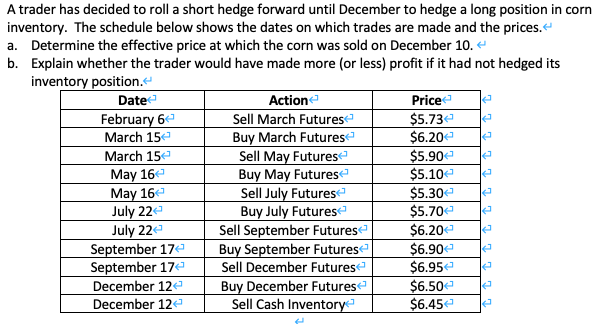

A trader has decided to roll a short hedge forward until December to hedge a long position in corn inventory. The schedule below shows the dates on which trades are made and the prices.< a. Determine the effective price at which the corn was sold on December 10. < b. Explain whether the trader would have made more (or less) profit if it had not hedged its inventory position.< Date February 6 March 15 March 15 May 16 May 16 July 22 July 22 September 174 September 174 December 12 December 12 Action Sell March Futures Buy March Futures Sell May Futures Buy May Futures Sell July Futures Buy July Futures Sell September Futures Buy September Futures Sell December Futures Buy December Futures Sell Cash Inventory Price $5.73 $6.20€ $5.90€ $5.10€ $5.30€ $5.70€ $6.20€ $6.90€ $6.95€ $6.50€ $6.45€

A trader has decided to roll a short hedge forward until December to hedge a long position in corn inventory. The schedule below shows the dates on which trades are made and the prices.< a. Determine the effective price at which the corn was sold on December 10. < b. Explain whether the trader would have made more (or less) profit if it had not hedged its inventory position.< Date February 6 March 15 March 15 May 16 May 16 July 22 July 22 September 174 September 174 December 12 December 12 Action Sell March Futures Buy March Futures Sell May Futures Buy May Futures Sell July Futures Buy July Futures Sell September Futures Buy September Futures Sell December Futures Buy December Futures Sell Cash Inventory Price $5.73 $6.20€ $5.90€ $5.10€ $5.30€ $5.70€ $6.20€ $6.90€ $6.95€ $6.50€ $6.45€

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 3BIC

Related questions

Question

Transcribed Image Text:A trader has decided to roll a short hedge forward until December to hedge a long position in corn

inventory. The schedule below shows the dates on which trades are made and the prices.

a. Determine the effective price at which the corn was sold on December 10. e

b. Explain whether the trader would have made more (or less) profit if it had not hedged its

inventory position.“

Date

Action

Sell March Futures

Buy March Futurese

Sell May Futures

Buy May Futuresa

Sell July Futuresa

Buy July Futuresa

Sell September Futurese

Buy September Futures

Sell December Futures

Buy December Futures

Sell Cash Inventory

Price

February 6

March 15e

$5.73e

$6.20

$5.90

$5.10

$5.30

$5.70

March 15e

May 16e

May 16

July 22

$6.20

$6.90

$6.95e

$6.50

$6.45

July 22e

September 17

September 17

December 12e

December 12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you