A taxpayer made available the following financial information: Gross sales - Php 10,000,000 Cost of sales - Php 6,000,000 Expenses: Salaries and wages – Php 1,000,000 Transportation and travel – Php 20,000 Rental - Php 240,000 Representation expense – Php 200,000 Depreciation expense – Php 200,000 Office supplies – Php 20,000 Miscellaneous expenses – Php 10,000 How much is the taxable income if the taxpayer is a domestic corporation and opted for OSD? Choices O Phn 2.400.000

A taxpayer made available the following financial information: Gross sales - Php 10,000,000 Cost of sales - Php 6,000,000 Expenses: Salaries and wages – Php 1,000,000 Transportation and travel – Php 20,000 Rental - Php 240,000 Representation expense – Php 200,000 Depreciation expense – Php 200,000 Office supplies – Php 20,000 Miscellaneous expenses – Php 10,000 How much is the taxable income if the taxpayer is a domestic corporation and opted for OSD? Choices O Phn 2.400.000

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

100%

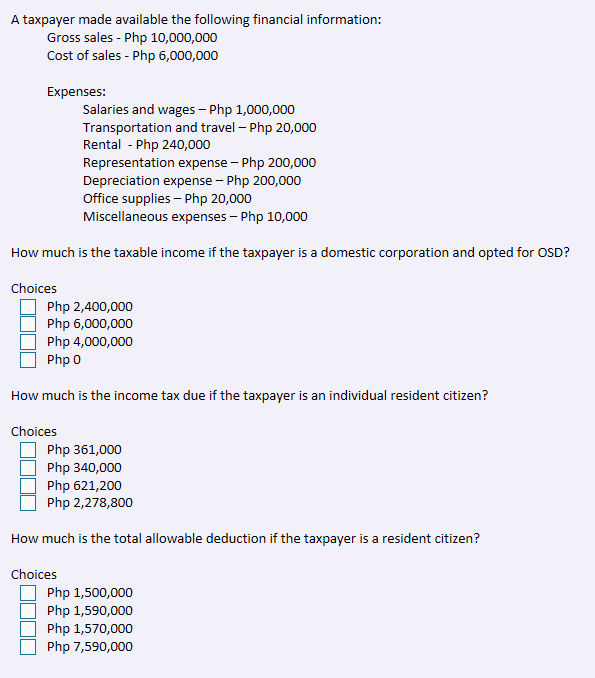

Transcribed Image Text:A taxpayer made available the following financial information:

Gross sales - Php 10,000,000

Cost of sales - Php 6,000,000

Expenses:

Salaries and wages – Php 1,000,000

Transportation and travel – Php 20,000

Rental - Php 240,000

Representation expense - Php 200,000

Depreciation expense - Php 200,000

Office supplies – Php 20,000

Miscellaneous expenses – Php 10,000

How much is the taxable income if the taxpayer is a domestic corporation and opted for OSD?

Choices

Php 2,400,000

Php 6,000,000

Php 4,000,000

Php 0

How much is the income tax due if the taxpayer is an individual resident citizen?

Choices

Php 361,000

Php 340,000

Php 621,200

Php 2,278,800

How much is the total allowable deduction if the taxpayer is a resident citizen?

Choices

Php 1,500,000

Php 1,590,000

Php 1,570,000

Php 7,590,000

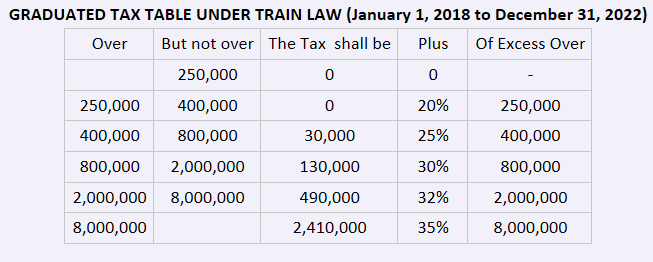

Transcribed Image Text:GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022)

Over

But not over The Tax shall be

Plus

Of Excess Over

250,000

250,000

400,000

20%

250,000

400,000

800,000

30,000

25%

400,000

800,000

2,000,000

130,000

30%

800,000

2,000,000 8,000,000

490,000

32%

2,000,000

8,000,000

2,410,000

35%

8,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT