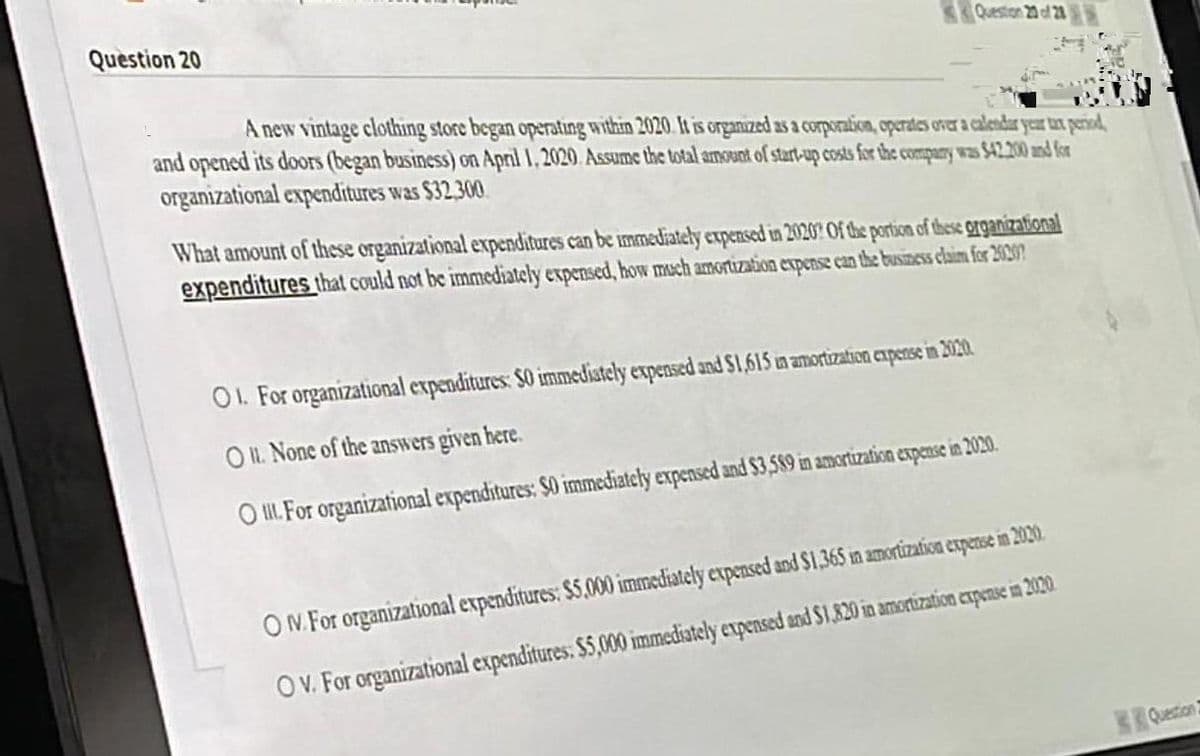

A new vintage clothing store began operating within 2020. It is organized as a corporation, operates over a calendar year tax period,

and opened its doors (began business) on April 1, 2020. Assume the total amount of start-up costs for the company was $42.200 and for

organizational expenditures was $32,300

What amount of these organizational expenditures can be immediately expensed in 2020? Of the portion of these organizational

expenditures that could not be immediately expensed, how much amortization expense can the business claim for 2020?

O1. For organizational expenditures: 50 immediately expensed and $1,615 in amortization expense in 2020.

OIL. None of the answers given here.

O. For organizational expenditures: $0 immediately expensed and $3,589 in amortization expense in 2020.

ON. For organizational expenditures: $5,000 immediately expensed and $1,365 in amortization expense in 2020.

OV. For organizational expenditures. $5,000 immediately expensed and $1,820 in amortization expense in 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning