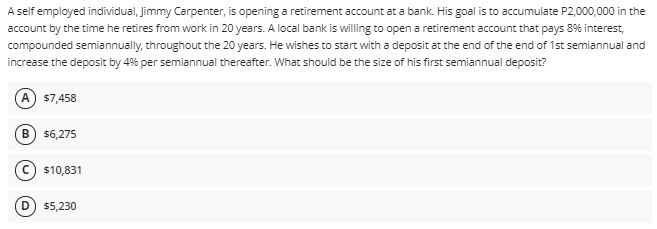

A self employed individual, Jimmy Carpenter, is opening a retirement account at a bank. His goal is to accumulate P2,000,000 in the account by the time he retires from work in 20 years. A local bank is willing to open a retirement account that pays 8% interest, compounded semiannually, throughout the 20 years. He wishes to start with a deposit at the end of the end of 1st semiannual and increase the deposit by 4% per semiannual thereafter. What should be the size of his first semiannual deposit? $7,458 $6,275 $10,831 $5,230

A self employed individual, Jimmy Carpenter, is opening a retirement account at a bank. His goal is to accumulate P2,000,000 in the account by the time he retires from work in 20 years. A local bank is willing to open a retirement account that pays 8% interest, compounded semiannually, throughout the 20 years. He wishes to start with a deposit at the end of the end of 1st semiannual and increase the deposit by 4% per semiannual thereafter. What should be the size of his first semiannual deposit? $7,458 $6,275 $10,831 $5,230

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 32P

Related questions

Question

Solve the following problems. You must show all your solutions -Draw the cash flow diagram for each problem -use interest rate with five decimal places. -Box your final answer and upload the picture of your complete solution.

Transcribed Image Text:A self employed individual, Jimmy Carpenter, is opening a retirement account at a bank. His goal is to accumulate P2,000,000 in the

account by the time he retires from work in 20 years. A local bank is willing to open a retirement account that pays 8% interest,

compounded semiannually, throughout the 20 years. He wishes to start with a deposit at the end of the end of 1st semiannual and

increase the deposit by 4% per semiannual thereafter. What should be the size of his first semiannual deposit?

A $7,458

B

$6,275

C) $10,831

$5,230

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning