Compantieincome staerements years end dec 31, 2018 and 2on Net sales Costs of goods sold gross Profitt selling! general expenses income from operatzons interest income beffore income tax S8,000 income tav expense Net income 2018 230,000 123.000 127,000 2017 199,000 102,000 97,000 S,000 461000 L8,000 28,000 10,000 18,000 72,000 expense 14,000 201000 38,000 Α E 2016 2017 30S,000 300,000 194,000 l,000 2018 total assets common soccholders equity 196,000 preffered cdividends avg. cmn shares outstanding 310,000 192,000 2,000 Ispoo 14,000 13,000 di ning the ycar

Compantieincome staerements years end dec 31, 2018 and 2on Net sales Costs of goods sold gross Profitt selling! general expenses income from operatzons interest income beffore income tax S8,000 income tav expense Net income 2018 230,000 123.000 127,000 2017 199,000 102,000 97,000 S,000 461000 L8,000 28,000 10,000 18,000 72,000 expense 14,000 201000 38,000 Α E 2016 2017 30S,000 300,000 194,000 l,000 2018 total assets common soccholders equity 196,000 preffered cdividends avg. cmn shares outstanding 310,000 192,000 2,000 Ispoo 14,000 13,000 di ning the ycar

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

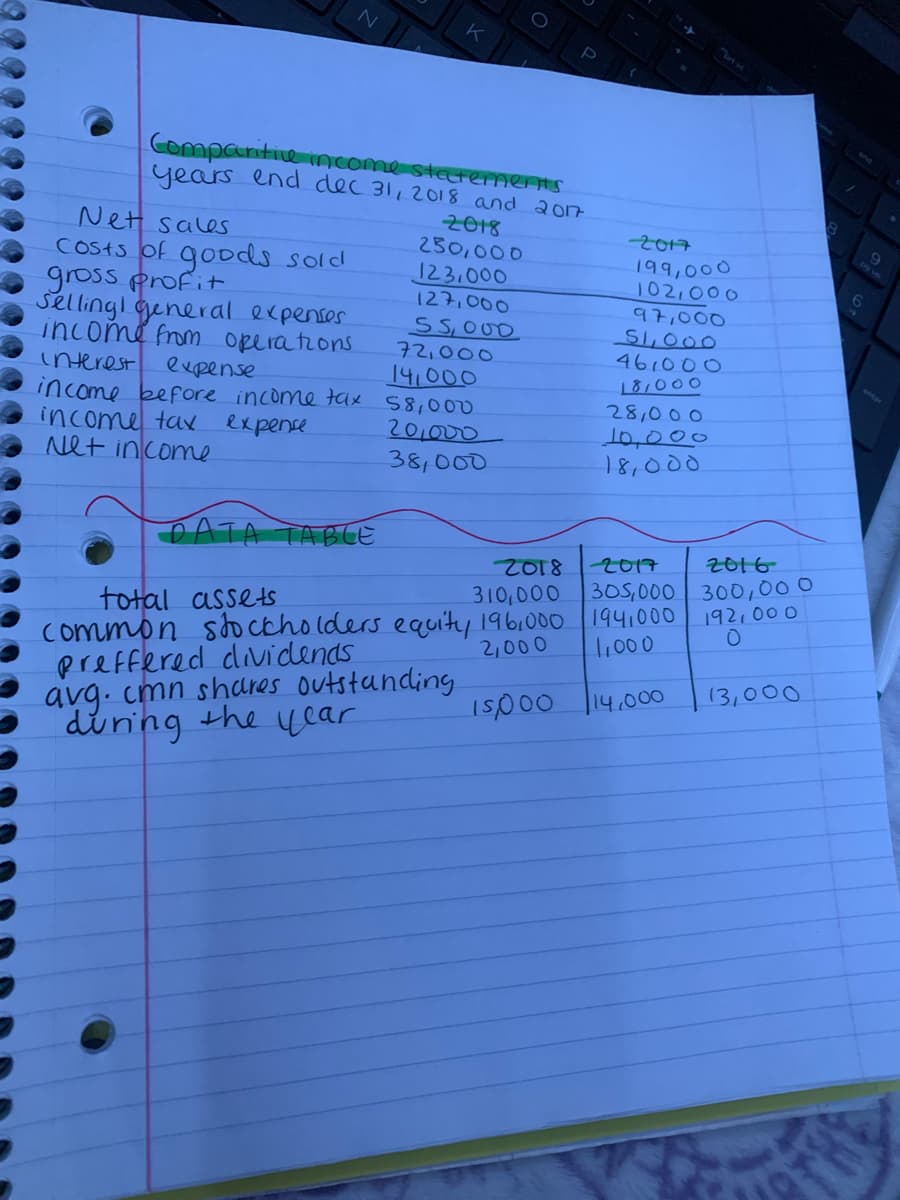

Please find the following ratios for both year 2017 and year 2018 based on following data

RATIO

AT

ROA

L

ROE

Transcribed Image Text:Compantie income statrements

years end dec 31,2018 and 2o17

00

Net sales

Costs of goods sold

gross profit

Sellingl general expenses

income from operations

interest

income beffore income tax 58,000

income tav expense

Net income

2018

230,000

123.000

127,000

2017

199,000

102,000

97,000

S1,000

461000

18,000

28,000

10,000

18,000

72,000

expense

14,000

20,000

38,000

DATA TABTE

2018

2017

2016

30S,000 300,000

192,000

310,000

total assets

common soccholders equity 196.000 1941000

preffered dividends

avg. cmn shares outstanding

di n'ng the year

2,000

l,000

Ispoo

14,000

13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,