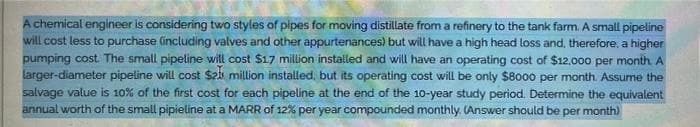

A chemical engineer is considering two styles of pipes for moving distillate from a refinery to the tank farm A small pipeline will cost less to purchase including valves and other appurtenances) but will have a high head loss and, therefore, a highen pumping cost The small pipeline will cost $17 million installed and will have an operating cost of $12,000 per month larger-diameter pipeline will cost $2 million installed, but its operating cost will be only $8000 per month. Assume the salvage value is 10% of the first cost for each pipeline at the end of the 10-year study period. Determine the equivalent annual worth of the small pipieline at a MARR of 12% per year compounded monthly. Answer should be per month)

Q: Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Ye...

A: a) NPV=? When r =8% Year Cashflow ($) PVIF @8% PV= Cashflows*PVIF 0 -37000000 1 -37000000 1 5...

Q: Combine the different component costs to determine the firm’s WACC.

A: WACC is the organization cost of capital in which each component (debt and equity) is considered on...

Q: Nicole loans P900,000 from bank today which gives her 10% interest rate compounded annually. Based o...

A: Loan amount (L) = P 900000 r = 10% n = 10 payments Let the annual payment = A

Q: 5. Assuming making four annual deposits of ($ 1000), and the first payment occurs at the end of the ...

A: Annuity can be defined as a series of payments or receipts of equal amounts of money at equal interv...

Q: Why is the NPV preferred over the IRR?

A: Net Present Value is a method of finding the profitability of a project by discounting future cash f...

Q: IRRs

A: IRR stands for internal rate of return is a process of computing the percentage of return over inves...

Q: Studies concluded that college graduation is a very good investment. Suppose a college graduate make...

A: Expected value of college graduation can be found using the earnings average and percentage given. S...

Q: 13) Your company bought a piece of machinery for $80,000, and depreciated it using a 5-year MACRS ap...

A: Depreciation is defined as any fall in the value of an asset due to its usage and time spent on it. ...

Q: Howell Petroleum, Ic., is trying to evaluate a generation project with the following cash flows: Yea...

A: NPV can be calculated by following function in excel =NPV(rate,value1,[value2],…) + Initial investme...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: WACC: It stands for Weighted Average Cost of Capital. It refers to the total cost of the project. It...

Q: Ronnie invests $55,000 in a food truck (which has a lifespan of two years) , the net cash flows of ...

A: In order to find net present value, subtract the present worth of cash outflows (or initial investme...

Q: Mrs. Go make deposits that forms a geometric gradient that increases at 6%per month for 1 year. She ...

A: Annuity represents the equal payments made constantly and gradient for annuity shows the constant in...

Q: Penny Pincher Discount Grocers has issued a bond with a coupon rate of 11%. It recently closed at a ...

A: Current yield = Face value of bond * Coupon rate / Current stock price

Q: Daryl Kearns saved $240,000 during the 30 years that he worked for a major corporation. Now he has r...

A: Net present value is the sum of the present value of net of all cash outflows and inflows discounted...

Q: What do you think is the current state of business opportunites for venture capital invetors in the ...

A: Venture capital is professionally managed equity capital used to fund high-growth, small and medium-...

Q: draw the cash flow tnx.

A: The present value is the total value of the future payment series you must have now. For example, if...

Q: (a) Assuming no withdrawals are made, how much money is in the Youngs' account after 3 years? (b) Ho...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: 5) In late November 2014, a car dealership in southern Wisconsin was offering a new 2014 Toyota Coro...

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first...

Q: Last month, corporations supplied $250 billion in one-year discount bonds to investors at an average...

A: Slope of demand curve is defiened as the change in price divided by the change in suppy of the bond....

Q: Compute the present value for each of the following bonds a. Priced at the end of its fifth year, a ...

A: To Find: Present Value of Bonds

Q: Company ABS’s Cash Conversion Cycle has 241.46 days while Company CBN has 194 days of CCC. Which com...

A: Cash conversion cycle (CCC) refers to the time period ( number of days) between the payment for raw ...

Q: Consider a bond with a coupon of 5.8 percent, eleven years to maturity, and a current price of $1,06...

A: Yield to maturity (YTM) is the total return expected on the bond if the bold is held till maturity. ...

Q: Markowitz Portfolio Theory

A: Modern portfolio theory states that the investor can choose the mix of low-risk and riskier investme...

Q: Emily Dao, 27, just received a promotion at work that increased her annual salary to $37,000. She is...

A: Since you have posted a multiple question, therefore, we will be solving the first question only as ...

Q: What does the financial breakeven point shows?

A: A breakeven point is a situation of no loss no profit. The breakeven point is generally calculated a...

Q: John has been asked to evaluate whether it would be better to lease an asset or to borrow money from...

A: Net Present Value is the difference between the present value of cash inflows and present value of c...

Q: Achi Corp. has preferred stock with an annual dividend of $2.83. If the required return on Achi's p...

A: Annual dividend = $2.83 Required return = 7.5%

Q: Price Forward Dividend 1T Target Est $86.36 $2.08 $105.28 Given the information in the table, if the...

A: Given Forward dividend = $2.08 1T Target Est = $105.28 Required return = 11.5%

Q: A $5,000 bond that has a coupon rate of 5.60% payable semi-annually and maturity of 5 years was purc...

A: The book value of the bond refers to the money that the issuer of the bond owes to the holder of the...

Q: Consider the decision of whether to hold wealth as money or as an interest-earning asset that pays a...

A: The nominal interest rate is the rate that we get before any adjustments are made. The real rate is ...

Q: Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a fac...

A: Cash Flow at the time of maturity = $1000 Interest (Annuity) annually = ($1000 * 7.8%) =$78 Tabl...

Q: Find the present value PV of the annuity account necessary to fund the withdrawal given

A: Present Value of Annuity: It represents the present worth of the future annuity periodic payments m...

Q: (b) A trader buys one May2022 futures contracts on frozen orange juice. Each contract is for the del...

A: Margin call is made in a situation where due to change in market price, the margin balance falls bel...

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: The majority of businesses employ a combination of equity and (debt) loan funding.The rate of return...

Q: Required: Calculate the quick ratio in each of the above cases and select the case which is in the b...

A: Quick Ratio: It is a measure of the firm's short-term liquidity and shows the ability of the firm t...

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash F...

A: NPV or Net present value is determined by adding the discounted value of all inflows and outflows to...

Q: 1. Compute the cost of equity for this project 2. Compute the relevant cost of debt for this projec...

A: Weighted average cost of capital (WACC) refers to the combined cost of company's capital from all th...

Q: For an 18-year, 3.09% annual-pay bond currently trading at par, calculate the approximate modified d...

A:

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts f...

Q: State the key characteristics of active fund management and passive fund management, focusing on how...

A: Fund management refers to the process of managing a financial institution's cash flow and the fund m...

Q: When your first child is born, you begin to save for college by depositing $225 per month in an acco...

A: Future value is calculated by multiplying the present value with the 1+r factor for the given rate o...

Q: Basic Opfion Strafegies Profif Computation Assume the below prices for calls and puts: Call Put Stri...

A: Call option A call option gives its holder the right to purchase the stock at the strike price. With...

Q: stock. The required return on this stock is 13 percent. What will your capital gain and capital gain...

A: The capital gain is the increase in price of stock due to the dividend and dividend growth rate and ...

Q: What is the price of Thera Corpn's zero coupon bond with 10 years to maturity? The bond was original...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: Eight years ago, Ohio Valley Trucking purchased a large-capacity dump truck for $110,000 to provide ...

A: Purchase price of truck is $110,000 Time period 8 years Per year maintainance cost is $12,200 Resale...

Q: a) Use rate of return (ROR) analysis to determine which of the mutually exclusive projects listed be...

A: Mutually exclusive projects are those available set of investment alternatives who are closely relat...

Q: If Average assets and capital are 900,000 and 540,000, respectively, with a net income of 47,520, wh...

A: Return on equity is a type of financial ratio of a company. Return on equity is a performance measur...

Q: Motorhed Inc is currently trading at $8 per share with 2.5 billion shares on issue. It announces a 2...

A: Current price -$8 No of shares – 2.5 billion Total value of shares = 2.5*8 = $20 billion Right iss...

Q: How transactions between suppliers and users of funds take place. How would you prove that there was...

A: Financial markets are marketplaces where fund suppliers and fund demanders can do business. Financia...

Q: On January 1, Year 1, you are considering the purchase of Nico Enterprises' common stock. Based on y...

A: Current value of common stock can be calculated as the summation of present value of dividend paymen...

Step by step

Solved in 2 steps

- The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 8%, and the projects’ expected net costs are listed in the following table: What is the IRR of each alternative? What is the present value of the costs of each alternative? Which method should be chosen?Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Shelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?

- Southland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.At Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?Emerald Island Company is considering building a manufacturing plant in County Kerry. Predicting sales of 100,000 units, Emerald Isle estimates the following expenses: An Irish firm that specializes in marketing will be engaged to sell the manufactured product and will receive a commission of 10% of the sales price. None of the U.S. home office expense will be allocated to the Irish facility. Required: 1. If the unit sales price is 2, how many units must be sold to break even? (Hint: First compute the variable cost per unit.) 2. Calculate the margin of safety ratio. 3. Calculate the contribution margin ratio.

- Lander Parts, Inc., produces various automobile parts. In one plant, Lander has a manufacturing cell with the theoretical capability to produce 450,000 fuel pumps per quarter. The conversion cost per quarter is 9,000,000. There are 150,000 production hours available within the cell per quarter. Required: 1. Compute the theoretical velocity (per hour) and the theoretical cycle time (minutes per unit produced). 2. Compute the ideal amount of conversion cost that will be assigned per subassembly. 3. Suppose the actual time required to produce a fuel pump is 40 minutes. Compute the amount of conversion cost actually assigned to each unit produced. What happens to product cost if the time to produce a unit is decreased to 25 minutes? How can a firm encourage managers to reduce cycle time? Finally, discuss how this approach to assigning conversion cost can improve delivery time. 4. Assuming the actual time to produce one fuel pump is 40 minutes, calculate MCE. How much non-value-added time is being used? How much is it costing per unit? 5. Cycle time, velocity, MCE, conversion cost per unit (theoretical conversion rate actual conversion time), and non-value-added costs are all measures of performance for the cell process. Discuss the incentives provided by these measures.Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)I know that its the thing to do, insisted Pamela Kincaid, vice president of finance for Colgate Manufacturing. If we are going to be competitive, we need to build this completely automated plant. Im not so sure, replied Bill Thomas, CEO of Colgate. The savings from labor reductions and increased productivity are only 4 million per year. The price tag for this factoryand its a small oneis 45 million. That gives a payback period of more than 11 years. Thats a long time to put the companys money at risk. Yeah, but youre overlooking the savings that well get from the increase in quality, interjected John Simpson, production manager. With this system, we can decrease our waste and our rework time significantly. Those savings are worth another million dollars per year. Another million will only cut the payback to about 9 years, retorted Bill. Ron, youre the marketing managerdo you have any insights? Well, there are other factors to consider, such as service quality and market share. I think that increasing our product quality and improving our delivery service will make us a lot more competitive. I know for a fact that two of our competitors have decided against automation. Thatll give us a shot at their customers, provided our product is of higher quality and we can deliver it faster. I estimate that itll increase our net cash benefits by another 2.4 million. Wow! Now thats impressive, Bill exclaimed, nearly convinced. The payback is now getting down to a reasonable level. I agree, said Pamela, but we do need to be sure that its a sound investment. I know that estimates for construction of the facility have gone as high as 48 million. I also know that the expected residual value, after the 20 years of service we expect to get, is 5 million. I think I had better see if this project can cover our 14% cost of capital. Now wait a minute, Pamela, Bill demanded. You know that I usually insist on a 20% rate of return, especially for a project of this magnitude. Required: 1. Compute the NPV of the project by using the original savings and investment figures. Calculate by using discount rates of 14% and 20%. Include salvage value in the computation. 2. Compute the NPV of the project using the additional benefits noted by the production and marketing managers. Also, use the original cost estimate of 45 million. Again, calculate for both possible discount rates. 3. Compute the NPV of the project using all estimates of cash flows, including the possible initial outlay of 48 million. Calculate by using discount rates of 14% and 20%. 4. CONCEPTUAL CONNECTION If you were making the decision, what would you do? Explain.

- Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?Mortech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,500 per month in fixed costs. Mortech sells 200 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $45 per unit of variable costs, plus an increase in fixed costs of $1,000 per month. The current price of the camera is $200. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings?