a. Calculate the payback period for this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. Calculate the NPV for this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. Calculate the IRR for this project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Calculate the payback period for this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. Calculate the NPV for this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. Calculate the IRR for this project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11E

Related questions

Question

Kindly help me solve this problem using Excel. Have to calculate the payback period for the project, calculate the

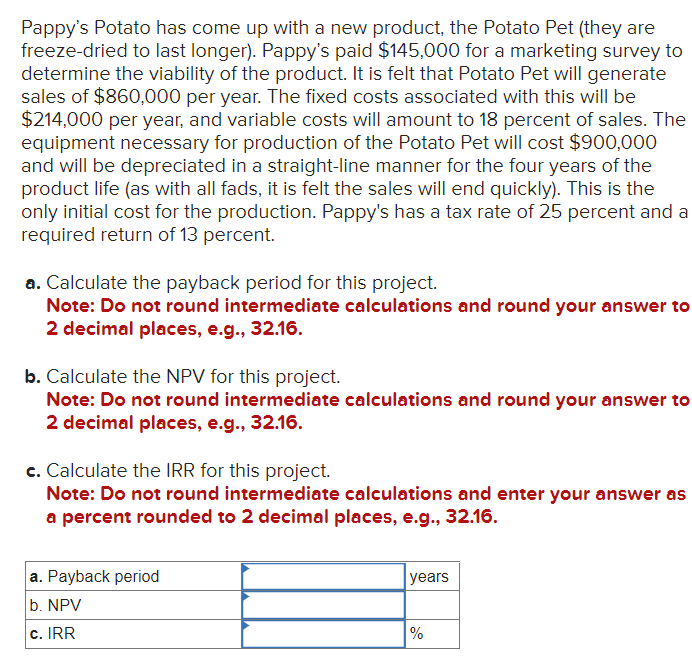

Transcribed Image Text:Pappy's Potato has come up with a new product, the Potato Pet (they are

freeze-dried to last longer). Pappy's paid $145,000 for a marketing survey to

determine the viability of the product. It is felt that Potato Pet will generate

sales of $860,000 per year. The fixed costs associated with this will be

$214,000 per year, and variable costs will amount to 18 percent of sales. The

equipment necessary for production of the Potato Pet will cost $900,000

and will be depreciated in a straight-line manner for the four years of the

product life (as with all fads, it is felt the sales will end quickly). This is the

only initial cost for the production. Pappy's has a tax rate of 25 percent and a

required return of 13 percent.

a. Calculate the payback period for this project.

Note: Do not round intermediate calculations and round your answer to

2 decimal places, e.g., 32.16.

b. Calculate the NPV for this project.

Note: Do not round intermediate calculations and round your answer to

2 decimal places, e.g., 32.16.

c. Calculate the IRR for this project.

Note: Do not round intermediate calculations and enter your answer as

a percent rounded to 2 decimal places, e.g., 32.16.

a. Payback period

b. NPV

c. IRR

years

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning