(a) What is the balance due on the original mort- gage (20 payments have been made in the last 5 years)? (b) How much will EnergyMax's payments drop with the new loan? (c) How much longer will the proposed loan run?

(a) What is the balance due on the original mort- gage (20 payments have been made in the last 5 years)? (b) How much will EnergyMax's payments drop with the new loan? (c) How much longer will the proposed loan run?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

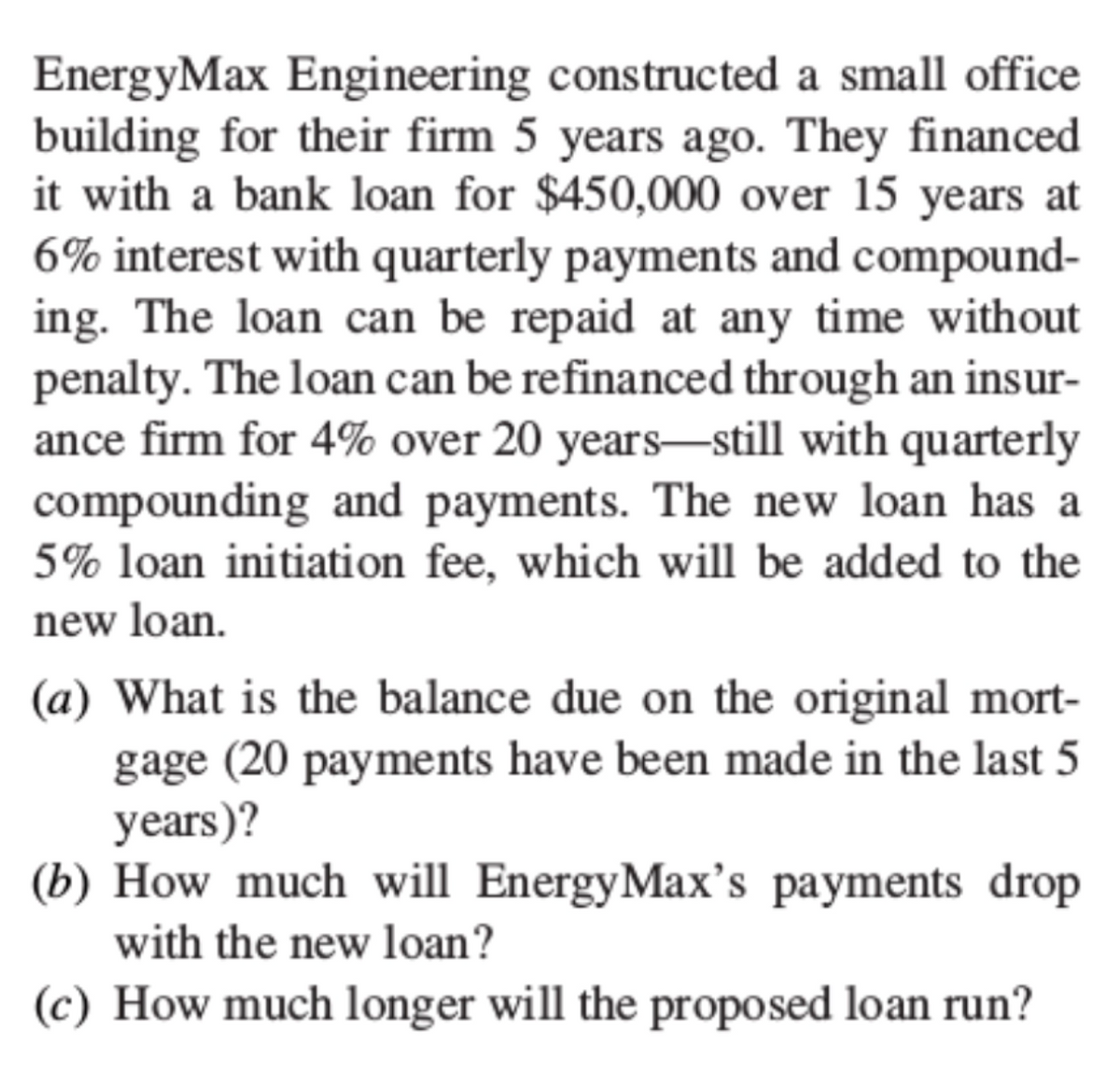

Transcribed Image Text:EnergyMax Engineering constructed a small office

building for their firm 5 years ago. They financed

it with a bank loan for $450,000 over 15 years at

6% interest with quarterly payments and compound-

ing. The loan can be repaid at any time without

penalty. The loan can be refinanced through an insur-

ance firm for 4% over 20 years-still with quarterly

compounding and payments. The new loan has a

5% loan initiation fee, which will be added to the

new loan.

(a) What is the balance due on the original mort-

gage (20 payments have been made in the last 5

years)?

(b) How much will EnergyMax's payments drop

with the new loan?

(c) How much longer will the proposed loan run?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning