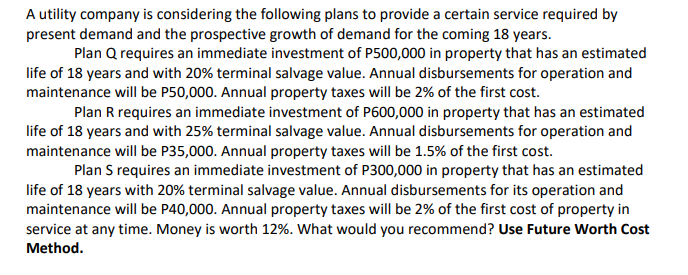

A utility company is considering the following plans to provide a certain service required by present demand and the prospective growth of demand for the coming 18 years. Plan Q requires an immediate investment of P500,000 in property that has an estimated life of 18 years and with 20% terminal salvage value. Annual disbursements for operation and maintenance will be P50,000. Annual property taxes will be 2% of the first cost. Plan R requires an immediate investment of P600,000 in property that has an estimated life of 18 years and with 25% terminal salvage value. Annual disbursements for operation and maintenance will be P35,000. Annual property taxes will be 1.5% of the first cost. Plan S requires an immediate investment of P300,000 in property that has an estimated life of 18 years with 20% terminal salvage value. Annual disbursements for its operation and maintenance will be P40,000. Annual property taxes will be 2% of the first cost of property in service at any time. Money is worth 12%. What would you recommend? Use Future Worth Cost Method.

A utility company is considering the following plans to provide a certain service required by present demand and the prospective growth of demand for the coming 18 years. Plan Q requires an immediate investment of P500,000 in property that has an estimated life of 18 years and with 20% terminal salvage value. Annual disbursements for operation and maintenance will be P50,000. Annual property taxes will be 2% of the first cost. Plan R requires an immediate investment of P600,000 in property that has an estimated life of 18 years and with 25% terminal salvage value. Annual disbursements for operation and maintenance will be P35,000. Annual property taxes will be 1.5% of the first cost. Plan S requires an immediate investment of P300,000 in property that has an estimated life of 18 years with 20% terminal salvage value. Annual disbursements for its operation and maintenance will be P40,000. Annual property taxes will be 2% of the first cost of property in service at any time. Money is worth 12%. What would you recommend? Use Future Worth Cost Method.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 2CE

Related questions

Question

100%

Economics (UPVOTE WILL EB GIVEN PLEASE WRITE THE COMPLETE SOLUTIONS LEGIBLY AND FOLLOW THE INSTRUCTIONS CAREFULLY. DO NOT SOLVE USING EXCEL)

Transcribed Image Text:A utility company is considering the following plans to provide a certain service required by

present demand and the prospective growth of demand for the coming 18 years.

Plan Q requires an immediate investment of P500,000 in property that has an estimated

life of 18 years and with 20% terminal salvage value. Annual disbursements for operation and

maintenance will be P50,000. Annual property taxes will be 2% of the first cost.

Plan R requires an immediate investment of P600,000 in property that has an estimated

life of 18 years and with 25% terminal salvage value. Annual disbursements for operation and

maintenance will be P35,000. Annual property taxes will be 1.5% of the first cost.

Plan S requires an immediate investment of P300,000 in property that has an estimated

life of 18 years with 20% terminal salvage value. Annual disbursements for its operation and

maintenance will be P40,000. Annual property taxes will be 2% of the first cost of property in

service at any time. Money is worth 12%. What would you recommend? Use Future Worth Cost

Method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College