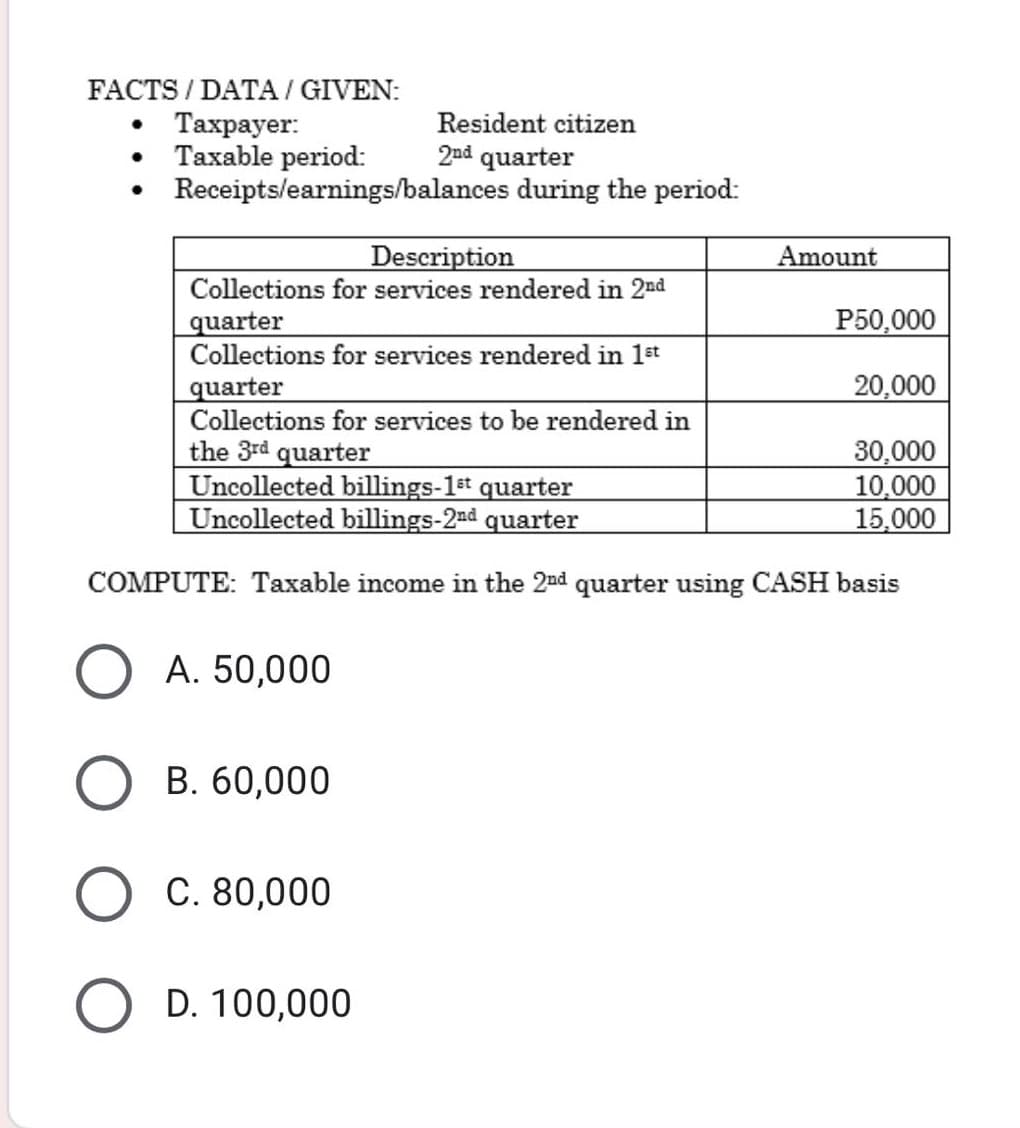

FACTS / DATA / GIVEN: • Taxpayer: • Taxable period: Receipts/earnings/balances during the period: Resident citizen 2nd quarter Description Collections for services rendered in 2nd Amount P50,000 quarter Collections for services rendered in 1st quarter Collections for services to be rendered in 20,000 the 3rd quarter Uncollected billings-1st quarter Uncollected billings-2nd quarter 30,000 10,000 15,000 COMPUTE: Taxable income in the 2nd quarter using CASH basis O A. 50,000 B. 60,000 C. 80,000 O D. 100,000

Q: A taxpayer made available the following financial information: Gross sales - Php 10,000,000…

A: Here in this question, we are required to answer taxable income in Philippines if used OSD. Under…

Q: . Taxpayer incurred the following for the taxable period: Supplies purchased P80,000 Supplies used…

A: Under Cash basis, expenses shall be Deductible only when actually paid. Amortization and unpaid…

Q: Required information [The following information applies to the questions displayed below.] In 2021,…

A: Maximum charity deduction of 10% of income less ordinary deduction (before deduction of the…

Q: For the year ended December 31, 2019, Nelson Co.’s income statement showed income of $445,000 before…

A: Journal Entry: Journal entry has two effects for every transaction. The journal entry is passed by…

Q: Data of an individual taxpayer for the current taxable period: Gross sales Cost of sales Sales…

A: Regular itemized deduction is subtraction allowed so as to calculate the taxes, it reduces the…

Q: What is the taxable income if the taxpayer had chosen itemized deduction? A citizen who is married,…

A: Calculation of taxable Income

Q: of an individual taxpayer for the current taxable period: s sales of sales discounts granted (for…

A: Standard deduction from Taxable Income: It is the amount which deducted from the taxable income of…

Q: 5.Pedro earned and incurred the following income and expenses: Compensation (exclusive of mandatory…

A: Graduated tax rates in Philippines is applied to the business taxable income , the individuals who…

Q: During the year of 2021, Daniels corporation collects all of the Accounts Receivable and sells the…

A:

Q: 19 A taxpayer registered in 2010 made available the following financial information for TY2021:…

A: Beginning July 1, 2020, the CREATE Act reduces the corporate income tax rate from 30% to 25%. The…

Q: A taxpayer made available the following financial information: Gross receipts - Php 10,000,000 Cost…

A: Income Tax in philipines: Income tax of domestic corporations is based on their gross income less…

Q: Required information [The following information applies to the questions displayed below.] In 2021,…

A: a. OCC taxable income for charitable contribution limitation purposes is $1,460,000 ($1,500,000 -…

Q: Required information [The following information applies to the questions displayed below.] Riverbend…

A: The company may purchase shares of another company. The company purchasing shares in another is…

Q: Two independent situations are described below. Each involves future deductible amounts and/or…

A: Deferred tax asset : Deferred Tax is a type of tax that levied on companies provision for future…

Q: 1. Firm B uses the calendar taxable year and the cash method of accounting. On December 31, 20x6,…

A: CASH BASED ACCOUNTING:- Cash based accounting is referred as the accounting in which the payments…

Q: Beaver Dam Inc. (BDI) listed the following items to prepare a reconciliation between book and…

A: Solution:- a) Calculation of BDI’s tax expense for financial statement purposes as follows:- Basic…

Q: A taxpayer registered in 2010 made available the following financial information for TY2021: Balance…

A: The tax rate for domestic corporation under CREATE law is 25%, if income of the corporation is more…

Q: GIVEN: Taxpayer is a proprietary educational institution. Taxable period is 2021. • Financial data:…

A: Income Tax: - Income Tax is the tax that is imposed by the government on the income generated by a…

Q: . Taxpayer incurred the following for the taxable period: |Supplies purchased P80,000 Supplies used…

A: Under Cash basis expenses shall be allowed when actually paid. Amortization and other historical…

Q: Stanton Inc. is a calendar year, cash basis taxpayer. Stanton Inc. decides to change to the accrual…

A: Net income is defined as the amount which the individual earns after deducting the taxes as well as…

Q: A taxpayer made available the following financial information: Gross receipts - Php…

A: Total allowable deduction if the taxpayer is a resident citizen = Cost of service + Depreciation…

Q: A taxpayer engaged in service business provides you with the following. Determine the gross income…

A: Cash basis accounting method means receipts are recorded when actually received.

Q: E18-11 Multiple Tax Rates For the year ended December 31, 2019, Nelson Co.’s income statement showed…

A: Deferred Tax Asset / (Liability) : When taxes payable as per Federal Tax laws is higher than tax…

Q: GIVEN: • Taxpayer is a PEZA-registered enterprise Taxable year is 2021 • Financial data Related…

A: hilippine Economic Zone Authority (PEZA) registered entities are given tax incentives such as in the…

Q: ! Required information [The following information applies to the questions displayed below.] Rebecca…

A: In case of accrual basis of accounting revenue and expenses are recognised in books of accounts as…

Q: FACTS / DATA / GIVEN: . Тахрауer: Taxable period: Expenses/payments during the period: Resident…

A: Total Expense = Cash expense + expense Unpaid

Q: For the year ended December 31, 2019, Nelson Co.’s income statement showed income of $435,000 before…

A: Given information is: Income from Income Statement = $435,000

Q: 1. Prior to 2020, taxable income and pretax financial income were identical. 2. Pretax financial…

A: Pretax financial income = $1,359,000 Equipment Purchased = $1,260,000 Life = 5 years Depreciation on…

Q: Deductions from Gross Income Classify the items for deduction in the following scenarios. 3. A…

A: Introduction: An itemized deduction appears to be an expenditure that may be deducted from your…

Q: 2. For the year ended December 31, 20x1, Mont Co.'s books showed income of P600,000 before provision…

A: Tax is the charge on the taxable income of a person that person is known as taxpayer. Taxable income…

Q: Eight independent situations are described below. Each involves future deductible amounts and/or…

A:

Q: . Compute BDI’s tax expense for financial statement purposes. b. Compute BDI’s tax payable to the…

A: "Since you have posted a question with multiple sub-parts, we will solve the first 3-sub parts for…

Q: compute the maximum amount of organization costs that may be deducted for each of the following…

A: G Corporation is an accrual basis taxpayer, that means that the income and expenses of G corporation…

Q: How much is the gross income under accrual basis? A taxpayer engaged in service business provides…

A: Accrual Income - It the amount of revenue recorded when transaction occur but payment not received…

Q: GIVEN: • Taxpayer is a non-stock and non-profit educational institution. • It has been granted with…

A: The correct option with proper explanation are as follows

Q: Taxpayer - Resident citizen Gross sales 2,600,000 Other operating income 200,000 Non-operating…

A: Optional Standard Deduction or OSD pertains to a 40% tax deduction to your annual gross income. On…

Q: TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The…

A: Rate of Profit=Gain realizedContract Price×100

Q: 1. Mr Asta, resident citizen, revealed the following data for 2019: Gross income from business is P…

A: Calculation of allowed contribution deduction Particulars Amount Govt for prior activities…

Q: ompute taxable income under the head Income from ofther sources of Mrs. X from the following data:…

A: Please see the next step for the solution

Q: FACTS / DATA / GIVEN: Тахрауer: • Taxable period: • Receipts/earnings during the period: Resident…

A: Tax is charged on the taxable income and taxable income is the income which has been earned by the…

Q: quired information The following information applies to the questions displayed below.] In 2021, OCC…

A: In accordance with the taxation, the net operating loss is deductible from the ordinary income…

Q: Remsco has taxable income of $67,000 and a charitable contribution limit modified taxable income of…

A: Taxable income is that income over which government imposes tax. It included all incomes after…

Q: A resident citizen has the following data for a taxable year: Ordinary income P300,000 Ordinary loss…

A: Short term capital loss can be set off only against capital gain( firstly towards short term capital…

Q: Determine the tax base of the depreciable property as of the end of the year 2021.

A: Tax is the amount which is charged on the taxable income of the taxpayer. There are deductions like…

Q: Classify the items for deduction in the following scenarios. 2. Debtor Corporation shows the…

A: Itemized deductions are those deductions which allow the person to deduct the designated expenses…

Q: How do you get the answer to part 4? Corning-Howell reported taxable income in 2021 of $156…

A: The following computations are done for Lincoln County’s General Fund.

Q: A taxpayer registered in 2010 made available the following financial information for TY2021:…

A: Taxable income is the amount of income computed to measure the amount of taxes to be paid to the…

Q: A taxpayer made available the following financial information: Gross sales - Php 10,000,000…

A: Gross profit = Gross sales - Cost of sales = Php 10,000,000 - Php 6,000,000 = Php 4,000,000

Step by step

Solved in 2 steps

- *see attached What amount of permanent difference between accounting income and taxable income existed at year-end?a. P 520,000b. P 360,000c. P 800,000d. P 280,000A derived its income from its self-operated talpakan business. The details of his business for 2021 are as follows: Gross Receipts - P100,000.00 Operating Expenses - P50,000.00 Income taxes withheld in general - P10,000.00 Question: What is A's taxable income? Group of answer choices P40,000.00 P50,000.00 P90,000.00 P100,000.00Beckett Corporation has nexus with States A and B. Apportionable income for the year totals $1,190,000 . Beckett's apportionment factors for the year use the following data. Compute Beckett's B taxable income for the year; B uses a three-factor apportionment formula with a double-weighted sales factor. State AState BTotalSales$1,428,000$856,800$2,284,800Property$238,000$0 $238,000Payroll$357,000$0 $357,000

- ABC Corporation has the following information for the taxable year 2022: Quarter RCIT MCIT CWT 1st P200,000 P160,000 P40,000 2nd 240,000 500,000 60,000 3Rd 500,000 150,000 80,000 4th 300,000 200,000 70,000 MCIT carry-over from prior year amounts to P60,000 and excess tax credits from prior year amounts to P20,000. How much was the income tax payable for the first quarter? How much was the income tax payable for the third quarter? How much was the annual income tax payable?An entity reported taxable income of P 8,000,000 during 2019. Its first year of operations.The following are the differences that cause financial income to differ from taxable incomeexcess tax depreciation over accounting depreciation, P 500,000, revenue collected fortax in excess of accounting revenue, P 2,000,000 and tax penalties as an expense in theincome statement, P 200,000. The income tax rate is 30%1. What total tax expense should be reported for 2019?a. 1,890,000b. 2,400,000c. 1,950,000d. 2,010,0002. What is the net deferred tax expense or benefit for 2019?a. 450,000 expenseb. 450,000 benefitc. 510,000 expensed. 510,000 benefitE18-11 Multiple Tax Rates For the year ended December 31, 2019, Nelson Co.’s income statement showed income of $435,000 before income, tax expense. To compute taxable income, the following differences were noted: Income from tax-exempt municipal bonds $60,000 Depreciation deducted for tax purposes in excess of depreciation recorded on the books $120,000 Proceeds received from life insurance on death of an insured employee $100,00 Corporate tax rate for 2019 30% Enacted tax rate for future periods 35% Required: 1. Calculate taxable income and tax payable for tax purposes. 2. Prepare Nelson’s income tax journal entry at the end of 2019.

- Compute for the tax due (A,B,C) for the below taxable income based on the Income Tax Tables: TAXABLE INCOME (Annual) TAX DUE P300,000 A P500,000 B P800,000 C .The following information applies to the operations of MK Inc. for 2022 and 2023. Assume a tax rate of 20% for both years.2022 information:Sales on account in the amount of $675,000Warranty expense and associated liability in the amount of $145,000No other expenses incurred.2023 information:Sales on account in the amount of $210,000Warranty repairs made in the amount of $69,000No expenses incurred.What is MK's income tax expense for 2022? Group of answer choices $121,200 $135,000 $106,000 $164,000Assume that Shoreline Hotel Inc., (SHI) decides to make the following entry on December 31, 2018. Current tax rate is 40%. DR Current income tax expense $634,800 CR Income tax payable $634,800 This would imply that Select one: a. the taxable income for 2018 was different than the accounting income. b. the income tax expense reported by SHI on its income statement would be $750,000. c. the taxable income for 2018 was determined to be $1,587,000. d. All of the above. e. None of the above.

- Additional Information: - income tax expenses were included in other general expenses for the two years. tax expenses for 2022 were $15,650,000 and 2021 were $11,435,000. - income tax payable as of 31 December 2022 was included underneath Provisions section and amount was $2,950,000 REQUIRED : THIS SOCI IS WRONG PLEASE PREPARE THE RIGHT ONEIdentify which one of the following accounting entry for transfer of net profit at the end of the year: a. Dr: Profit and Loss account RO 35660 Cr: Profit and Loss Appropriation account RO 35660 b. Dr: Profit and Loss Appropriation account RO 35660 Cr: Profit and Loss account Ro 35660 c. Dr: Profit and Loss account RO 35660 Cr: Partners' Capital Account RO 35660 d. Dr: Partner's Capital Account RO 35660 Cr: Profit and Loss account RO 35660An entity reported pretax financial income of P8.000,000 for the current year. The taxable income was P7,000,000 for the current year. The difference is due to accelerated depreciation for income tax purposes. The income tax rate is 30% and the entity made estimated tax payment of P500,000 during the current year. The amount should be reported as current tax expense for the current year?