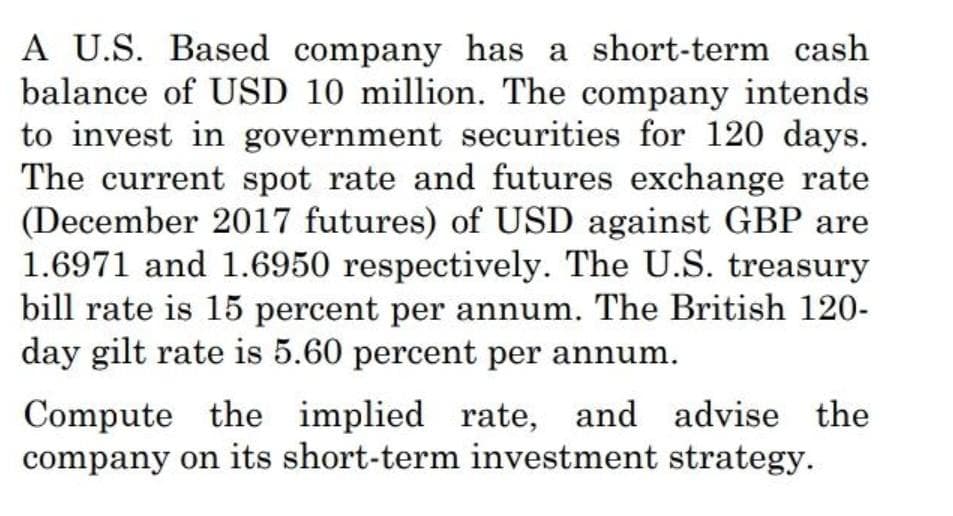

A U.S. Based company has a short-term cash balance of USD 10 million. The company intends to invest in government securities for 120 days. The current spot rate and futures exchange rate (December 2017 futures) of USD against GBP are 1.6971 and 1.6950 respectively. The U.S. treasury bill rate is 15 percent per annum. The British 120- day gilt rate is 5.60 percent per annum.

A U.S. Based company has a short-term cash balance of USD 10 million. The company intends to invest in government securities for 120 days. The current spot rate and futures exchange rate (December 2017 futures) of USD against GBP are 1.6971 and 1.6950 respectively. The U.S. treasury bill rate is 15 percent per annum. The British 120- day gilt rate is 5.60 percent per annum.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 9CQ

Related questions

Question

Transcribed Image Text:A U.S. Based company has a short-term cash

balance of USD 10 million. The company intends

to invest in government securities for 120 days.

The current spot rate and futures exchange rate

(December 2017 futures) of USD against GBP are

1.6971 and 1.6950 respectively. The U.S. treasury

bill rate is 15 percent per annum. The British 120-

day gilt rate is 5.60 percent per annum.

Compute the implied rate, and advise the

company on its short-term investment strategy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning