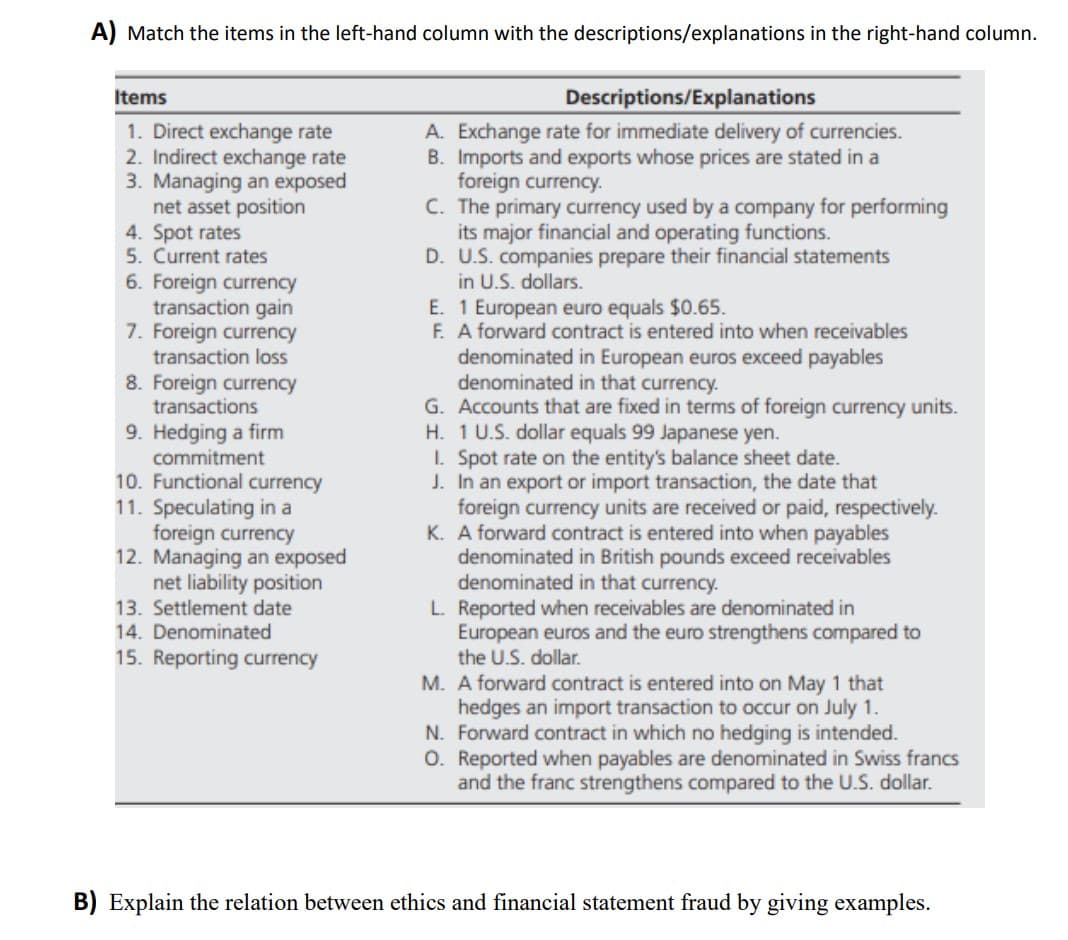

A) Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations A. Exchange rate for immediate delivery of currencies. B. Imports and exports whose prices are stated in a foreign currency. C. The primary currency used by a company for performing its major financial and operating functions. D. U.S. companies prepare their financial statements in U.S. dollars. E. 1 European euro equals $0.65. F. A forward contract is entered into when receivables denominated in European euros exceed payables denominated in that currency. G. Accounts that are fixed in terms of foreign currency units. H. 1 U.S. dollar equals 99 Japanese yen. I. Spot rate on the entity's balance sheet date. J. In an export or import transaction, the date that foreign currency units are received or paid, respectively. K. A forward contract is entered into when payables denominated in British pounds exceed receivables denominated in that currency. L. Reported when receivables are denominated in European euros and the euro strengthens compared to the U.S. dollar. M. A forward contract is entered into on May 1 that hedges an import transaction to occur on July 1. N. Forward contract in which no hedging is intended. O. Reported when payables are denominated in Swiss francs and the franc strengthens compared to the U.S. dollar. 1. Direct exchange rate 2. Indirect exchange rate 3. Managing an exposed net asset position 4. Spot rates 5. Current rates 6. Foreign currency transaction gain 7. Foreign currency transaction loss 8. Foreign currency transactions 9. Hedging a firm commitment 10. Functional currency 11. Speculating in a foreign currency 12. Managing an exposed net liability position 13. Settlement date 14. Denominated 15. Reporting currency

A) Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations A. Exchange rate for immediate delivery of currencies. B. Imports and exports whose prices are stated in a foreign currency. C. The primary currency used by a company for performing its major financial and operating functions. D. U.S. companies prepare their financial statements in U.S. dollars. E. 1 European euro equals $0.65. F. A forward contract is entered into when receivables denominated in European euros exceed payables denominated in that currency. G. Accounts that are fixed in terms of foreign currency units. H. 1 U.S. dollar equals 99 Japanese yen. I. Spot rate on the entity's balance sheet date. J. In an export or import transaction, the date that foreign currency units are received or paid, respectively. K. A forward contract is entered into when payables denominated in British pounds exceed receivables denominated in that currency. L. Reported when receivables are denominated in European euros and the euro strengthens compared to the U.S. dollar. M. A forward contract is entered into on May 1 that hedges an import transaction to occur on July 1. N. Forward contract in which no hedging is intended. O. Reported when payables are denominated in Swiss francs and the franc strengthens compared to the U.S. dollar. 1. Direct exchange rate 2. Indirect exchange rate 3. Managing an exposed net asset position 4. Spot rates 5. Current rates 6. Foreign currency transaction gain 7. Foreign currency transaction loss 8. Foreign currency transactions 9. Hedging a firm commitment 10. Functional currency 11. Speculating in a foreign currency 12. Managing an exposed net liability position 13. Settlement date 14. Denominated 15. Reporting currency

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 14QE

Related questions

Question

THIS IS WHY I CHOOSE BARTLEBY

Transcribed Image Text:A) Match the items in the left-hand column with the descriptions/explanations in the right-hand column.

Items

Descriptions/Explanations

1. Direct exchange rate

2. Indirect exchange rate

3. Managing an exposed

net asset position

4. Spot rates

5. Current rates

6. Foreign currency

transaction gain

7. Foreign currency

transaction loss

8. Foreign currency

transactions

A. Exchange rate for immediate delivery of currencies.

B. Imports and exports whose prices are stated in a

foreign currency.

C. The primary currency used by a company for performing

its major financial and operating functions.

D. U.S. companies prepare their financial statements

in U.S. dollars.

E. 1 European euro equals $0.65.

F. A forward contract is entered into when receivables

denominated in European euros exceed payables

denominated in that currency.

G. Accounts that are fixed in terms of foreign currency units.

H. 1 U.S. dollar equals 99 Japanese yen.

I. Spot rate on the entity's balance sheet date.

J. In an export or import transaction, the date that

foreign currency units are received or paid, respectively.

K. A forward contract is entered into when payables

denominated in British pounds exceed receivables

denominated in that currency.

L. Reported when receivables are denominated in

European euros and the euro strengthens compared to

the U.S. dollar.

9. Hedging a firm

commitment

10. Functional currency

11. Speculating in a

foreign currency

12. Managing an exposed

net liability position

13. Settlement date

14. Denominated

15. Reporting currency

M. A forward contract is entered into on May 1 that

hedges an import transaction to occur on July 1.

N. Forward contract in which no hedging is intended.

O. Reported when payables are denominated in Swiss francs

and the franc strengthens compared to the U.S. dollar.

B) Explain the relation between ethics and financial statement fraud by giving examples.

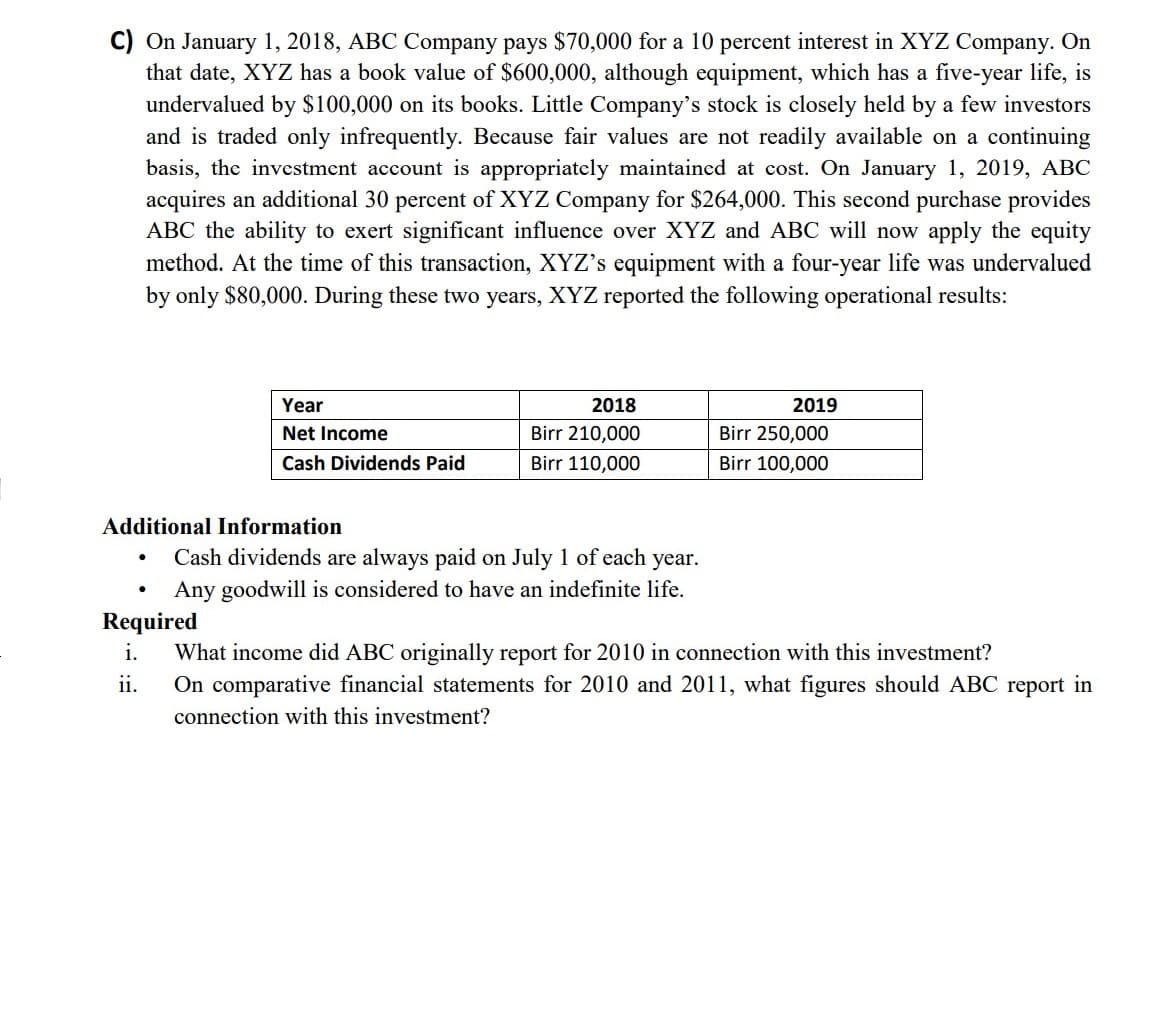

Transcribed Image Text:C) On January 1, 2018, ABC Company pays $70,000 for a 10 percent interest in XYZ Company. On

that date, XYZ has a book value of $600,000, although equipment, which has a five-year life, is

undervalued by $100,000 on its books. Little Company's stock is closely held by a few investors

and is traded only infrequently. Because fair values are not readily available on a continuing

basis, the investment account is appropriately maintained at cost. On January 1, 2019, ABC

acquires an additional 30 percent of XYZ Company for $264,000. This second purchase provides

ABC the ability to exert significant influence over XYZ and ABC will now apply the equity

method. At the time of this transaction, XYZ's equipment with a four-year life was undervalued

by only $80,000. During these two years, XYZ reported the following operational results:

Year

2018

2019

Net Income

Birr 210,000

Birr 250,000

Cash Dividends Paid

110,000

sirr 100,000

Additional Information

Cash dividends are always paid on July 1 of each year.

Any goodwill is considered to have an indefinite life.

Required

i.

What income did ABC originally report for 2010 in connection with this investment?

ii.

On comparative financial statements for 2010 and 2011, what figures should ABC report in

connection with this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College