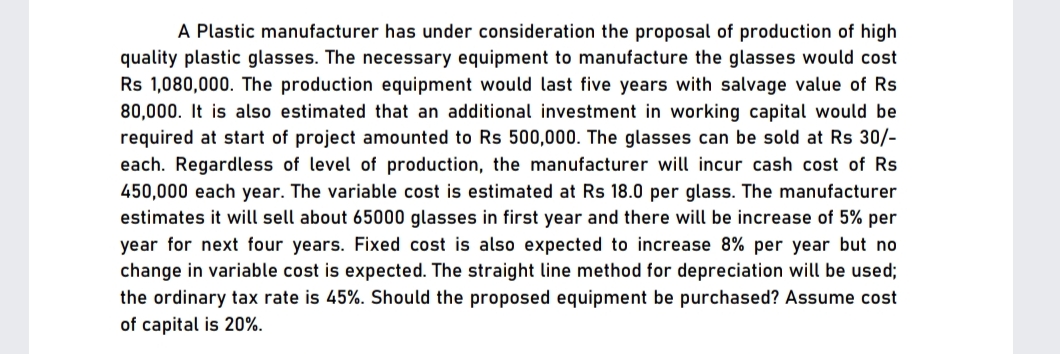

A Plastic manufacturer has under consideration the proposal of production of high quality plastic glasses. The necessary equipment to manufacture the glasses would cost Rs 1,080,000. The production equipment would last five years with salvage value of Rs 80,000. It is also estimated that an additional investment in working capital would be required at start of project amounted to Rs 500,000. The glasses can be sold at Rs 30/- each. Regardless of level of production, the manufacturer will incur cash cost of Rs 450,000 each year. The variable cost is estimated at Rs 18.0 per glass. The manufacturer estimates it will sell about 65000 glasses in first year and there will be increase of 5% per year for next four years. Fixed cost is also expected to increase 8% per year but no change in variable cost is expected. The straight line method for depreciation will be used; the ordinary tax rate is 45%. Should the proposed equipment be purchased? Assume cost of capital is 20%.

A Plastic manufacturer has under consideration the proposal of production of high quality plastic glasses. The necessary equipment to manufacture the glasses would cost Rs 1,080,000. The production equipment would last five years with salvage value of Rs 80,000. It is also estimated that an additional investment in working capital would be required at start of project amounted to Rs 500,000. The glasses can be sold at Rs 30/- each. Regardless of level of production, the manufacturer will incur cash cost of Rs 450,000 each year. The variable cost is estimated at Rs 18.0 per glass. The manufacturer estimates it will sell about 65000 glasses in first year and there will be increase of 5% per year for next four years. Fixed cost is also expected to increase 8% per year but no change in variable cost is expected. The straight line method for depreciation will be used; the ordinary tax rate is 45%. Should the proposed equipment be purchased? Assume cost of capital is 20%.

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1eM

Related questions

Question

100%

Transcribed Image Text:A Plastic manufacturer has under consideration the proposal of production of high

quality plastic glasses. The necessary equipment to manufacture the glasses would cost

Rs 1,080,000. The production equipment would last five years with salvage value of Rs

80,000. It is also estimated that an additional investment in working capital would be

required at start of project amounted to Rs 500,000. The glasses can be sold at Rs 30/-

each. Regardless of level of production, the manufacturer will incur cash cost of Rs

450,000 each year. The variable cost is estimated at Rs 18.0 per glass. The manufacturer

estimates it will sell about 65000 glasses in first year and there will be increase of 5% per

year for next four years. Fixed cost

change in variable cost is expected. The straight line method for depreciation will be used;

the ordinary tax rate is 45%. Should the proposed equipment be purchased? Assume cost

of capital is 20%.

also expected to increase 8% per year but no

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning