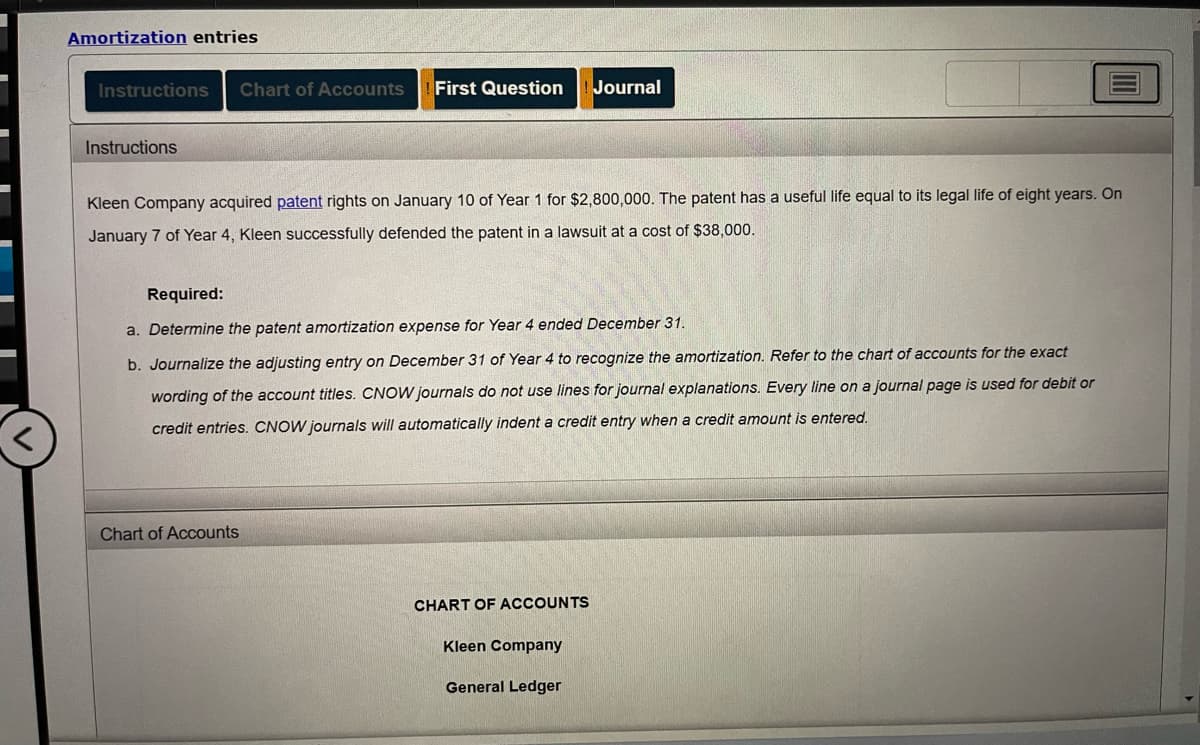

Amortization entries Instructions Chart of Accounts First Question Journal Instructions Kleen Company acquired patent rights on January 10 of Year 1 for $2,800,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $38,000. Required: a. Determine the patent amortization expense for Year 4 ended December 31. b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Kleen Company General Ledger

Amortization entries Instructions Chart of Accounts First Question Journal Instructions Kleen Company acquired patent rights on January 10 of Year 1 for $2,800,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $38,000. Required: a. Determine the patent amortization expense for Year 4 ended December 31. b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Kleen Company General Ledger

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 64E

Related questions

Question

Transcribed Image Text:Amortization entries

Instructions Chart of Accounts First Question

Journal

Instructions

Kleen Company acquired patent rights on January 10 of Year 1 for $2,800,000. The patent has a useful life equal to its legal life of eight years. On

January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $38,000.

Required:

a. Determine the patent amortization expense for Year 4 ended December 31.

b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. Refer to the chart of accounts for the exact

wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or

credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

Chart of Accounts

CHART OF ACCOUNTS

Kleen Company

General Ledger

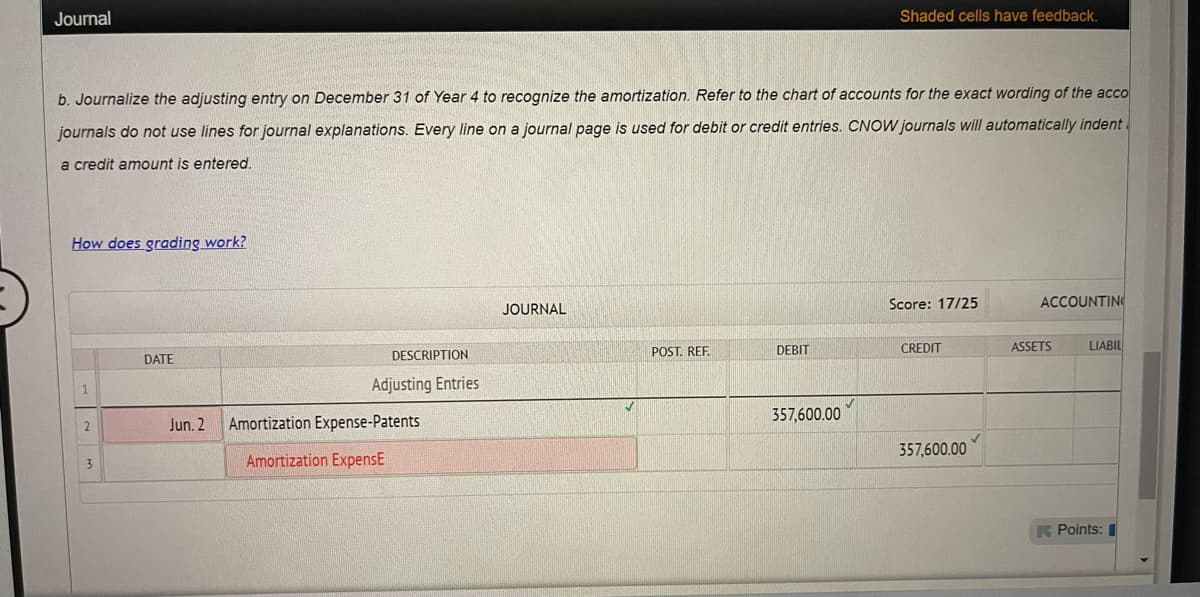

Transcribed Image Text:Journal

Shaded cells have feedback.

b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. Refer to the chart of accounts for the exact wording of the acco

journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent

a credit amount is entered.

How does grading work?

JOURNAL

Score: 17/25

CREDIT

ACCOUNTING

ASSETS LIABIL

DATE

DESCRIPTION

POST. REF.

DEBIT

1

Adjusting Entries

357,600.00

357,600.00

K Points:

2

Jun. 2

Amortization Expense-Patents

Amortization ExpensE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,