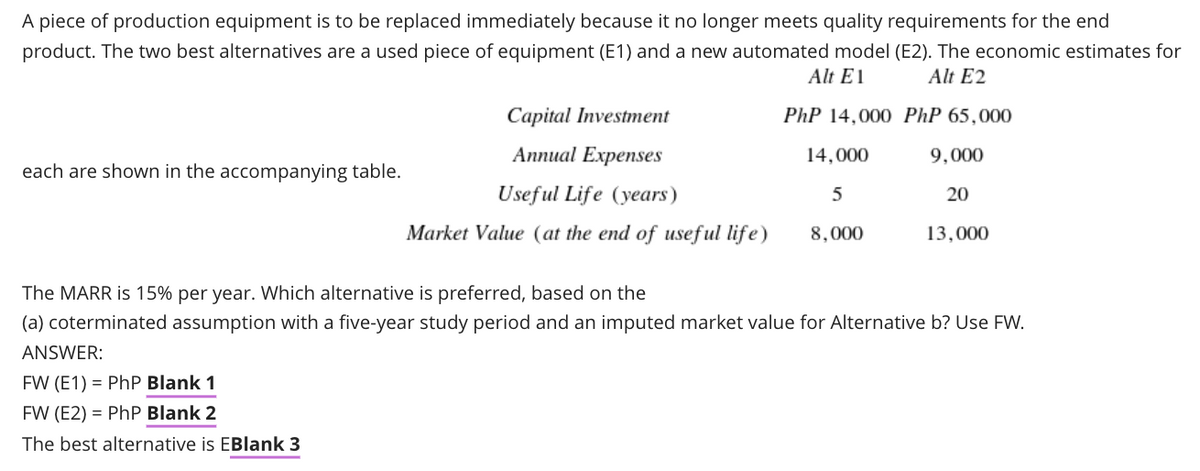

A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for Alt E1 Alt E2 Capital Investment PhP 14,000 PhP 65,000 Aппual Expenses 14,000 9,000 each are shown in the accompanying table. Useful Life (years) 20 Market Value (at the end of useful life) 8,000 13,000 The MARR is 15% per year. Which alternative is preferred, based on the (a) coterminated assumption with a five-year study period and an imputed market value for Alternative b? Use FW.

A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for Alt E1 Alt E2 Capital Investment PhP 14,000 PhP 65,000 Aппual Expenses 14,000 9,000 each are shown in the accompanying table. Useful Life (years) 20 Market Value (at the end of useful life) 8,000 13,000 The MARR is 15% per year. Which alternative is preferred, based on the (a) coterminated assumption with a five-year study period and an imputed market value for Alternative b? Use FW.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 8Q

Related questions

Question

Transcribed Image Text:A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end

product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for

Alt E1

Alt E2

Capital Investment

PhP 14,000 PhP 65,000

Aппual Expenses

14,000

9,000

each are shown in the accompanying table.

Useful Life (years)

5

20

Market Value (at the end of useful life)

8,000

13,000

The MARR is 15% per year. Which alternative is preferred, based on the

(a) coterminated assumption with a five-year study period and an imputed market value for Alternative b? Use FW.

ANSWER:

FW (E1) = PhP Blank 1

FW (E2) = PhP Blank 2

The best alternative is EBlank 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning