Regulation of Deposit Insurance rue or False: Prior to 1991, all U.S. banks pald the same rate on FDIC Insurance, causing banks to engage in riskier behaviors, which is an example of he moral hazard problem. O True O False tegulation of Deposits Vhich of the following removed restrictions on opening bank branches across state lines? O The Community Reinvestment Act (CRA) The Riegle-Neal Interstate Banking and Branching Efficiency Act O The Garn-St. Germain Act O The Depository Institutions Deregulation and Monetary Control Act (DIDMCA)

Regulation of Deposit Insurance rue or False: Prior to 1991, all U.S. banks pald the same rate on FDIC Insurance, causing banks to engage in riskier behaviors, which is an example of he moral hazard problem. O True O False tegulation of Deposits Vhich of the following removed restrictions on opening bank branches across state lines? O The Community Reinvestment Act (CRA) The Riegle-Neal Interstate Banking and Branching Efficiency Act O The Garn-St. Germain Act O The Depository Institutions Deregulation and Monetary Control Act (DIDMCA)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12C: Researching GAAP Situation Hamilton Company operates in an industry with numerous competitors. It is...

Related questions

Question

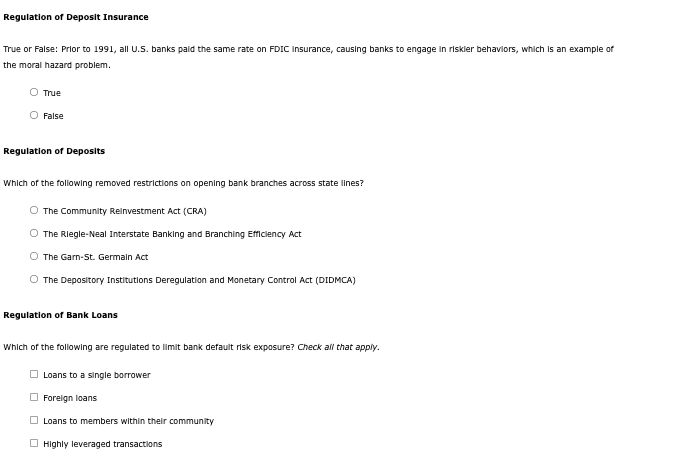

Transcribed Image Text:Regulation of Deposit Insurance

True or False: Prior to 1991, all U.S. banks pald the same rate on FDIC Insurance, causing banks to engage in riskler behavlors, which is an example of

the moral hazard problem.

O True

O False

Regulation of Deposits

Which of the following removed restrictions on opening bank branches across state lines?

O The Community Reinvestment Act (CRA)

O The Riegle-Neal Interstate Banking and Branching Efficiency Act

O The Garn-St. Germain Act

O The Depository Institutions Deregulation and Monetary Control Act (DIDMCA)

Regulation of Bank Loans

Which of the following are regulated to limit bank default risk exposure? Check all that apply.

Loans to a single borrower

O Foreign loans

O Loans to members within their community

O Highly leveraged transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage