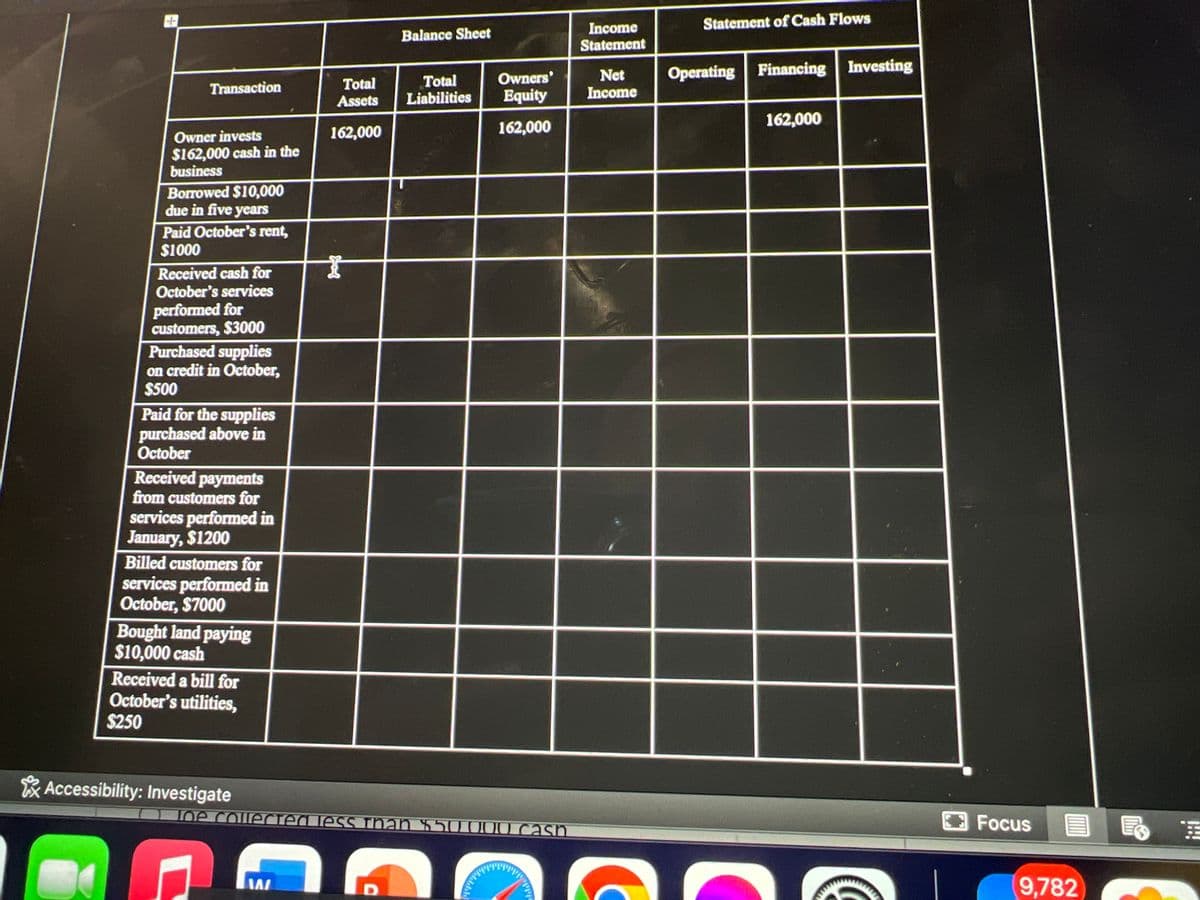

The following is a set of transactions for Hoosier corporation for the month of oct 20x1. For each of the following indicate the impact is the transaction on the Balance sheet, income statement, and statement of cash flows for oct 20x1. The first transaction is provided as examples and is correct. Place parenthesis around amount to indicate negative numbers if there is no effect leave the cell blank.

The following is a set of transactions for Hoosier corporation for the month of oct 20x1. For each of the following indicate the impact is the transaction on the Balance sheet, income statement, and statement of cash flows for oct 20x1. The first transaction is provided as examples and is correct. Place parenthesis around amount to indicate negative numbers if there is no effect leave the cell blank.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

The following is a set of transactions for Hoosier corporation for the month of oct 20x1. For each of the following indicate the impact is the transaction on the

Transcribed Image Text:Transaction

Owner invests

$162,000 cash in the

business

Borrowed $10,000

due in five years

Paid October's rent,

$1000

Received cash for

October's services

performed for

customers, $3000

Purchased supplies

on credit in October,

$500

Paid for the supplies

purchased above in

October

Received payments

from customers for

services performed in

January, $1200

Billed customers for

services performed in

October, $7000

Bought land paying

$10,000 cash

Received a bill for

October's utilities,

$250

Accessibility: Investigate

Total

Assets

162,000

}

W

7

Joe collected less than $50 000 cash

Balance Sheet

D

Owners'

Total

Liabilities Equity

162,000

Income

Statement

Net

Income

C

Statement of Cash Flows

Operating Financing Investing

162,000

wwwwww

Focus

9,782

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning