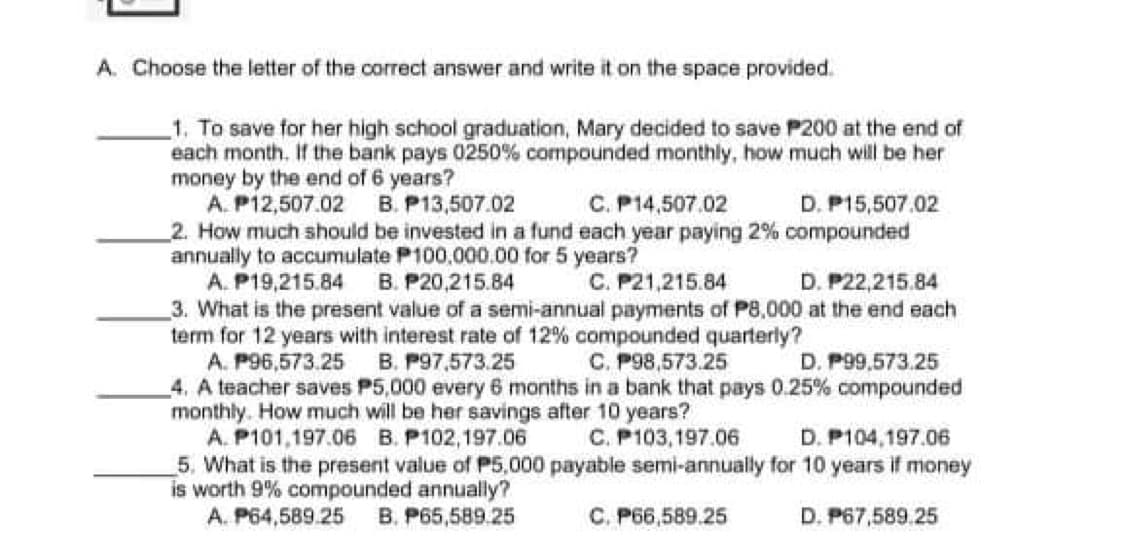

A. Choose the letter of the correct answer and write it on the space provided. 1. To save for her high school graduation, Mary decided to save P200 at the end of each month. If the bank pays 0250 % compounded monthly, how much will be her money by the end of 6 years? A. P12,507.02 B. P13,507.02 2. How much should be invested in a fund each year paying 2% compounded annually to accumulate P100,000.00 for 5 years? A. P19,215.84 B. P20,215.84 C. P21,215.84 3. What is the present value of a semi-annual payments of P8,000 at the end each term for 12 years with interest rate of 12% compounded quarterly? A. P96,573.25 B. P97,573.25 4. A teacher saves P5,000 every 6 months in a bank that pays 0.25 % compounded monthly. How much will be her savings after 10 years? A. P101,197.06 B. P102,197.06 C. P14,507.02 D. P15,507.02 D. P22,215.84 C. P98,573.25 D. P99,573.25 C. P103,197.06 D. P104,197.06 5. What is the present value of P5,000 payable semi-annually for 10 years if money is worth 9% compounded annually? A. P64,589.25 B. P65,589.25 C. P66,589.25 D. P67,589.25

A. Choose the letter of the correct answer and write it on the space provided. 1. To save for her high school graduation, Mary decided to save P200 at the end of each month. If the bank pays 0250 % compounded monthly, how much will be her money by the end of 6 years? A. P12,507.02 B. P13,507.02 2. How much should be invested in a fund each year paying 2% compounded annually to accumulate P100,000.00 for 5 years? A. P19,215.84 B. P20,215.84 C. P21,215.84 3. What is the present value of a semi-annual payments of P8,000 at the end each term for 12 years with interest rate of 12% compounded quarterly? A. P96,573.25 B. P97,573.25 4. A teacher saves P5,000 every 6 months in a bank that pays 0.25 % compounded monthly. How much will be her savings after 10 years? A. P101,197.06 B. P102,197.06 C. P14,507.02 D. P15,507.02 D. P22,215.84 C. P98,573.25 D. P99,573.25 C. P103,197.06 D. P104,197.06 5. What is the present value of P5,000 payable semi-annually for 10 years if money is worth 9% compounded annually? A. P64,589.25 B. P65,589.25 C. P66,589.25 D. P67,589.25

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:A. Choose the letter of the correct answer and write it on the space provided.

1. To save for her high school graduation, Mary decided to save P200 at the end of

each month. If the bank pays 0250% compounded monthly, how much will be her

money by the end of 6 years?

A. P12,507.02 B. P13,507.02

2. How much should be invested in a fund each year paying 2% compounded

annually to accumulate P100,000.00 for 5 years?

A. P19,215.84 B. P20,215.84

3. What is the present value of a semi-annual payments of P8,000 at the end each

term for 12 years with interest rate of 12% compounded quarterly?

A. P96,573.25

4. A teacher saves P5,000 every 6 months in a bank that pays 0.25% compounded

monthly. How much will be her savings after 10 years?

A. P101,197.06 B. P102,197.06

5. What is the present value of P5,000 payable semi-annually for 10 years if money

is worth 9% compounded annually?

A. P64,589.25

C. P14,507.02

D. P15,507.02

C. P21,215.84

D. P22,215.84

B. P97,573.25

C. P98,573.25

D. P99,573.25

C. P103,197.06

D. P104,197.06

B. P65,589.25

C. P66,589.25

D. P67,589.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning