a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 12.1 percent that is paid semiannually. The bond is currently selling for a price of $1,122 and will mature in 10 years. The firm's tax rate is 34 percent. b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company?

a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 12.1 percent that is paid semiannually. The bond is currently selling for a price of $1,122 and will mature in 10 years. The firm's tax rate is 34 percent. b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company?

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 11EP

Related questions

Question

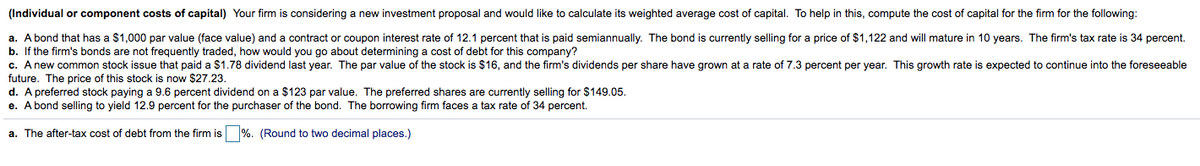

Transcribed Image Text:(Individual or component costs of capital) Your firm is considering a new investment proposal and would like to calculate its weighted average cost of capital. To help in this, compute the cost of capital for the firm for the following:

a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 12.1 percent that is paid semiannually. The bond is currently selling for a price of $1,122 and will mature in 10 years. The firm's tax rate is 34 percent.

b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company?

c. A new common stock issue that paid a $1.78 dividend last year. The par value of the stock is $16, and the firm's dividends per share have grown at a rate of 7.3 percent per year. This growth rate is expected to continue into the foreseeable

future. The price of this stock is now $27.23.

d. A preferred stock paying a 9.6 percent dividend on a $123 par value. The preferred shares are currently selling for $149.05.

e. A bond selling to yield 12.9 percent for the purchaser of the bond. The borrowing firm faces a tax rate of 34 percent.

a. The after-tax cost of debt from the firm is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning