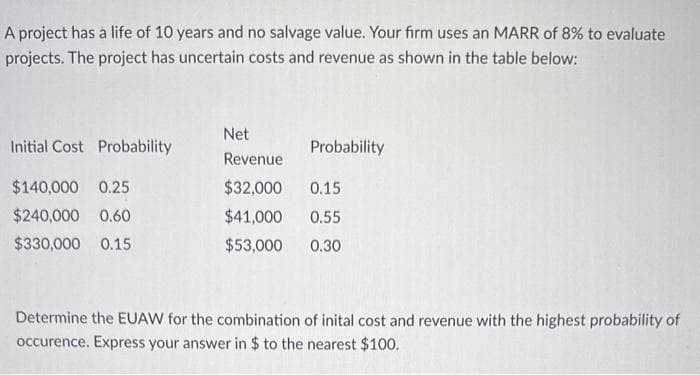

A project has a life of 10 years and no salvage value. Your firm uses an MARR of 8% to evaluate projects. The project has uncertain costs and revenue as shown in the table below: Initial Cost Probability $140,000 0.25 $240,000 0.60 $330,000 0.15 Net Revenue $32,000 0.15 $41,000 0.55 $53,000 0.30 Probability Determine the EUAW for the combination of inital cost and revenue with the highest probability of occurence. Express your answer in $ to the nearest $100.

A project has a life of 10 years and no salvage value. Your firm uses an MARR of 8% to evaluate projects. The project has uncertain costs and revenue as shown in the table below: Initial Cost Probability $140,000 0.25 $240,000 0.60 $330,000 0.15 Net Revenue $32,000 0.15 $41,000 0.55 $53,000 0.30 Probability Determine the EUAW for the combination of inital cost and revenue with the highest probability of occurence. Express your answer in $ to the nearest $100.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

Solve neatly with proper explanation

Transcribed Image Text:A project has a life of 10 years and no salvage value. Your firm uses an MARR of 8% to evaluate

projects. The project has uncertain costs and revenue as shown in the table below:

Initial Cost Probability

$140,000 0.25

$240,000 0.60

$330,000 0.15

Net

Revenue

$32,000 0.15

$41,000 0.55

$53,000

0.30

Probability

Determine the EUAW for the combination of inital cost and revenue with the highest probability of

occurence. Express your answer in $ to the nearest $100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning