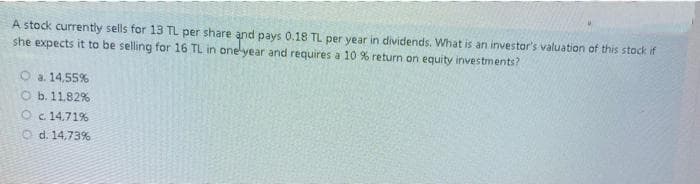

A stock currently sells for 13 TL per share and pays 0.18 TL per year in dividends. What is an investor's valuation of this stock if she expects it to be selling for 16 TL in onelyear and requires a 10 % return on equity investments? O a. 14,55% O b. 11.82% O c 14,71% O d. 14,73%

Q: I. 1) Suppose you buy one share of stock for $50 and sell it for $100. Your profit is $50. If that…

A: Average annual rate (AAR) is the average annualized return of an investment, portfolio, asset, or…

Q: If a commercial bank offers a loan of $1,400 and the borrower will repay the loan with probability…

A: A repayment plan is a structured repaying of funds that have been loaned to an individual, business…

Q: Amy has a utility function U(Y) = YO5, where Y is income. Amy faces an opportunity to invest her…

A: E(U)=ΣPiUiWhere, E(U)=Expected utilityPi=ProbabilityUi=Utility

Q: The term 'random walk' is used in investments to refer to O A. stock price changes that are random…

A: An asset that is being created with the sole intention of growing money in the future is known as…

Q: 10. Suppose the insured has a $75,000 liability loss that is covered under his homeowners policy and…

A: In a market, insurance refers to the service provided by the financial institutions according to…

Q: An insurance company has just launched a security that will pay $150 indefinitely, starting the…

A: Present value (PV) is the current value of a future stream of cash flows given a specified interest…

Q: Paul wants to create a scholarship fund at his alma mater. He wants to provide support fe…

A: Simple interest=(P*R*T) /100 where P-principal amount R-rate of interest T-time

Q: 7. In an efficient market, professional portfolio management can offer all of the following bellells…

A: A market where the stock prices tend to trade at a fair market value that in turn reflects all of…

Q: Assume that the CAPM holds and expectations of stocks' returns and betas are correctly measured.…

A: Returns: It refers to the amount that people or firm will be getting in the future. The returns are…

Q: expectancy of 20 years. Suppose that the discount rate is 20%, that electricity can be purchased at…

A: The marginal cost is the change in the total cost that arises when the quantity produced is…

Q: The conflict of preferences occurs because. O a. Customers of firms have different needs to those…

A: Answer - Need to find - The conflict of preferences occurs because Evaluating the options:- 1.…

Q: The King of France offers you an investment opportunity that would pay you $40 per year forever. If…

A: Answer: Given, Periodic return = $40 Yield to maturity = 4% = 0.04 The following formula will be…

Q: Dhofar Energy Services has a Beta = 1.68 The risk-free rate on a treasury bill is current 4.4% and…

A: Given Dhofar energy services has Beta = 1.68 Risk-free rate on a treasury bill is currently(Rf) =…

Q: A shoe company will make a new type of shoe. The fixed cost for the production will be $24,000. The…

A: Break Even point is the point at which total cost and total revenue are equal , here we calculate…

Q: your home is S250000, but the replacement cost of the structure is $190000, how much homeowner's…

A: 1. Replacement cost is attached to your home insurance inclusion. Perhaps the main thing to realize…

Q: O 6.38 percent

A:

Q: O a. False

A: The equilibrium level of income and price level is determined by the equality of Aggregate demand…

Q: Time left 0: If your tuition is $25,000 this semester, your books cost $1,500, you can only work 20…

A: Opportunity cost = explicit cost + implicit cost Explicit cost is out of pocket expenses and…

Q: 30. CAPM and Cost of Capital. Suppose the Treasury bill rate is 4% and the market risk premium is…

A: a. when Beta is 0.75 cost of capital = Risk free rate + Beta*(Market risk premium) = 0.04 +…

Q: emaining Time: 44 minutes, 10 seconds. uestion Completion Status: A Moving to another question will…

A: Saudi Arabia is the economy whose main Gross domestic product is generated from oil like petroleum…

Q: Label each of the following behaviors with the correct bias or heuristic. LO8.3 a. Your uncle says…

A: Hello. Since you have posted multiple parts of the question and not specified which part of the…

Q: 10. How much are you willing to pay for one share of XYZ bank stock if the company just paid a 1.5$…

A: Given: The annual dividend paid by a company is = $1.5 annually The dividends increase by = 3%…

Q: How long it will take an investment that has a return of 8% per year to double three times in value?…

A: Answer: Correct option: a (14.27 years) Explanation: Rate of return (r) = 8% In 14.27 years the…

Q: Elinore is asked to invest $4,900 in a friend's business with the promise that the friend will repay…

A: Opportunity cost: - opportunity cost is a forgone benefit that we could have earned by applying all…

Q: If the discount rate on 3-month commercial paper is 4.9% while the yield on 3-month CDs is 5%, the…

A: Discount rate: The rate of return used to discount future cash flows back to their present value is…

Q: Arbitrage would be prevented from ensuring that identical products sell for the same price…

A: Profit: The term profit refers to the monetary benefit that arises due to the sale and purchase of a…

Q: Question 16 "The Contract Price is P100,000,000.00, and the Down Payment is 25% and the First…

A: Option B is correct.

Q: 5. What is player 3's knowledge of player 1's choice: 1 A 113 1 L 1 3 RL 000 R 113 3 L RL R 2 1 1 2…

A: Here, the given payoff tree explains a game with three players where player 1 performs A or B,…

Q: What is the required reserve ratio? O 10% O 5% O 25% O 20%

A: Given Checkable deposits = 20 Total reserves = 4 With banks holds no excess reserves, the total…

Q: If the MPS is .30, MPC is Select one: O a. 1+.30 = 1.30 O b. None of the options O c. 1-0.3 =0.7…

A: Marginal propensity to consume (MPC) refers to the value of additional consumption due to increase…

Q: If a corporate bond with a face value of $20,000 pays yearly coupon payments of $500, what is the…

A: Given Face value of bond = 20000 $ Coupon payment = 500 $ Yield on bond = coupon payment / face…

Q: Refer question 1 and answer both the questios Question 1 Afrm raises capital to invest in a…

A: Revenue for a firm can be defined as the sum total of money that the firm earns by selling the goods…

Q: What is the present value or price of a $150 annual perpetuity if the returns on similar contracts…

A: Given; Value of annual perpetuity= $150 Discount rate= 7% Formula to calculate present value:-…

Q: A company has proposed a project that has initial costs of $10 million, on-going costs of $1 million…

A: The company incur annual cost of $1 million per year and take benefit of $2 million per year ,…

Q: What is the average fixed cost and average variable cost if nine instructional modules are produced?…

A: Cost is the total amount spent or the total expenditure which is incurred while producing a product…

Q: What is the current value of a security that pays $500 per year for 7 years if similar investments…

A:

Q: The median annual growth in the stock index is 7%. Which of the following annual stock index growth…

A: Here answer is “12.9 %”

Q: Bates that the price of a gallon of jet fuel will rise from $3.00/gallon to 3.50/gallon between now…

A: The Fuel hegde contract is a futures contract that allows a fuel consumer company to establish fixed…

Q: How long does it take for $8,000 to become $12,500 when the interest rate is 8% per year. (ABET,…

A:

Q: You can buy a mountain bike on sale for only $562.97. What is the percent markdown if the original…

A: Sale price= $562.97 Original price = $659.50

Q: Consider an investment opportunity for Mary Smith that produces a 15 percent positive return if…

A: Mary used $20 of her saving and $80 of borrowed money to make $100 investment. After the loss it…

Q: Given the data in the table below, calculate the marginal propensity to save. Consumption Personal…

A: Marginal Propensity to Save: MPS means the proportion of additional disposable income that is saved,…

Q: If population of a city grows at 2.3 percent, how long will it take to double? O a. 30.1368 O b.…

A: Rule 70 implies the time taken for the particular growth rate to get double. Formula: time required…

Q: If real GDP per capita in the United States is $8,000, what will real GDP per capita in the United…

A: Given information: Real GDP = $8,000 Growth rate = 3.2% Number of years = 5

Q: Jacob manages a cloth manufacturing firm. He is deciding whelher of nol machinery costs $45,000…

A: Net present value (NPV) is the difference between the present value of cash inflows and the present…

Q: Al approximately what interest rate, i, will a present investment of $2000 increase to a future…

A: Answer; Correct Option is (a) 7%

Q: In 2018, Walmart reported sales of $500.3 billion, gross profits of $136.9 billion, EBIT of $20.4…

A: Given sales = 500.3 Billion $ Gross profit = 136.9 Billion $ Cost of goods sold = sales - Gross…

Q: The common stock of Eddie's Engines, Inc. sells for $25.71 a share. The stock is expected to pay…

A: Economics is a branch of social science that describes and analyzes the behaviors and decisions…

Q: A household has $5 in wealth and faces a MB of consumption of $1.66, 1.44, 1.31, 1.22 and 1.18 for…

A: The household saving rate is characterized as gross household saving separated by gross…

Step by step

Solved in 3 steps

- A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table: Country Weight InMSCI Index Manager’sWeight Manager’s Returnin Country Return of Stock Indexfor That Country U.K. 0.29 0.24 22% 15% Japan 0.42 0.2 17 17 U.S. 0.23 0.22 10 13 Germany 0.06 0.34 7 15 Required: a. Calculate the total value added of all the manager’s decisions this period. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) b. Calculate the value added (or subtracted) by her country allocation decisions. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount…Calculate Current ratio based on the following information Cash 15,000.00 Prepaid Insurance 5,540.00 Rent Payable 3,400.00 Accounts Receivable 5,860.00 Accounts Payable 14,500.00 Furniture 20,000.00 Automobile 48,500.00 Group of answer choices O. 2.59 O. 3.27 O. 5.30 O. 1.47If the MPS is .30, MPC is Select one: O a. 1+.30 = 1.30 O b. None of the options O c. 1-0.3 =0.7 O d. 0.3

- Suppose you are considering whether to purchase a house off of Lake Erie for $400,000. You expect thetotal costs of maintaining the property (utilities, repairs, etc.) to equal $15,000/year, and that you would be able togenerate $35,000/year in revenue if you were to put the house on the short term rental market.a. (3) Suppose you are deciding between purchasing the home or whether to invest $400,000 in an interest-bearingaccount. If your objective is to maximize your own net income, what would the interest rate have to equal for youto invest in the interest-bearing account?b. (4) Suppose you decide to buy the house, and now you have to decide whether/when to list the house on theshort term rental market (like Airbnb) or stay in the house yourself. Briefly explain what this decision woulddepend on. What are the implicit (opportunity) costs associated with renting the house to someone else on a givenday? What are the implicit costs associated with the staying in the house yourself?c.…A town is endowed with an oil reserve. The total stock of oil from the reserve is 110 barrels. The townmust sell all 110 barrels within two time periods, so the quantity extracted will be q1 + q2 = 110, whereq1, for example, is the quantity extracted in period 1. The price per barrel that the town can sell theoil for is pt= 150 −10/11 qt in each period. There is a constant cost of extraction c = 50, such that theresource rent earned by each barrel in each period is πt= pt−c. If the interest rate is 20%, how muchoil will the town extract in period 1 and in period 2 (what should q1 and q2 be) if it wanted to extractefficiently (i.e. maximize profits)?Millicent’s utility function is U(w) = W0.5 , where W is her wealth. She owns a “pure water” producing firm that will be worth GH100 or 0 Ghana cedis next year with equal probability. a. Suppose her firm is the only asset she has. What is the lowest price at which she will agree to sell her pure water? (Hint: price=amount that will give her the same expected utility) b. Assume that she has GH200 safely stored under her mattress, find the new lowest price at which she will agree to sell her “pure water” producing firm c. From your answers in parts (a) and (b), what is the relationship between her wealth and her degree of risk aversion?

- A firm is considering purchasing equipment to manufacture a new product. The equipment will cost $3M, and expected net cash inflowsare $0.35M indefinitely. If market demand for theproduct is low, then over the next five years thefirm will have the option of discarding the equipment on a secondary market for $2.2M. Assume thatMARR = 12%, s = 50%, and r = 6%. What isthe value of this investment opportunity for the firm?If consumption is $30,000 when income is $40,000, and consumption increases to $34,000 when income increases to $45,000, the MPC is Select one: O a. None of the options O b. 0.8 O c. 0.2 O d. 0.4A university spent $2 million to install solar panels atop a parking garage. These panels will have a capacity of 700 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 20%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 8,214.28 5,867.34 2,346.94 4,693.87 If the solar panels can operate only for 5,281 hours a year at maximum, the project break even. Continue to assume that the solar panels can operate only for 5,281 hours a year at maximum. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at least blank

- Suppose Natasha currently makes $ 50,000 per year working as a manager at a cable TV company. She then develops two possible entreprenuiral business opportunities. In one, she will quit her job to start an organic soap company. In the other, she will try to develop an Internet-based competitor to the local cable company. For the soap-making opportunity, she anticipates annual revenue of $ 465, 000 and costs for the necessary land, labor, and capital of $ 395, 000 per year. For the Internet opportunity, she anticipates costs for land, labor, and capital of $ 3, 250,000 per year as compared to revenues of $ 3, 275,000 per year. What opportunity should she persue? a) She would persue the soap business b) She would persue the Internet business c). She would continue working for the cable TV company.1. Now, imagine that Port Chester decides to crack down on motorists who park illegally by increasing the number of officers issuing parking tickets (thus, raising the probability of a ticket). If the cost of a ticket is $100, and the opportunity cost for the average driver of searching for parking is $12, which of the following probabilities would make the average person stop parking illegally? Assume that people will not park illegally if the expected value of doing so is negative. Check all that apply. A. 9% B. 18% C. 17% D. 10% 2. Alternatively, the city could hold the number of officers constant and discourage parking violations by raising the fine for illegal parking. Suppose the average probability of getting caught for parking illegally is currently 10% citywide, and the average opportunity cost of parking is, again, $12. The fine that would make the average person indifferent between searching for parking and parking illegally is ____ , assuming that people will not…A university spent $2 million to install solar panels atop a parking garage. These panels will have a capacity of 700 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 30%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 6,893.28 8,616.60 3,446.64 12,924.90 If the solar panels can operate only for 7,755 hours a year at maximum, the project break even. Continue to assume that the solar panels can operate only for 7,755 hours a year at maximum. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at least Note:- Do not provide handwritten solution. Maintain accuracy and…