A reconciliation of pretax financial statement income to taxable year of operations. The income tax rate is 25%.

A reconciliation of pretax financial statement income to taxable year of operations. The income tax rate is 25%.

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Transcribed Image Text:5

A Assignments x

Questlon 13 X

E Finaclal Acc X

Finaclal Acc x

M Inbox (6,449 X

Birdiedon WX

Grades Hom X

Assignment x

M Conne

ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... *

TV

Accounting for Income Taxes) i

Saved

Help

Save & Exit

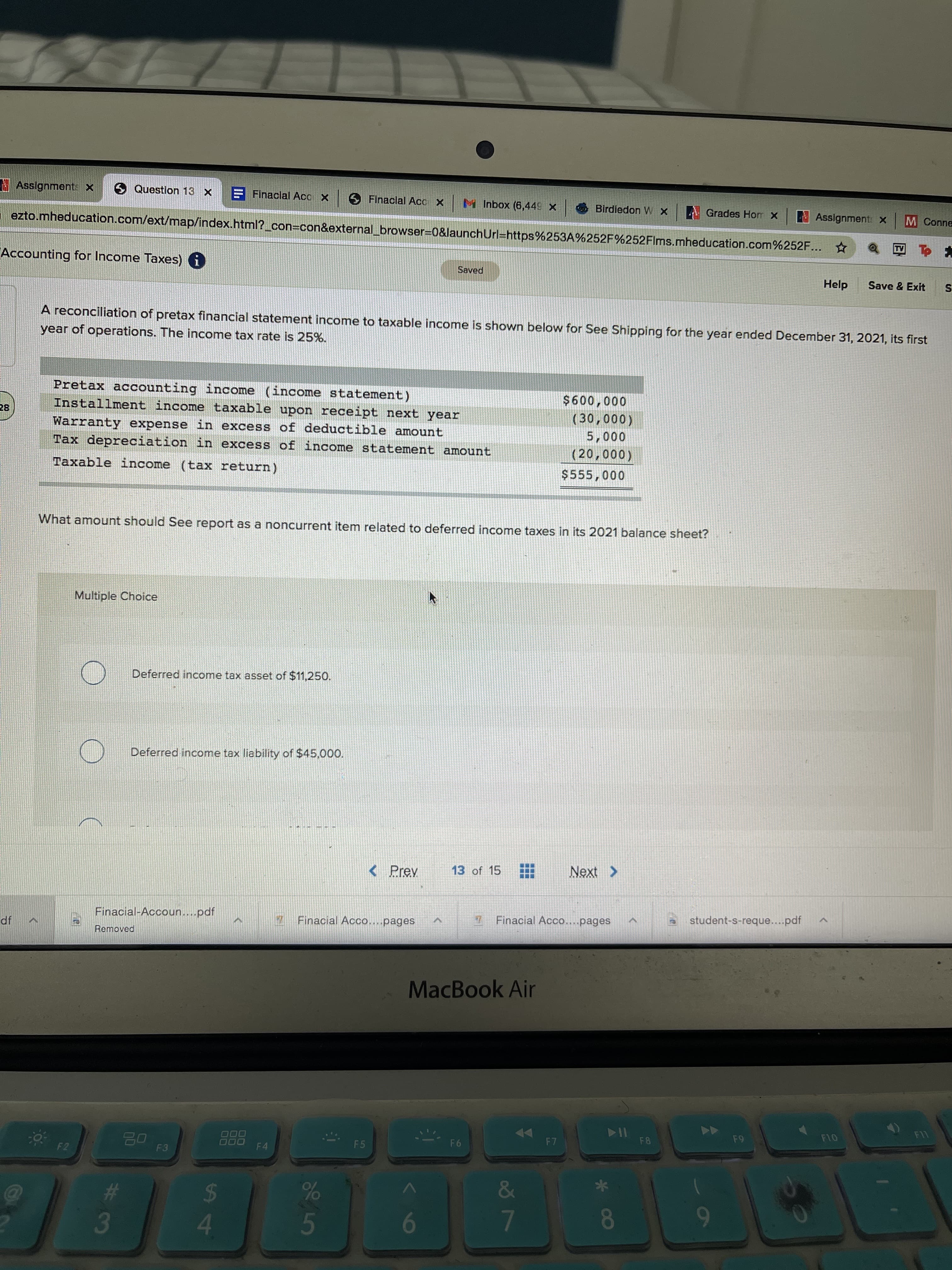

A reconciliation of pretax financial statement income to taxable income is shown below for See Shipping for the year ended December 31, 2021, its first

year of operations. The income tax rate is 25%.

Pretax accounting income (income statement)

Installment income taxable upon receipt next year

000'009$

(000'0)

000'S

82

Warranty expense in excess of deductible amount

Tax depreciation in excess of income statement amount

(000'07)

Taxable income (tax return)

000's

What amount should See report as a noncurrent item related to deferred income taxes in its 2021 balance sheet?

Multiple Choice

Deferred income tax asset of $11,250.

Deferred income tax liability of $45,000.

< Prev

13 of 15

Next >

Finacial Acco....pages

a student-s-reque...pdf

Finacial-Accoun....pdf

7 Finacial Acco....pages

Removed

MacBook Air

F7

F5

F4

F3

24

4.

3

6

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you