A. Companies such as Sime Darby, Maxis and Nestle carry out many transactions in foreign currencies and have foreign operations. The entities are required to apply MFRS 121 The Effects of Changes in Foreign Exchange Rates in translating the financial statements of foreign operations to include in the consolidated financial statements. Required: a. Briefly discuss the THREE (3) primary indicators/factors in determining the functional currency of a company in order to records its transactions and prepare the financial statements. b. Briefly explain the following translation methods: i. Translating from foreign to functional currency ii. Translating from functional to presentation currency

A. Companies such as Sime Darby, Maxis and Nestle carry out many transactions in foreign currencies and have foreign operations. The entities are required to apply MFRS 121 The Effects of Changes in Foreign Exchange Rates in translating the financial statements of foreign operations to include in the consolidated financial statements. Required: a. Briefly discuss the THREE (3) primary indicators/factors in determining the functional currency of a company in order to records its transactions and prepare the financial statements. b. Briefly explain the following translation methods: i. Translating from foreign to functional currency ii. Translating from functional to presentation currency

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 2DIC

Related questions

Question

Please solve all questions

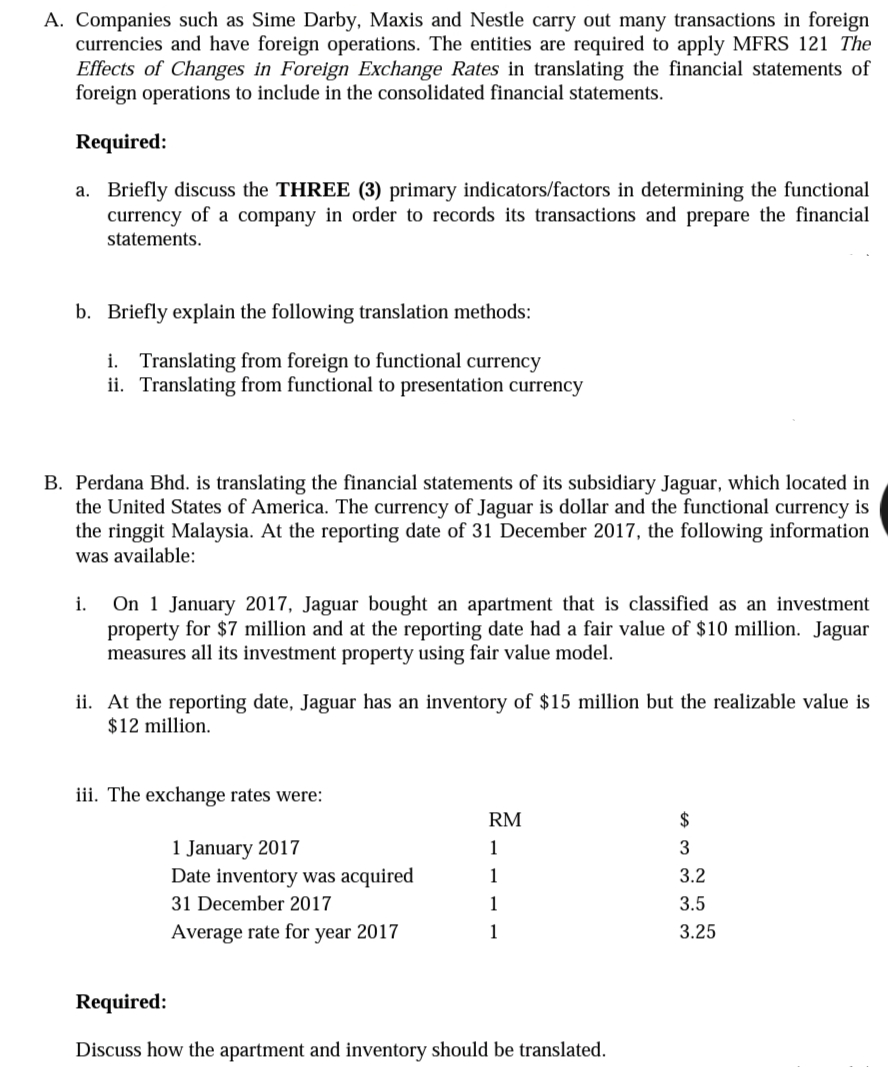

Transcribed Image Text:A. Companies such as Sime Darby, Maxis and Nestle carry out many transactions in foreign

currencies and have foreign operations. The entities are required to apply MFRS 121 The

Effects of Changes in Foreign Exchange Rates in translating the financial statements of

foreign operations to include in the consolidated financial statements.

Required:

a. Briefly discuss the THREE (3) primary indicators/factors in determining the functional

currency of a company in order to records its transactions and prepare the financial

statements.

b. Briefly explain the following translation methods:

i. Translating from foreign to functional currency

ii. Translating from functional to presentation currency

B. Perdana Bhd. is translating the financial statements of its subsidiary Jaguar, which located in

the United States of America. The currency of Jaguar is dollar and the functional currency is

the ringgit Malaysia. At the reporting date of 31 December 2017, the following information

was available:

On 1 January 2017, Jaguar bought an apartment that is classified as an investment

property for $7 million and at the reporting date had a fair value of $10 million. Jaguar

measures all its investment property using fair value model.

i.

ii. At the reporting date, Jaguar has an inventory of $15 million but the realizable value is

$12 million.

iii. The exchange rates were:

RM

$

1 January 2017

Date inventory was acquired

3

1

3.2

31 December 2017

1

3.5

Average rate for year 2017

1

3.25

Required:

Discuss how the apartment and inventory should be translated.

----

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning