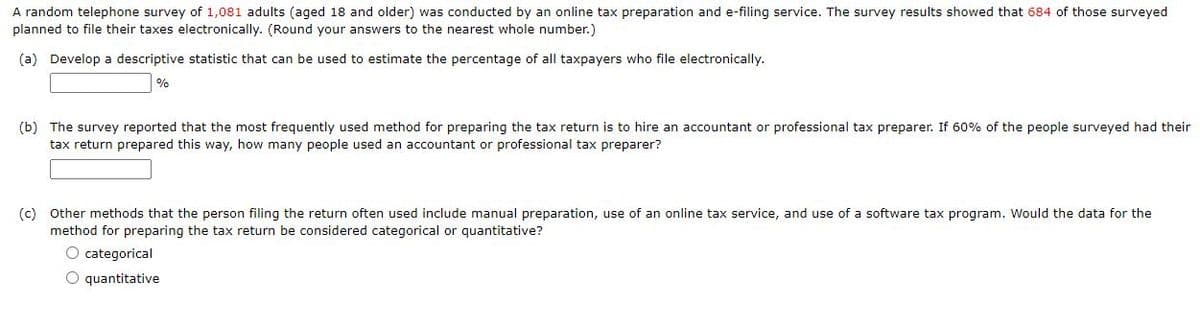

A random telephone survey of 1,081 adults (aged 18 and older) was conducted by an online tax preparation and e-filing service. The survey results showed that 684 of those surveyed planned to file their taxes electronically. (Round your answers to the nearest whole number.) (a) Develop a descriptive statistic that can be used to estimate the percentage of all taxpayers who file electronically. (b) The survey reported that the most frequently used method for preparing the tax return is to hire an accountant or professional tax preparer. If 60% of the people surveyed had their tax return prepared this way, how many people used an accountant or professional tax preparer? (c) Other methods that the person filing the return often used include manual preparation, use of an online tax service, and use of a software tax program. Would the data for the method for preparing the tax return be considered categorical or quantitative? O categorical O quantitative

A random telephone survey of 1,081 adults (aged 18 and older) was conducted by an online tax preparation and e-filing service. The survey results showed that 684 of those surveyed planned to file their taxes electronically. (Round your answers to the nearest whole number.) (a) Develop a descriptive statistic that can be used to estimate the percentage of all taxpayers who file electronically. (b) The survey reported that the most frequently used method for preparing the tax return is to hire an accountant or professional tax preparer. If 60% of the people surveyed had their tax return prepared this way, how many people used an accountant or professional tax preparer? (c) Other methods that the person filing the return often used include manual preparation, use of an online tax service, and use of a software tax program. Would the data for the method for preparing the tax return be considered categorical or quantitative? O categorical O quantitative

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 30PPS

Related questions

Topic Video

Question

Transcribed Image Text:A random telephone survey of 1,081 adults (aged 18 and older) was conducted by an online tax preparation and e-filing service. The survey results showed that 684 of those surveyed

planned to file their taxes electronically. (Round your answers to the nearest whole number.)

(a) Develop a descriptive statistic that can be used to estimate the percentage of all taxpayers who file electronically.

%

(b) The survey reported that the most frequently used method for preparing the tax return is to hire an accountant or professional tax preparer. If 60% of the people surveyed had their

tax return prepared this way, how many people used an accountant or professional tax preparer?

(c) Other methods that the person filing the return often used include manual preparation, use of an online tax service, and use of a software tax program. Would the data for the

method for preparing the tax return be considered categorical or quantitative?

O categorical

O quantitative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning