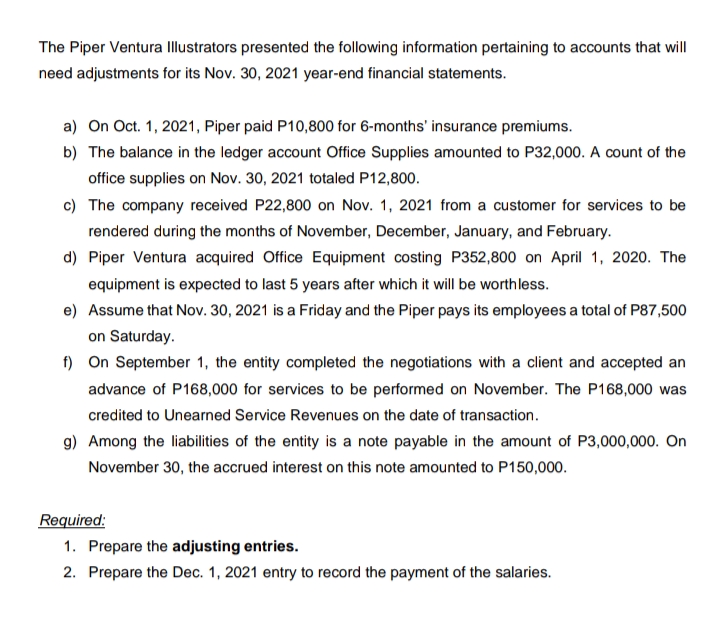

The Piper Ventura Illustrators presented the following information pertaining to accounts that will need adjustments for its Nov. 30, 2021 year-end financial statements. a) On Oct. 1, 2021, Piper paid P10,800 for 6-months’ insurance premiums. b) The balance in the ledger account Office Supplies amounted to P32,000. A count of the office supplies on Nov. 30, 2021 totaled P12,800. c) The company received P22,800 on Nov. 1, 2021 from a customer for services to be rendered during the months of November, December, January, and February. d) Piper Ventura acquired Office Equipment costing P352,800 on April 1, 2020. The equipment is expected to last 5 years after which it will be worthless. e) Assume that Nov. 30, 2021 is a Friday and the Piper pays its employees a total of P87,500 on Saturday. f) On September 1, the entity completed the negotiations with a client and accepted an advance of P168,000 for services to be performed on November. The P168,000 was credited to Unearned Service Revenues on the date of transaction. g) Among the liabilities of the entity is a note payable in the amount of P3,000,000. On November 30, the accrued interest on this note amounted to P150,000. Required: 1. Prepare the adjusting entries. 2. Prepare the Dec. 1, 2021 entry to record the payment of the salaries.

The Piper Ventura Illustrators presented the following information pertaining to accounts that will need adjustments for its Nov. 30, 2021 year-end financial statements. a) On Oct. 1, 2021, Piper paid P10,800 for 6-months’ insurance premiums. b) The balance in the ledger account Office Supplies amounted to P32,000. A count of the office supplies on Nov. 30, 2021 totaled P12,800. c) The company received P22,800 on Nov. 1, 2021 from a customer for services to be rendered during the months of November, December, January, and February. d) Piper Ventura acquired Office Equipment costing P352,800 on April 1, 2020. The equipment is expected to last 5 years after which it will be worthless. e) Assume that Nov. 30, 2021 is a Friday and the Piper pays its employees a total of P87,500 on Saturday. f) On September 1, the entity completed the negotiations with a client and accepted an advance of P168,000 for services to be performed on November. The P168,000 was credited to Unearned Service Revenues on the date of transaction. g) Among the liabilities of the entity is a note payable in the amount of P3,000,000. On November 30, the accrued interest on this note amounted to P150,000. Required: 1. Prepare the adjusting entries. 2. Prepare the Dec. 1, 2021 entry to record the payment of the salaries.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PA: The following accounts appear in the ledger of Celso and Company as of June 30, the end of this...

Related questions

Question

100%

The Piper Ventura Illustrators presented the following information pertaining to accounts that will

need adjustments for its Nov. 30, 2021 year-end financial statements.

a) On Oct. 1, 2021, Piper paid P10,800 for 6-months’ insurance premiums.

b) The balance in the ledger account Office Supplies amounted to P32,000. A count of the office supplies on Nov. 30, 2021 totaled P12,800.

c) The company received P22,800 on Nov. 1, 2021 from a customer for services to be rendered during the months of November, December, January, and February.

d) Piper Ventura acquired Office Equipment costing P352,800 on April 1, 2020. The equipment is expected to last 5 years after which it will be worthless.

e) Assume that Nov. 30, 2021 is a Friday and the Piper pays its employees a total of P87,500 on Saturday.

f) On September 1, the entity completed the negotiations with a client and accepted an advance of P168,000 for services to be performed on November. The P168,000 was credited to Unearned Service Revenues on the date of transaction.

g) Among the liabilities of the entity is a note payable in the amount of P3,000,000. On November 30, the accrued interest on this note amounted to P150,000.

Required:

1. Prepare the adjusting entries .

2. Prepare the Dec. 1, 2021 entry to record the payment of the salaries.

Transcribed Image Text:The Piper Ventura Illustrators presented the following information pertaining to accounts that will

need adjustments for its Nov. 30, 2021 year-end financial statements.

a) On Oct. 1, 2021, Piper paid P10,800 for 6-months' insurance premiums.

b) The balance in the ledger account Office Supplies amounted to P32,000. A count of the

office supplies on Nov. 30, 2021 totaled P12,800.

c) The company received P22,800 on Nov. 1, 2021 from a customer for services to be

rendered during the months of November, December, January, and February.

d) Piper Ventura acquired Office Equipment costing P352,800 on April 1, 2020. The

equipment is expected to last 5 years after which it will be worthless.

e) Assume that Nov. 30, 2021 is a Friday and the Piper pays its employees a total of P87,500

on Saturday.

f) On September 1, the entity completed the negotiations with a client and accepted an

advance of P168,000 for services to be performed on November. The P168,000 was

credited to Unearned Service Revenues on the date of transaction.

g) Among the liabilities of the entity is a note payable in the amount of P3,000,000. On

November 30, the accrued interest on this note amounted to P150,000.

Required:

1. Prepare the adjusting entries.

2. Prepare the Dec. 1, 2021 entry to record the payment of the salaries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage