ms. In 2021, SHE had provided you, its CPA, with the following information ab activities: ross profit from sales of home entertainment systems $475,000 (no book-tax fferences). ividends SHE received from a 21 percent-owned corporation of $137,000. SHI quity method of accounting this minority-owned subsidiary and this also repre o rata share of the corporation's earnings. xpenses other than the dividend received deduction (DRD), charitable contrib nd net operating loss (NOL), are $339,000. HE's tax depreciation exceeded book depreciation by $18,500 OL carryover from prior year of $17,000. HE's book federal income tax expense is $57,000.

ms. In 2021, SHE had provided you, its CPA, with the following information ab activities: ross profit from sales of home entertainment systems $475,000 (no book-tax fferences). ividends SHE received from a 21 percent-owned corporation of $137,000. SHI quity method of accounting this minority-owned subsidiary and this also repre o rata share of the corporation's earnings. xpenses other than the dividend received deduction (DRD), charitable contrib nd net operating loss (NOL), are $339,000. HE's tax depreciation exceeded book depreciation by $18,500 OL carryover from prior year of $17,000. HE's book federal income tax expense is $57,000.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

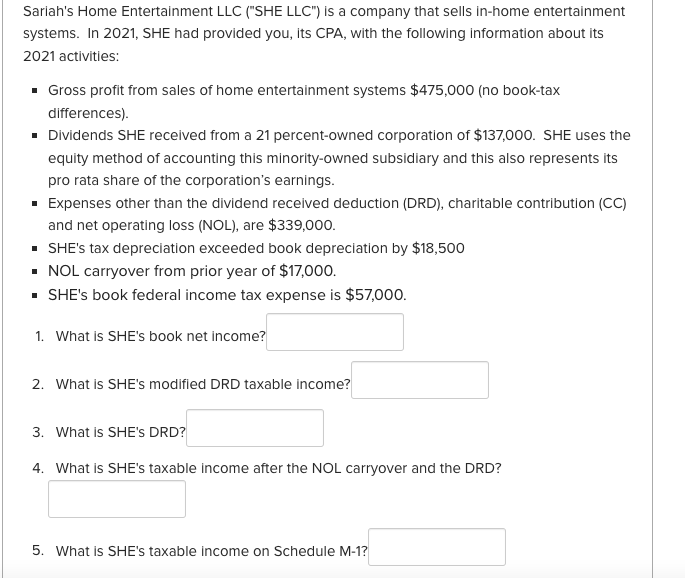

Transcribed Image Text:Sariah's Home Entertainment LLC ("SHE LLC") is a company that sells in-home entertainment

systems. In 2021, SHE had provided you, its CPA, with the following information about its

2021 activities:

▪ Gross profit from sales of home entertainment systems $475,000 (no book-tax

differences).

▪ Dividends SHE received from a 21 percent-owned corporation of $137,000. SHE uses the

equity method of accounting this minority-owned subsidiary and this also represents its

pro rata share of the corporation's earnings.

▪ Expenses other than the dividend received deduction (DRD), charitable contribution (CC)

and net operating loss (NOL), are $339,000.

▪ SHE's tax depreciation exceeded book depreciation by $18,500

▪ NOL carryover from prior year of $17,000.

▪ SHE's book federal income tax expense is $57,000.

1. What is SHE's book net income?

2. What is SHE's modified DRD taxable income?

3. What is SHE'S DRD?

4. What is SHE's taxable income after the NOL carryover and the DRD?

5. What is SHE's taxable income on Schedule M-1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you