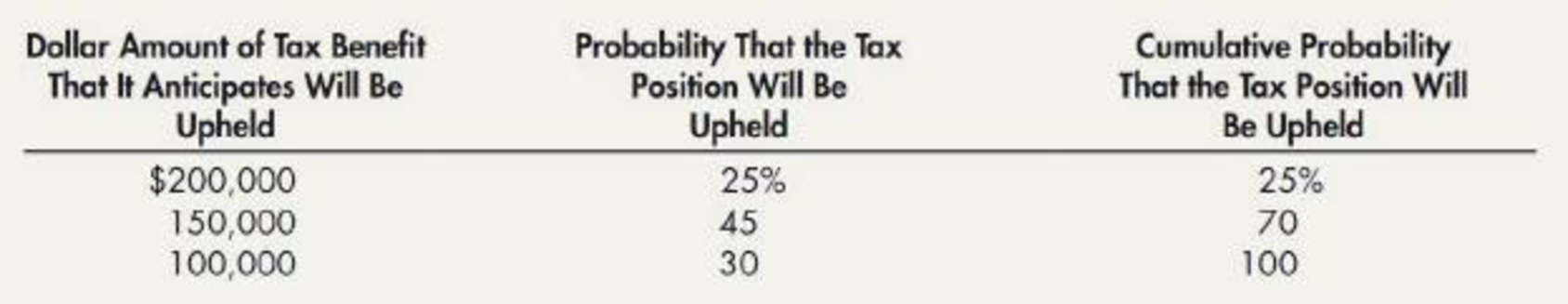

Uncertain Tax Position At the end of the current year, Boyd Company claims a $200,000 tax credit on its income tax return. Boyd is uncertain whether the IRS will accept this credit. It studies the IRS regulations and determines that it is more likely than not that the IRS will accept all or some of this tax credit. Based on this research, Boyd estimates the following probability distribution of possible outcomes:

Required:

For the current year, determine (1) the amount that Boyd will recognize as a current tax benefit and (2) the amount that it will record as the unrecognized tax benefit.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

Additional Business Textbook Solutions

Auditing And Assurance Services

Advanced Financial Accounting

Fundamentals of Cost Accounting

INTERMEDIATE ACCOUNTING

Financial Accounting

FINANCIAL ACCT.FUND.(LOOSELEAF)

- How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.arrow_forwardRhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)arrow_forwardMultiple Temporary Differences Wilcox Company has prepared the following reconciliation of its pretax financial income with its taxable income for 2019: At the beginning of 2019, Wilcox had a deferred tax liability of 495. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. At the end of 2019, Wilcox anticipates that actual warranty costs will exceed estimated warranty expense by 100 next year and that financial depreciation will exceed tax depreciation by 1,800 in future years. Wilcox has earned income in all past years and expects to earn income in the future. Required: 1. Prepare Wilcoxs income tax journal entry at the end of 2019. 2. Prepare the lower portion of Wilcoxs 2019 income statement. 3. Show how the income tax items are reported on Wilcoxs December 31, 2019, balance sheet.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning