your home is S250000, but the replacement cost of the structure is $190000, how much homeowner's insurance should you have? $60000 O $250000 O $190000 O $440000 Eimberly has a homeowner's insurance policy. Her home was broken into, and $5200 worth of possessions were stolen. If her leductible is $2200, how much coverage will her insurance company pay for the loss? O so $3000 O $5200 O $2200 orothy Taylor has a personal auto policy with coverage limits of 20/40/15. Dorothy has collision coverage witha $250 deductible ne runs a red light and causes an auto accident in which three people are injured. Each of them sues her for $19900 in personal injur nd $5000 for vehicle damage (there is no injury to Dorothy or her car). How much will Dorothy have to pay out of pocket, and how uch will her insurer pay?

your home is S250000, but the replacement cost of the structure is $190000, how much homeowner's insurance should you have? $60000 O $250000 O $190000 O $440000 Eimberly has a homeowner's insurance policy. Her home was broken into, and $5200 worth of possessions were stolen. If her leductible is $2200, how much coverage will her insurance company pay for the loss? O so $3000 O $5200 O $2200 orothy Taylor has a personal auto policy with coverage limits of 20/40/15. Dorothy has collision coverage witha $250 deductible ne runs a red light and causes an auto accident in which three people are injured. Each of them sues her for $19900 in personal injur nd $5000 for vehicle damage (there is no injury to Dorothy or her car). How much will Dorothy have to pay out of pocket, and how uch will her insurer pay?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter20: The Problem Of Adverse Selection Moral Hazard

Section: Chapter Questions

Problem 3MC

Related questions

Question

please answer in detail

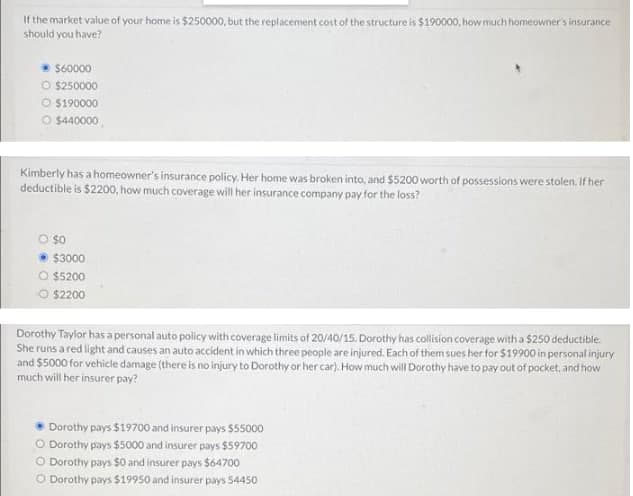

Transcribed Image Text:If the market value of your home is $250000, but the replacement cost of the structure is $190000, how much homeowner's insurance

should you have?

• S60000

O $250000

O $190000

O $440000

Kimberly has a homeowner's insurance policy. Her home was broken into, and $5200 worth of possessions were stolen. If her

deductible is $2200, how much coverage will her insurance company pay for the loss?

O so

• $3000

O $5200

O s2200

Dorothy Taylor has a personal auto policy with coverage limits of 20/40/15. Dorothy has collision coverage with a $250 deductible.

She runs a red light and causes an auto accident in which three people are injured. Each of them sues her for $19900 in personal injury

and $5000 for vehicle damage (there is no injury to Dorothy or her car). How much will Dorothy have to pay out of pocket, and how

much will her insurer pay?

Dorothy pays $19700 and insurer pays $55000

O Dorothy pays $5000 and insurer pays $59700

O Dorothy pays $0 and insurer pays $64700

O Dorothy pays $19950 and insurer pays 54450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning