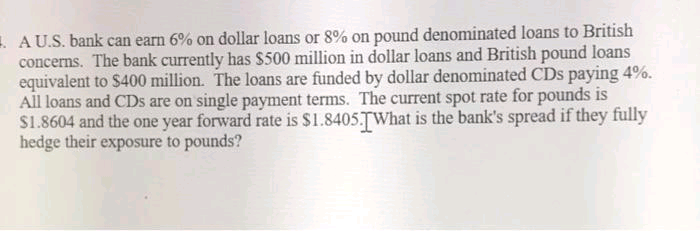

A U.S. bank can earn 6% on dollar loans or 8% on pound denominated loans to British concerns. The bank currently has $500 million in dollar loans and British pound loans equivalent to $400 million. The loans are funded by dollar denominated CDs paying 4%. All loans and CDs are on single payment terms. The current spot rate for pounds is $1.8604 and the one year forward rate is $1.8405.TWhat is the bank's spread if they fully hedge their exposure to pounds?

Q: Brown Company, had the following statements prepared as of December 31, 2020. Brown Company…

A: Cash Flows from Operating Activities…

Q: Question 9: The Internal Re venue Senvico levies a small senvice fee for emplovers wbo utilize the…

A: The Internal Revenue Service is the taxation authority in the USA. It takes…

Q: PhotoGrid Gibson Corporation began fiscal Year 2 with the following balances in its inventory…

A: a) Calculation to compute ending balances: 1) Ending balance of raw material= Beginning balance of…

Q: Trifecta Distributors has decided to discontinue manufacturing its X Plus model. Currently, the…

A: Solution:- Preparation of a differential analysis per unit to determine if Trifecta should complete…

Q: Company had ary 1, Vilma c n method of P pany had esti er 31, 2020 wi y had fixed as f P2,000,000 c

A: The total amount of expense that should be reported in the interim income statement ended on 30…

Q: Cairns owns 75 percent of the voting stock of Hamilton, Inc. The parent’s interest was acquired…

A: interest acquired several years ago = 1,000,000$ *10 *6% = 600,000$ Therefore it is 600,000$ on 13…

Q: On November 1, 2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a…

A: The Yuan is selling at discount in forward market <spot rate. The forward contract include a…

Q: PROBLEM 7-20 Evaluating the Profitability of Services LO7-2, LO7-3, L07-4, L07-5 Gallatin Carpet…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Blue Co. acquired coal mines for $86,000,000 on February 10, 20X7 which were estimated to contain…

A: Cost of Inventory Per Ton = (Cost of coal mines - Salvage Value) / Estimated tons of coal

Q: Exercise 16-39 (Algo) Variable Cost Variances (LO 16-5) The records of Norton, Inc. show the…

A: Lets understand the basics. Direct labor rate variance indicates the variance between the rate at…

Q: On 1 March 2021 Dora Ltd enters into a binding agreement with a New Zealand company, which requires…

A: As per IAS 21, a transaction entered into a foreign currency need to be entered at the initial…

Q: ble on this month's operations in the Computer Chip Division: Selling price per chip $50 Variable…

A: Given Current Purchase Price of the computer Division = $ 45 Per Chip Number of chips purchased in…

Q: At the beginning of the current year, Lessee Company leased a new machine from Lessor Company with…

A: First we need to compute Initial recognition of lease liability on commencement date = present…

Q: eriodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item…

A: LIFO method - Last in first out. It assumes that last inventory are sold first FIFO - First on…

Q: Honest Corporation carried a provision of P1,500,000 in the draft financial statements for the year…

A: Answer: C.1,000,000 Accrued liabilities are such liabilities which have not yet been paid during an…

Q: Crane Company's balance sheet accounts as of December 31, 2021 and 2020 and information relating to…

A: Cash Flow Statement For the year ended December 31, 2021 Amount (In $) Amount (In $)…

Q: Insight Compeny's standard factory overhead rate is $3.86 per direct labor hour (DLH, calculated et…

A: A spending variance is also known as a rate variance, It is the difference between an expense's…

Q: Indicate whether each of the following items would be added to or subtracted from net income to…

A: Cash flows from operating activities: The Cash flow operating activities refer to the money or…

Q: Coleridge Company estimates that its production workers will work 143,000 direct labor hours during…

A: Given, Estimated overhead = $1,287,000 Estimated direct labor hours = $143,000

Q: 1. Angel Trading presents the following sales figures in terms of units. 2014 10 000 2015 11 650…

A: Simple moving average is the method by using which sales can be forecasted by using average trend of…

Q: Caribbean Kayaks (CK) Maritza (which means "star of the sea") Joseph is preparing the 2022 budget…

A: Direct Material Budget helps the enterprise to estimate the requirements of the total quantity of…

Q: Question 15: The lookback period runs from July 1 through June 30.

A: Lookback Period : Look back Period is used to determine if an organization is an applicable tax…

Q: The following information was taken from the 2021 financial statements of Crane Company:…

A: A cash flow statement indicates cash inflow and cash outflow information of a particular time…

Q: artners Lim and Tan share profits in a 2:1 ratio, respectively. Each partner receives an annual…

A: Lets understand the basics. Partnership is an agreement between two or more person who works…

Q: On Jan. 1, 2021, Sleepy Company entered into a direct financing lease. A third party guaranteed the…

A: A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner…

Q: E9.6 (LO 2), AP Rottino Company purchased a new machine on October 1, 2022, at a cost of $150,000.…

A: Depreciation is a reduction of the historical cost of a fixed asset in an accounting practice until…

Q: For a consumer, utility maximization occurs at O the intersection of two budget lines O the…

A: Consumer always tend to achieve and obtain maximum utility from the consumption of goods at a given…

Q: 1. The financial statements of Kare-Kare Company for the calendar year ending December 31, 2021 are…

A: In the context of the given question, the events or transactions that have occurred before or after…

Q: Wet Mop Incorporated expects to sell 10,000 mops. Fixed costs (for the year) are expected to be…

A: There are two type of costs being incurred in the business. One is fixed costs and other is variable…

Q: 1. The financial statements of Kare-Kare Company for the calendar year ending December 31, 2021 are…

A: Income before tax before the following events occurred in the company = P50,000,000 Investment held…

Q: P9-13 (Static) Recording and Reporting Deferred Income Tax: Depreciation (Supplement B) LO9-6 [The…

A: Introduction Deferred income tax liability is the obligation recorded in the balance sheet…

Q: National Retail has two departments, Housewares and Sporting. Indirect expenses for the period…

A: The traditional method of overhead allocation is based on a predetermined overhead rate. The…

Q: Choose one specialized industry and identify one specific financial reporting standards or distinct…

A: Financial reporting standards are the set of accounting rules and policies within the framework of…

Q: What total amount of expenses should be reported in the income statement for the 2nd quarter of…

A: Expenses means the amount spent on running the business. It will be shown in income statement and…

Q: Which of the following amounts paid by an employer to an employee is not subject to withholding? Oa.…

A: Given : Multiple options a) Salary b) Travel expense reimbursements from an accountable plan c)…

Q: April Industries employs a standard costing system in the manufacturing of its sole product, a park…

A: Standard cost per unit = standard cost for material output/Actual output

Q: onresidential real property is depreciated over 27

A: Regarding tax depreciation, the residential properties have a determinable useful life of 27.5 years…

Q: Cork Oak Corporation purchased a heavy-duty truck (not considered a passenger automobile for…

A: Since you have posted two independent questions, therefore, as per the guidelines, the solution to…

Q: ed: nate the tage to

A: 1) Calculation : 2021 2022 Estimated ending inventory at retail $453,800 $822,800…

Q: On June 1, 2020, the Crocus Company began construction of a new manufacturing plant. The plant was…

A: The Specific interest method is used to identify borrowings or sections of borrowings that are…

Q: Required information [The following information applies to the questions displayed below.] Lacy is a…

A: Qualified dividend is taxed at preferential rate and rest income will be taxed at ordinary tax rate.…

Q: P12.1B (LO 1,2,3,5) (Correct Intangible Asset Account) Dolphin Co., organized in 2019, has set up a…

A: Journal entries shows the recording of the transactions and every transaction dual impact that is.,…

Q: osition of the assets would be P700,000 and the component’s operating income was P200,000. What…

A: Pretax losses refer to the sum value of money gained or losses made by a company before paying taxes…

Q: Top 10 Global Brands. Calculate their brand value as a % of the global market. Brand Value ($m)…

A: Note: 1 Million 0.001 billion 1 Million 0.000001 Trillion

Q: Cost of Goods Sold Gross Operating Expenses Net Sales Net Profit ($) Margin ($) $336,500 $132,200 $…

A: Formula: Gross margin = Net sales - Cost of goods sold

Q: A local picnic table manufacturer has budgeted these overhead costs: Purchasing $80,000 Handling…

A: The overhead rate is calculated as total cost divided by the activity usage units.

Q: Functional currency is the currency that influences sales price, labour, material and other costs of…

A: Functional Currency: When an entity records and tracks its transactions in one currency, it is…

Q: s $62 million of long-t en Gate's equity capital is 15 percent. Moreover, the ns: the real estate…

A: EVA (economic value added) refers to the concept which computes the economic profit of a company.

Q: Q) $15,000 is invested in an account at time 0. At the end of 4 years, an additional $15,000 nvested…

A: Future Value: Using an expected rate of growth, future value (FV) is defined as the worth of a…

Q: To maximize profits, firms produce the level of output that: O a. equates total revenue and total…

A: The output levels achieve highest efficiency and peak profits when marginal revenue is on par or…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Mississippi Company borrows ¥80,000,000 at a time when the exchange rate is 110 ¥/$. Principal is to be repaid two years from now, and interest is for the yen bond is 4% per annum, paid annually in yen. Suppose the yen is expected to depreciate relative to the dollar to 120 ¥/$ in one year, and 125¥/$ in two years. Under these circumstances, what would be the effective dollar cost of this loan for Mississippi Company? Please enter your answer as % -- e.g. if your answer is 2.34% type in 2.34.Cullumber needs to borrow $4 million for an upgrade to its headquarters and manufacturing facility. Management has decided to borrow using a five-year term loan from its existing commercial bank. The prime rate is 4 percent, and Cullumber’s current rating is prime + 2.57 percent. The yield on a five-year U.S. Treasury note is 1.91 percent, and the three-month U.S. Treasury bill rate is 0.12 percent. What is the estimated loan rate for the five-year bank loan?Beez Kneez co. needs to borrow $4 million for an upgrade to its headquarters and manufacturing facility. Management has decided to borrow using a five-year term loan from its existing commercial bank. The prime rate is 3 percent, and Beez Kneez's current rating is prime + 2.40 percent. The yield on a five-year U.S. Treasury note is 1.90 percent, and the three-month U.S. Treasury bill rate is 0.08 percent. What is the estimated loan rate for the five-year bank loan? Estimated loan rate is_____%

- Ghana Company enters into an IRG arrangement with Meterbank for 9 months, P800,000 loan starting 3 months from now. The IRG rate is at 11% and the bank quotes a premium of P4,000. Compute for the effective interest rate if the actual interest rate 3 months from now is 8%Cal Bank believes the US Dollar will appreciate over the next five days from GHS 4.48 to GHS 4.50. The following annual interest rates apply: Currency Lending Rate Borrowing RateDollars 7.10% 7.50%Ghana Cedis 6.80% 7.25% Cal Bank has the capacity to borrow either GHS 10 million or $5 million. If Cal Bank's forecast is correct, what will its dollar profit be from speculation over the five-day period (assuming it does not use any of its existing consumer deposits to capitalize on its expectations)?Sheridan needs to borrow $4 million for an upgrade to its headquarters and manufacturing facility. Management has decided to borrow using a five-year term loan from its existing commercial bank. The prime rate is 4 percent, and Sheridan’s current rating is prime + 2.49 percent. The yield on a five-year U.S. Treasury note is 1.99 percent, and the three-month U.S. Treasury bill rate is 0.10 percent. What is the estimated loan rate for the five-year bank loan? Estimated loan rate is enter the estimated loan rate in percentages %

- Sheridan needs to borrow $4 million for an upgrade to its headquarters and manufacturing facility. Management has decided to borrow using a five-year term loan from its existing commercial bank. The prime rate is 4 percent, and Sheridan’s current rating is prime + 2.49 percent. The yield on a five-year U.S. Treasury note is 1.99 percent, and the three-month U.S. Treasury bill rate is 0.10 percent. What is the estimated loan rate for the five-year bank loan?The York Company has arranged a line of credit that allows it to borrow up to $45 milion at any time. The interest rate is .621 percent per month. Additionally, the company must deposit 3 percent of the amount borrowed in a non-interest bearing account. The bank uses compound interest on its line-of-credit loans. What is the effective annual rate on this line of credit? Multiple Choices 6.40% 7.71% 7.95% 7.06% 8.83%XYZ entered into a currency swap with its bank, and borrowed $10 million at 9% and swaps for a 11% yen loan. The spot exchange rate is 95/$. How much is the annual interest to be paid to the bank.

- A firm in the UK places £42,000 (forty-two thousand pounds) in a bond paying 6% compounded quarterly and leaves it there as collateral for a loan. Find (a) the balance in the account after 1 year and (b) the intererestDePaul International Bank is a U.S. bank that wants to speculate on the dollar-euro exchange rate. A euro (€) costs $1.08 today. The bank expects it to cost $1.12 in 4 months. Current annual interest rates are as follows: Currency Borrowing rate Lending rate Euro 4.8% 4.1% U.S. dollar 7.5% 6.6% The bank doesn't want to use any of its own money, but could borrow either $10,000,000 or €10,000,000. Assume there are 30 days in every month and 360 days per year. Ignore compounding when working with the interest rates. Part 1 What is the expected profit from the trade after 4 months (in $)?Below is the information regarding U.S. and Canadian annualized interest rates: Currency Lending Rate Borrowing Rate U.S Dollar ($) 6.73% 7.20% Euro (€) 6.80% 7.28% Note: Spot rate of Euro is $1.13 An international bank can borrow either 20 million U.S. dollars or 20 million euro. The bank expects the spot rate of the euro is $1.10 in 90 days, which is equal to ______ profit. A. $583,800 B. $588,200 C. $584,245 D. $579,845