If a home goods retailer pays $32.50 for the vacuum cleaner shown here, answer the following questions. (Round dollars to the nearest cent and percents to the nearest tenth of a percent.) 12-AMP POWERVAC PLUS $8999 • Microfiltration • On-board tools 1-yr. Product Replacement Policy, $7.99 (a) What is the percent markup based on selling price? 63.7 % (b) If the retailer pays $1.40 to the insurance company for each product replacement policy sold, what is the percent markup based on selling price of the vacuum cleaner and policy combination? % (c) If 6,000 vacuum cleaners are sold in a season and 40% are sold with the insurance policy, how many additional "markup dollars," the gross margin, were made by offering the policy? $ (d) As a housewares buyer for the retailer, what is your opinion of such insurance policies, considering their effect on the "profit picture" of the department? How can you sell more policies?

If a home goods retailer pays $32.50 for the vacuum cleaner shown here, answer the following questions. (Round dollars to the nearest cent and percents to the nearest tenth of a percent.) 12-AMP POWERVAC PLUS $8999 • Microfiltration • On-board tools 1-yr. Product Replacement Policy, $7.99 (a) What is the percent markup based on selling price? 63.7 % (b) If the retailer pays $1.40 to the insurance company for each product replacement policy sold, what is the percent markup based on selling price of the vacuum cleaner and policy combination? % (c) If 6,000 vacuum cleaners are sold in a season and 40% are sold with the insurance policy, how many additional "markup dollars," the gross margin, were made by offering the policy? $ (d) As a housewares buyer for the retailer, what is your opinion of such insurance policies, considering their effect on the "profit picture" of the department? How can you sell more policies?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 7E: Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The...

Related questions

Question

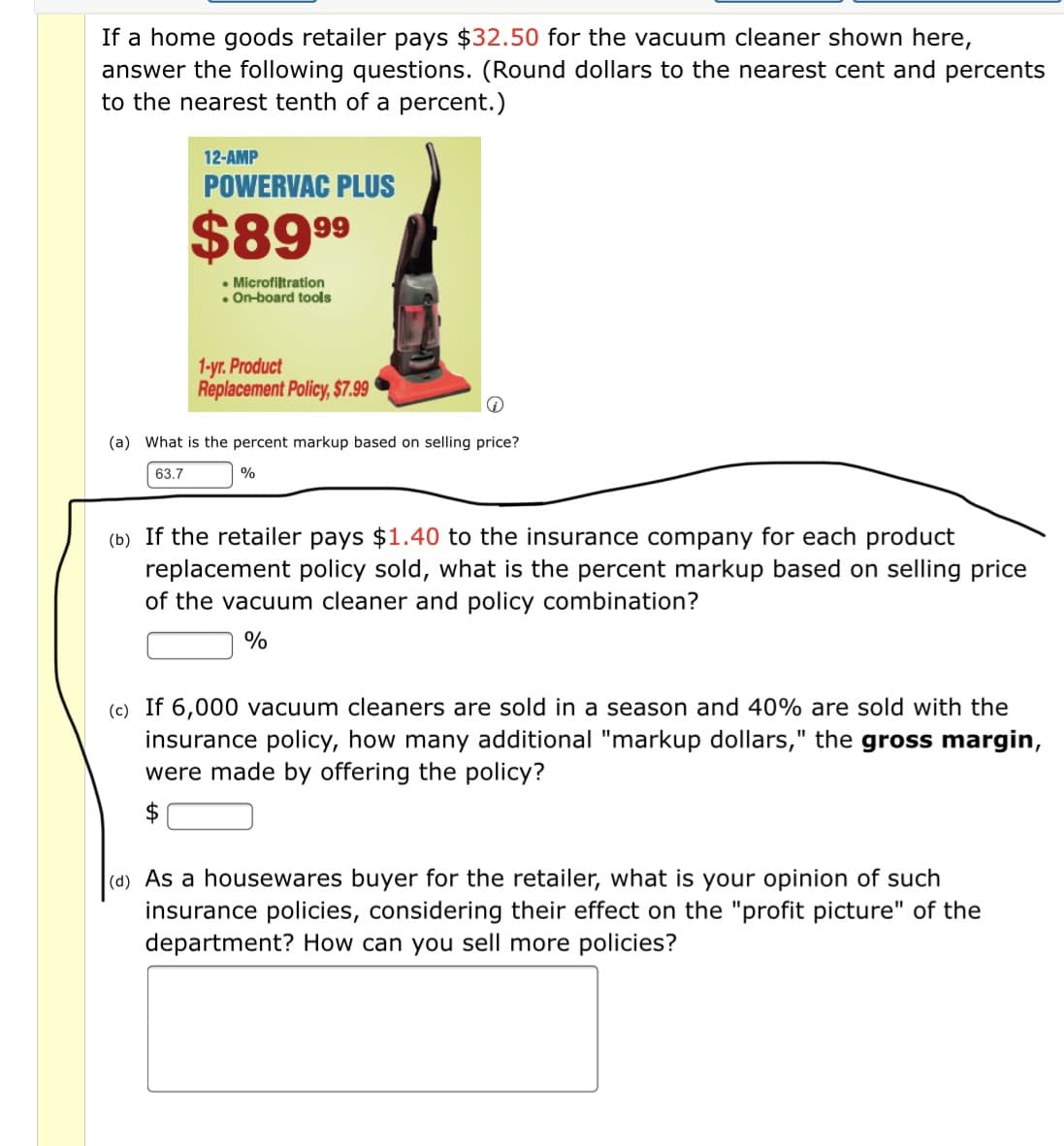

Transcribed Image Text:If a home goods retailer pays $32.50 for the vacuum cleaner shown here,

answer the following questions. (Round dollars to the nearest cent and percents

to the nearest tenth of a percent.)

12-AMP

POWERVAC PLUS

$899

• Microfiltration

• On-board tools

1-yr. Product

Replacement Policy, $7.99

(a) What is the percent markup based on selling price?

63.7

%

(b) If the retailer pays $1.40 to the insurance company for each product

replacement policy sold, what is the percent markup based on selling price

of the vacuum cleaner and policy combination?

%

(c) If 6,000 vacuum cleaners are sold in a season and 40% are sold with the

insurance policy, how many additional "markup dollars," the gross margin,

were made by offering the policy?

$

|(d) As a housewares buyer for the retailer, what is your opinion of such

insurance policies, considering their effect on the "profit picture" of the

department? How can you sell more policies?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning