a. A review of insurance policies showed that P6,800 is unexpired at the year-end. b. An inventory of cleaning supplies showed P12,440 on hand. C. Estimated depreciation on the building for the year is P128,000. d. Accrued interest on the mortgage payable is P10,000. e. On Sept. 1, the entity signed a contract, effective immediately, with Davao City Hospital to dry clean, for a fixed monthly charge of P4,000, the uniforms used by doctors in surgery. The hospital paid for four months' service in advance. Salaries are paid on Saturdays. The weekly payroll is P25,200. Assume that Sept. 30 falls on a Thursday and the entity has a six-day pay week.

a. A review of insurance policies showed that P6,800 is unexpired at the year-end. b. An inventory of cleaning supplies showed P12,440 on hand. C. Estimated depreciation on the building for the year is P128,000. d. Accrued interest on the mortgage payable is P10,000. e. On Sept. 1, the entity signed a contract, effective immediately, with Davao City Hospital to dry clean, for a fixed monthly charge of P4,000, the uniforms used by doctors in surgery. The hospital paid for four months' service in advance. Salaries are paid on Saturdays. The weekly payroll is P25,200. Assume that Sept. 30 falls on a Thursday and the entity has a six-day pay week.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.1P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

Transcribed Image Text:adjustment (using a + or - to indicate an increase or decrease), and the balance of the

For each of the above situations, show the accounts affected, the amount of the

TNT

all all a

5.4

64 4:08

GLOBE

K/s

Edit

88

50

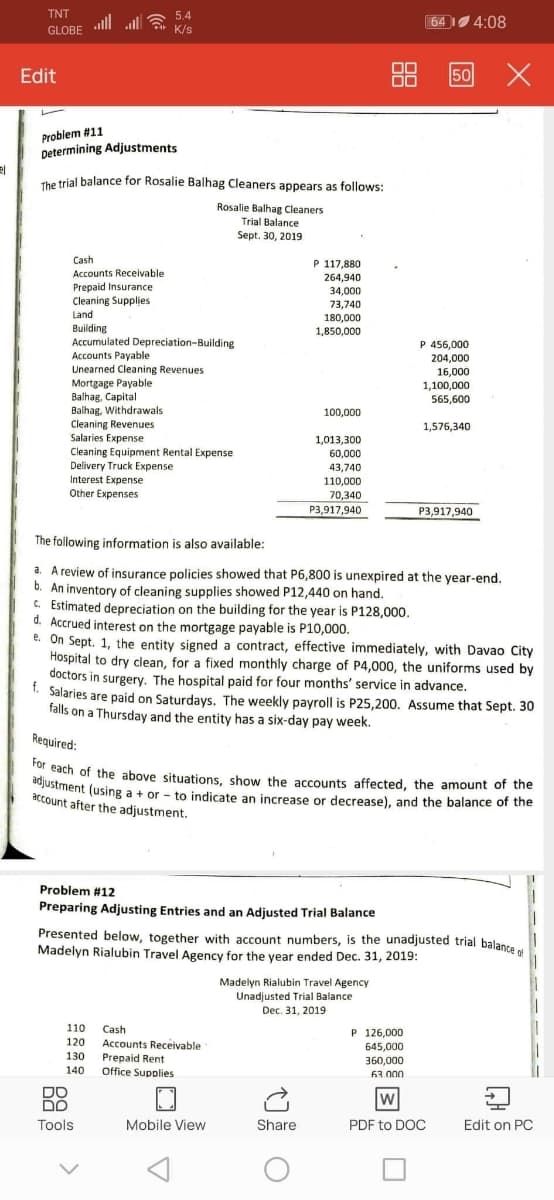

Problem #11

Determining Adjustments

de trial balance for Rosalie Balhag Cleaners appears as follows:

Rosalie Balhag Cleaners

Trial Balance

Sept. 30, 2019

Cash

P 117,880

Accounts Receivable

264,940

Prepaid Insurance

Cleaning Supplies

Land

34,000

73,740

180,000

1,850,000

Building

Accumulated Depreciation-Building

Accounts Payable

Unearned Cleaning Revenues

Mortgage Payable

Balhag, Capital

Balhag, Withdrawals

Cleaning Revenues

Salaries Expense

Cleaning Equipment Rental Expense

Delivery Truck Expense

P 456,000

204,000

16,000

1,100,000

565,600

100,000

1,576,340

1,013,300

60,000

43,740

Interest Expense

110,000

Other Expenses

70,340

P3,917,940

P3,917,940

The following information is also available:

a. A review of insurance policies showed that P6,800 is unexpired at the year-end.

b. An inventory of cleaning supplies showed P12,440 on hand.

C. Estimated depreciation on the building for the year is P128,000.

d. Accrued interest on the mortgage payable is P10,000.

e. On Sept. 1, the entity signed a contract, effective immediately, with Davao City

Hospital to dry clean, for a fixed monthly charge of P4,000, the uniforms used by

doctors in surgery. The hospital paid for four months' service in advance.

- Salaries are paid on Saturdays. The weekly payroll is P25,200. Assume that Sept. 30

falls on a Thursday and the entity has a six-day pay week.

Required:

adach of the above situations, show the accounts affected, the amount of the

justment (using a + or - to indicate an increase or decrease), and the balance of the

account after the adjustment.

Problem #12

Preparing Adjusting Entries and an Adjusted Trial Balance

Presented below, together with account numbers, is the unadjusted trial balance

Madelyn Rialubin Travel Agency for the year ended Dec. 31, 2019:

Madelyn Rialubin Travel Agency

Unadjusted Trial Balance

Dec. 31, 2019

110

Cash

P 126,000

645,000

120

Accounts Receivable

Prepaid Rent

Office Supplies

130

360,000

140

63.000

DO

DO

Tools

Mobile View

Share

PDF to DOC

Edit on PC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning