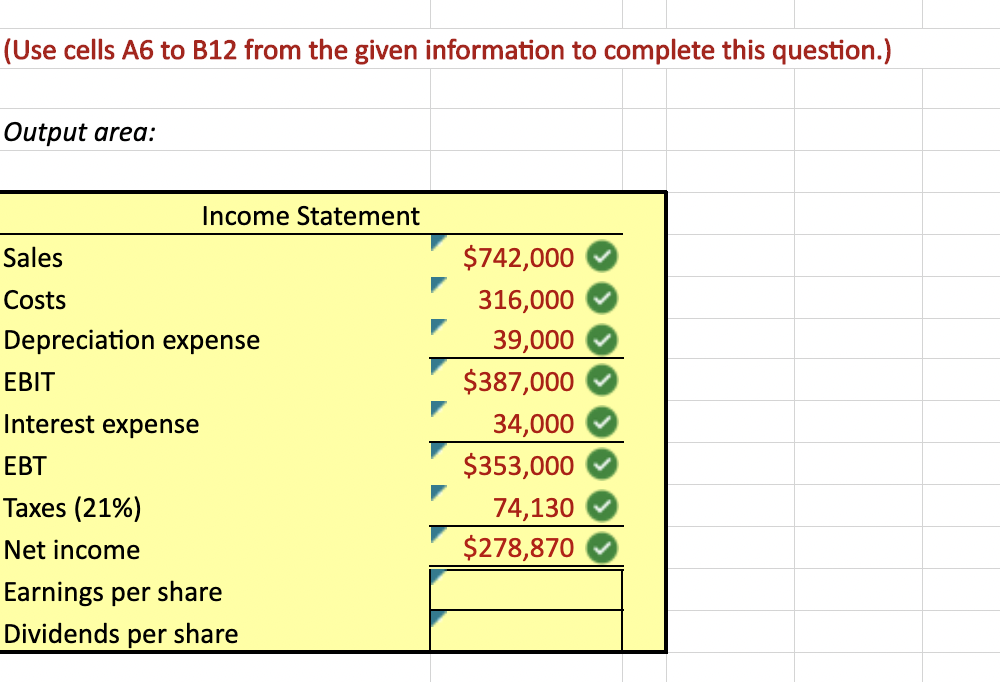

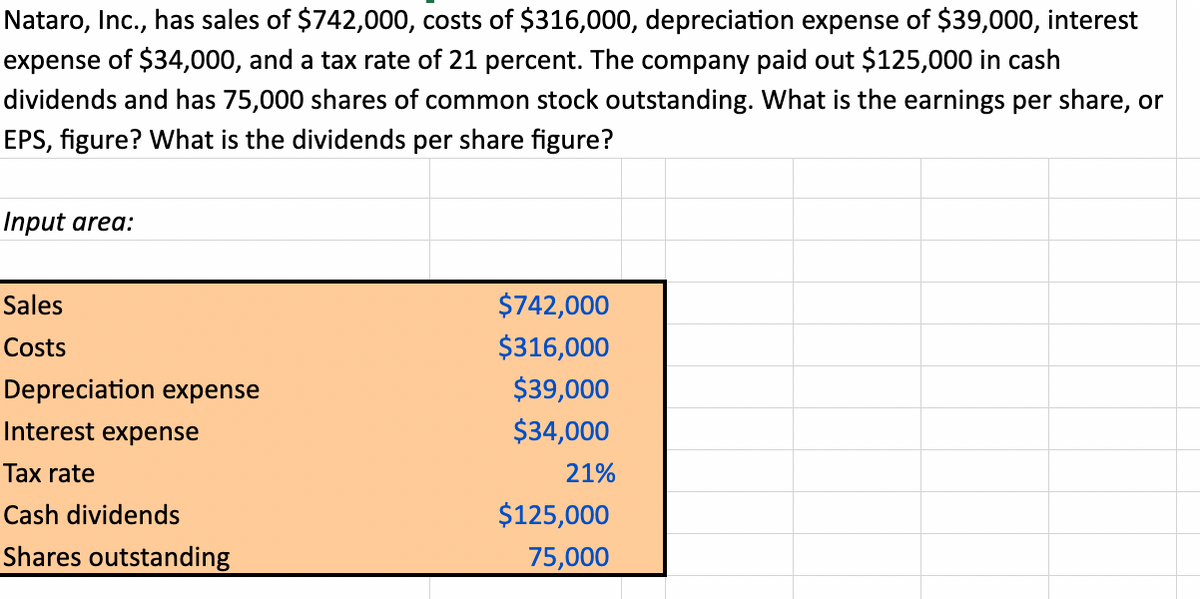

(Use cells A6 to B12 from the given information to complete this question. Output area: Income Statement Sales Costs Depreciation expense EBIT Interest expense EBT Taxes (21%) Net income Earnings per share Dividends per share $742,000 316,000 39,000 $387,000 34,000 $353,000 74,130 $278,870

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Please help me calculate the earnings per share and dividends per share. IT MUST BE CORRECT!!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps