a. Compute the maximum depreciation deduction that Redwood can take in 2021 and igen 2022 on each of these properties assuming one-half of the cost of each qualifying property bb was expensed under section 179 and an election out of bonus depreciation was made for each property class. Assume the equipment is 7-year property. b. Assume that Redwood elects the maximum allowed Section 179 expense on the equipment acquired on June 30, 2021, and that the equipment costs $1,200,000. The company uses bonus depreciation and regular MACRS to depreciate the rest of the cost. Redwood's business income limitation (taxable income before Section 179 expense, but after all other expenses, including depreciation) is $950,000. Compute the maximum total depreciation deduction (179, bonus, and regular depreciation) for the equipment for 2021.

a. Compute the maximum depreciation deduction that Redwood can take in 2021 and igen 2022 on each of these properties assuming one-half of the cost of each qualifying property bb was expensed under section 179 and an election out of bonus depreciation was made for each property class. Assume the equipment is 7-year property. b. Assume that Redwood elects the maximum allowed Section 179 expense on the equipment acquired on June 30, 2021, and that the equipment costs $1,200,000. The company uses bonus depreciation and regular MACRS to depreciate the rest of the cost. Redwood's business income limitation (taxable income before Section 179 expense, but after all other expenses, including depreciation) is $950,000. Compute the maximum total depreciation deduction (179, bonus, and regular depreciation) for the equipment for 2021.

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 76P

Related questions

Question

2022 tax rules

Transcribed Image Text:Depreciation and Amortization

8-33

ging tran acquired the following new properties. mi or to och sau od 360

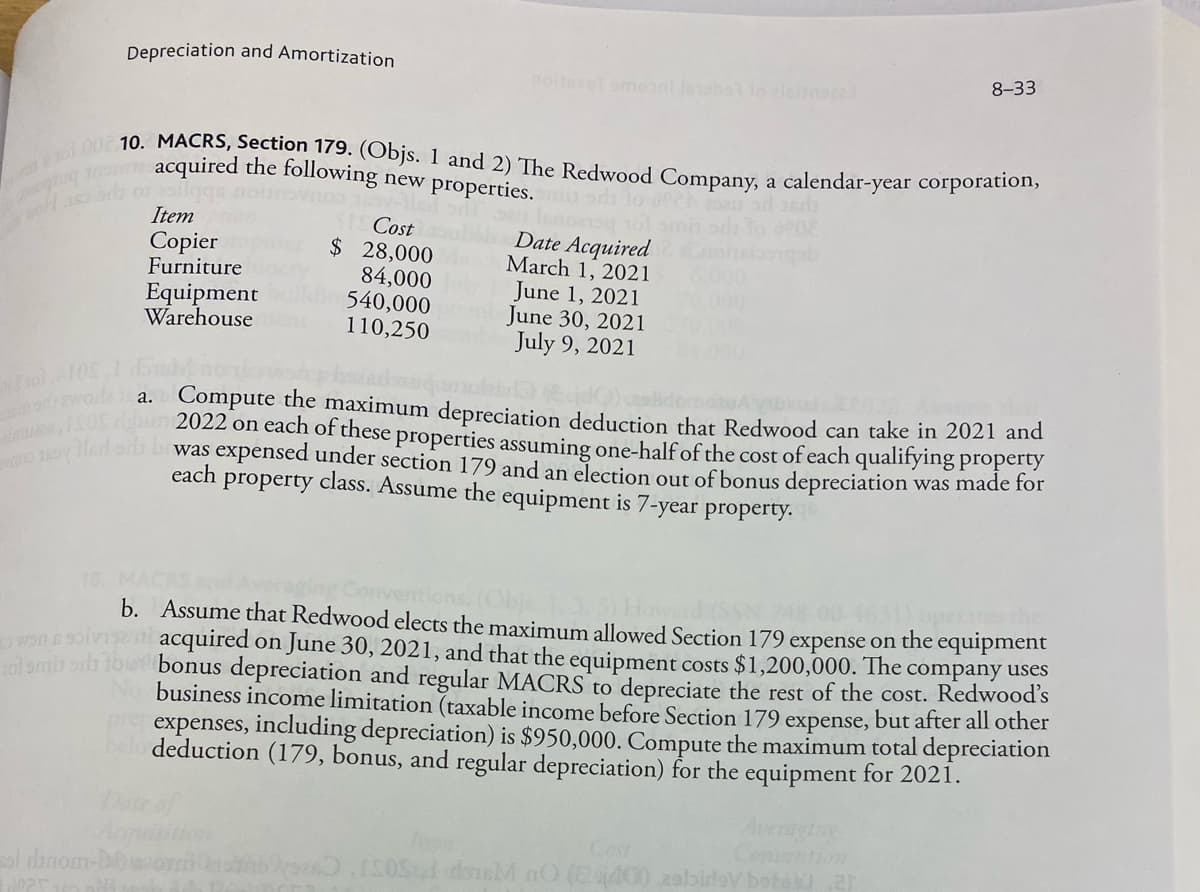

101 00 10. MACRS, Section 179. (Objs. 1 and 2) The Redwood Company, a calendar-year corporation,

STS Cost

odl seu lemono 101

Date Acquired

$ 28,000anh March 1, 2021

enopb

Item

Copier

Furniture

Equipment

Warehouse

84,000 July June 1, 2021

540,000 preb June 30, 2021

110,250cember July 9, 2021

01105

am only a

a. Compute the maximum depreciation deduction that Redwood can take in 2021 and

Ignor 2022 on each of these properties assuming one-half of the cost of each qualifying property

Swo zwy Hled s bawas expensed under section 179 and an election out of bonus depreciation was made for

each property class. Assume the equipment is 7-year property.

b.

won & S

Assume that Redwood elects the maximum allowed Section 179 expense on the equipment

en acquired on June 30, 2021, and that the equipment costs $1,200,000. The company uses

101 miss to bonus depreciation and regular MACRS to depreciate the rest of the cost. Redwood's

No business income limitation (taxable income before Section 179 expense, but after all other

pre expenses, including depreciation) is $950,000. Compute the maximum total depreciation

belo deduction (179, bonus, and regular depreciation) for the equipment for 2021.

sol dinom-P

OSąd douM nO (2440)

lov botos ar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT