a. Calculate the present value of total outflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outfows b. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outflows c. Calculate the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value

a. Calculate the present value of total outflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outfows b. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outflows c. Calculate the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

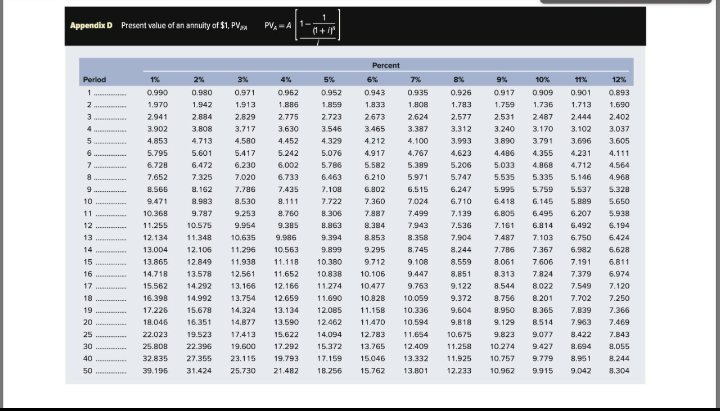

Transcribed Image Text:Appendix D Present value of an annuity of $1, PVa

PV-A1-

(1+ i

Percent

Period

1%

2%

3%

4%

5%

6%

7%

9%

10%

11%

12%

0.990

0.980

0.971

0.962

0.952

0.943

0.935

0.926

0.917

0.909

0.901

0.893

2.

1.970

1.942

1.913

1.886

1.859

1.833

1.808

1.783

1.759

1.736

1.713

1.690

2.941

2.884

2.829

2.775

2.723

2673

2.624

2.577

2.531

2487

2.444

2.402

4

3.902

3.808

3.717

3.630

3.546

3.465

3.387

3.312

3.240

3.170

3.102

3.037

4.853

4.713

4.580

4.452

4.329

4.212

4.100

3.993

3.890

3.791

3.696

3.605

...

5.795

5.601

5.417

5.242

5.076

4.917

4.767

4.623

4.486

4.355

4.231

4.111

6.728

6.472

6.230

6.002

5.786

5.582

5.389

5.206

5.033

4.868

4.712

4.564

7.652

7.325

7.020

6.733

6.463

6.210

5.971

5.747

5.535

5.335

5.146

4.968

8.566

8.162

7.786

7.435

7.108

6.802

6.515

6.247

5.995

5.759

5.537

5.328

10

9.471

8.983

8.530

8.111

7.722

7.360

7.024

6.710

6.418

6.145

5.889

5.650

10.368

9.787

9.253

8.760

8.306

7.887

7.499

7.139

6.805

6.495

6.207

5.938

11.

16 ..

11.255

10.575

9.954

9.385

B.863

8.384

7.943

7.536

7.161

6.814

6.492

6.194

13

12.134

11.348

10.635

9.586

9.394

8.853

8.358

7.904

7.487

7.103

6.750

6.424

14

13.004

12.105

11.296

10.563

9.899

9.295

8.745

8.244

7.786

7.367

6.982

6.628

15

13.865

12.849

11.938

11.118

10.380

9.712

9.108

8.559

8.061

7.606

7.191

6.811

16

14.718

13.578

12.561

11.652

10.838

10.106

9.447

8.851

8.313

7.824

7.379

6.974

17

15.562

14.292

13.166

12.166

11.274

10.477

9.763

9.122

8.544

8.022

7.549

7.120

18

16.398

14.992

13.754

12.659

11.690

10.028

10.059

9.372

8.756

8.201

7.702

7.250

19

17.226

15.678

14.324

13.134

12.085

11.158

10.336

9.604

8.950

8.365

7.839

7.366

20

18.046

16.351

14.877

13.590

12.462

11.470

10.594

9.818

9.129

8514

7.963

7.469

25

22.023

19.523

17.413

15.622

14.094

12.783

11.654

10.675

9.823

9.077

8.422

7.843

30

25.808

22.396

19.600

17.292

15.372

13.765

12.409

11.258

10.274

9.427

8.694

8.055

40

....

32.835

27.355

23.115

19.793

17.159

15.046

13.332

11.925

10.757

9.779

8.951

8.244

21.482

18.256

13.801

8.304

50

39.196

31.424

25,730

15.762

12.233

10.962

9915

9.042

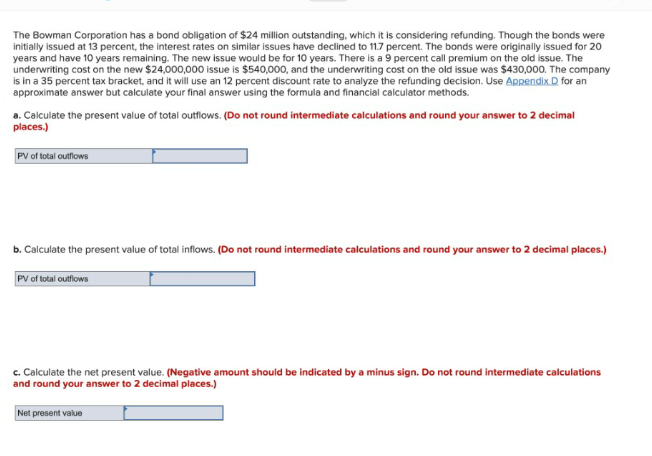

Transcribed Image Text:The Bowman Corporation has a bond obligation of $24 million outstanding, which it is considering refunding. Though the bonds were

initially issued at 13 percent, the interest rates on similar issues have declined to 11.7 percent. The bonds were originally issued for 20

years and have 10 years remaining. The new issue would be for 10 years. There is a 9 percent call premium on the old issue. The

underwriting cost on the new $24,000,000 issue is $540,000, and the underwriting cost on the old issue was $430,000. The company

is in a 35 percent tax bracket, and it will use an 12 percent discount rate to analyze the refunding decision. Use Appendix D for an

approximate answer but calculate your final answer using the formula and financial calculator methods.

a. Calculate the present value of total outflows. (Do not round intermediate calculations and round your answer to 2 decimal

places.)

PV of total outflows

b. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places.)

PV of total outflows

c. Calculate the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations

and round your answer to 2 decimal places.)

Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education