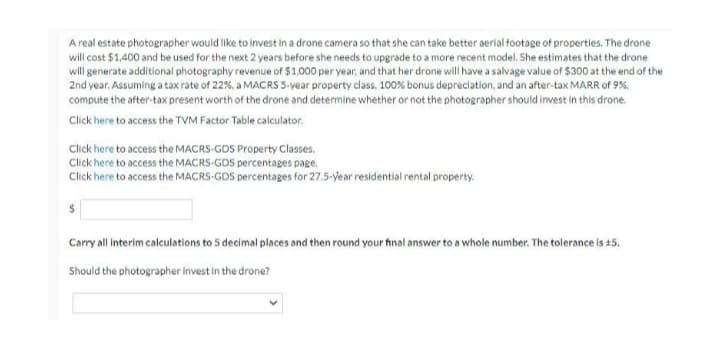

A real estate photographer would like to invest in a drone camera so that she can take better aerial footage of properties. The drone will cost $1,400 and be used for the next 2 years before she needs to upgrade to a more recent model. She estimates that the drone will generate additional photography revenue of $1.000 per year, and that her drone will have a salvage value of $300 at the end of the 2nd year. Assuming a tax rate of 22%, a MACRS 5-year property class, 100% bonus depreciation, and an after-tax MARR of 9%. compute the after-tax present worth of the drone and determine whether or not the photographer should invest in this drone. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-vear residential rental property. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is 15. Should the photographer invest in the drone?

A real estate photographer would like to invest in a drone camera so that she can take better aerial footage of properties. The drone will cost $1,400 and be used for the next 2 years before she needs to upgrade to a more recent model. She estimates that the drone will generate additional photography revenue of $1.000 per year, and that her drone will have a salvage value of $300 at the end of the 2nd year. Assuming a tax rate of 22%, a MACRS 5-year property class, 100% bonus depreciation, and an after-tax MARR of 9%. compute the after-tax present worth of the drone and determine whether or not the photographer should invest in this drone. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-vear residential rental property. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is 15. Should the photographer invest in the drone?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:A real estate photographer would like to invest in a drone camera so that she can take better aerial footage of properties. The drone

will cost $1,400 and be used for the next 2 years before she needs to upgrade to a more recent model. She estimates that the drone

will generate additional photography revenue of $1,000 per year, and that her drone will have a salvage value of $300 at the end of the

2nd year. Assuming a tax rate of 22%, a MACRS 5-vear property class, 100% bonus depreciation, and an after-tax MARR of 9%,

compute the after-tax present worth of the drone and determine whether or not the photographer should invest in this drone.

Click here to access the TVM Factor Table calculator.

Click here to access the MACRS-GDS Property Classes.

Click here to access the MACRS-GDS percentages page.

Click here to access the MACRS-GDS percentages for 27.5-year residential rental property.

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is 15.

Should the photographer invest in the drone?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning