a retail mail order firm that currently uses a central collection system that requires all checks to be sent to its Boston headquarte s required for mailed checks to be received, 3 days for DLF to process them, and 2 days for the checks to clear through its bank. A n would reduce the mailing and processing time to 2 days and the check clearing time to 1 day. DLF has an average daily collectic dopts the lockbox system, its average cash balance will increase by the correct response: P450,000 P1,200,000 P750,000

a retail mail order firm that currently uses a central collection system that requires all checks to be sent to its Boston headquarte s required for mailed checks to be received, 3 days for DLF to process them, and 2 days for the checks to clear through its bank. A n would reduce the mailing and processing time to 2 days and the check clearing time to 1 day. DLF has an average daily collectic dopts the lockbox system, its average cash balance will increase by the correct response: P450,000 P1,200,000 P750,000

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 5P

Related questions

Question

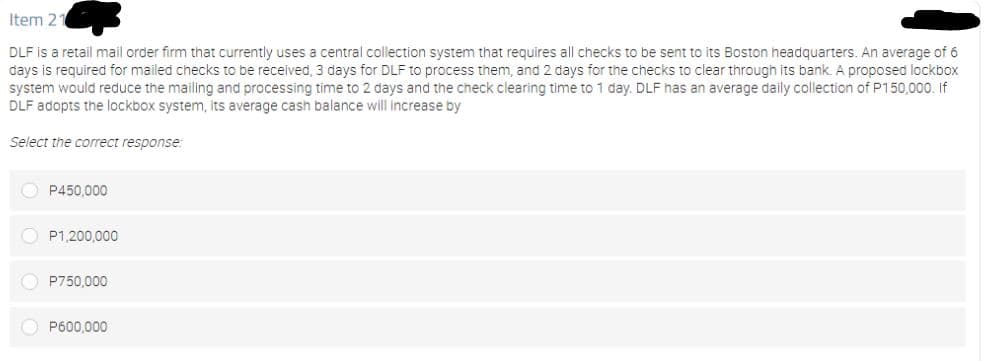

Transcribed Image Text:Item 2

DLF is a retail mail order firm that currently uses a central collection system that requires all checks to be sent to its Boston headquarters. An average of 6

days is required for mailed checks to be received, 3 days for DLF to process them, and 2 days for the checks to clear through its bank. A proposed lockbox

system would reduce the mailing and processing time to 2 days and the check clearing time to 1 day. DLF has an average daily collection of P150,000. If

DLF adopts the lockbox system, its average cash balance will increase by

Select the correct response:

O P450,000

O P1,200,000

O P750,000

O P600.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,