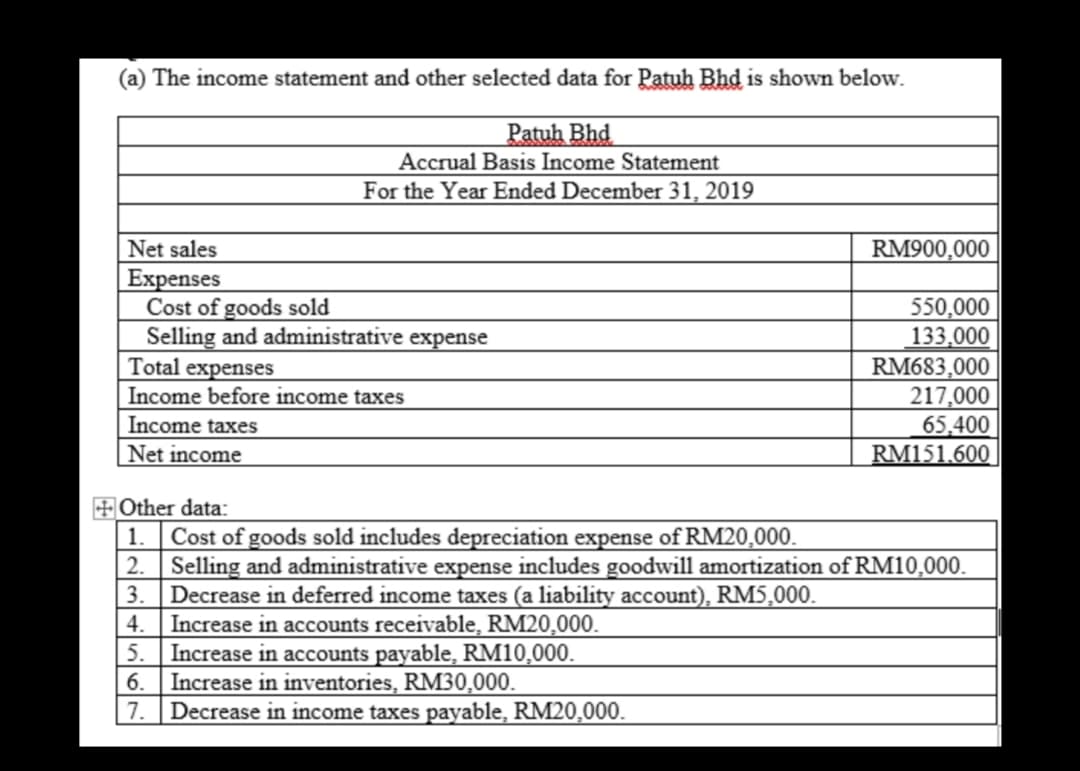

(a) The income statement and other selected data for Patuh Bhd is shown below. Patuh Bhd Accrual Basis Income Statement For the Year Ended December 31, 2019 Net sales RM900,000 Expenses Cost of goods sold Selling and administrative expense Total expenses Income before income taxes 550,000 133,000 RM683,000 217,000 65,400 RM151.600 Income taxes Net income + Other data: 1. Cost of goods sold includes depreciation expense of RM20,000. 2. Selling and administrative expense includes goodwill amortization of RM10,000. 3. Decrease in deferred income taxes (a liability account), RM5,000. Increase in accounts receivable, RM20,000. 5. Increase in accounts payable, RM10,000. 6. 4. Increase in inventories, RM30,000. 7. Decrease in income taxes payable, RM20,000.

(a) The income statement and other selected data for Patuh Bhd is shown below. Patuh Bhd Accrual Basis Income Statement For the Year Ended December 31, 2019 Net sales RM900,000 Expenses Cost of goods sold Selling and administrative expense Total expenses Income before income taxes 550,000 133,000 RM683,000 217,000 65,400 RM151.600 Income taxes Net income + Other data: 1. Cost of goods sold includes depreciation expense of RM20,000. 2. Selling and administrative expense includes goodwill amortization of RM10,000. 3. Decrease in deferred income taxes (a liability account), RM5,000. Increase in accounts receivable, RM20,000. 5. Increase in accounts payable, RM10,000. 6. 4. Increase in inventories, RM30,000. 7. Decrease in income taxes payable, RM20,000.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 3E: Identify each of the following items relating to sections of an income statement as Revenue from...

Related questions

Question

Required:

(i) Prepare a cash basis income statement

(ii) Prepare the cash flows from operating activities using the indirect approach.

(b)

Transcribed Image Text:(a) The income statement and other selected data for Patuh Bhd is shown below.

Patuh Bhd

Accrual Basis Income Statement

For the Year Ended December 31, 2019

Net sales

RM900,000

Expenses

Cost of goods sold

Selling and administrative expense

Total expenses

Income before income taxes

Income taxes

Net income

550,000

133,000

RM683,000

217,000

65,400

RM151.600

+Other data:

1. Cost of goods sold includes depreciation expense of RM20,000.

Selling and administrative expense includes goodwill amortization of RM10,000.

Decrease in deferred income taxes (a liability account), RM5,000.

Increase in accounts receivable, RM20,000.

5. Increase in accounts payable, RM10,000.

Increase in inventories, RM30,000.

Decrease in income taxes payable, RM20,000.

3.

4.

6.

7.

123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage