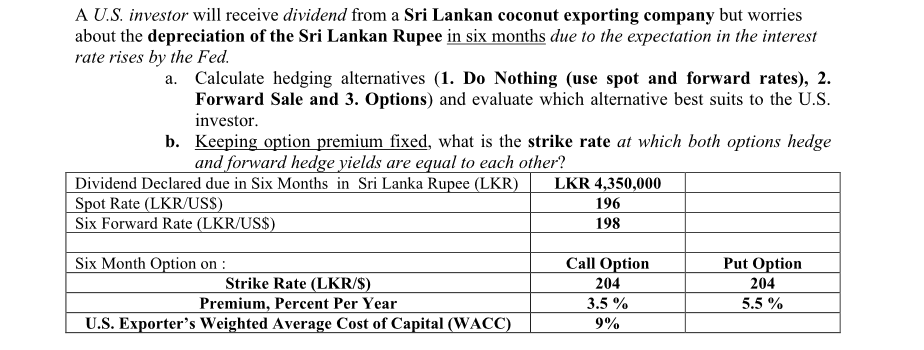

A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor. b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? Dividend Declared due in Six Months in Sri Lanka Rupee (LKR) Spot Rate (LKR/USS) Six Forward Rate (LKR/US$) Six Month Option on : Strike Rate (LKR/S) Premium, Percent Per Year U.S. Exporter's Weighted Average Cost of Capital (WACC) LKR 4,350,000 196 198 Call Option 204 3.5 % 9% Put Option 204 5.5%

A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor. b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? Dividend Declared due in Six Months in Sri Lanka Rupee (LKR) Spot Rate (LKR/USS) Six Forward Rate (LKR/US$) Six Month Option on : Strike Rate (LKR/S) Premium, Percent Per Year U.S. Exporter's Weighted Average Cost of Capital (WACC) LKR 4,350,000 196 198 Call Option 204 3.5 % 9% Put Option 204 5.5%

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 11QA

Related questions

Question

Please answer this question fast.

Transcribed Image Text:A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries

about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest

rate rises by the Fed.

a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2.

Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S.

investor.

b. Keeping option premium fixed, what is the strike rate at which both options hedge

and forward hedge yields are equal to each other?

Dividend Declared due in Six Months in Sri Lanka Rupee (LKR)

Spot Rate (LKR/USS)

Six Forward Rate (LKR/US$)

Six Month Option on :

Strike Rate (LKR/S)

Premium, Percent Per Year

U.S. Exporter's Weighted Average Cost of Capital (WACC)

LKR 4,350,000

196

198

Call Option

204

3.5%

9%

Put Option

204

5.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you