a. Compute the number of (1) days the property was rented at a fair rental price; (2) total days the property was used during the year; and (3) personal days. Discuss the significance of these three numbers as they pertain to the vacation home rules. b. Compute Dari's net rental income and any expenses that she must carry over to the next year.

a. Compute the number of (1) days the property was rented at a fair rental price; (2) total days the property was used during the year; and (3) personal days. Discuss the significance of these three numbers as they pertain to the vacation home rules. b. Compute Dari's net rental income and any expenses that she must carry over to the next year.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 4CPA

Related questions

Question

2022 tax rules

Transcribed Image Text:Rental Activities

TOU6XGT Smooni leisbet to alsitnezz3

9-25

a. Compute the number of (1) days the property was rented at a fair rental price; (2) total

days the property was used during the year; and (3) personal days. Discuss the significance

of these three numbers as they pertain to the vacation home rules.

b. Compute Dari's net rental income and any expenses that she must carry over to the next

year.

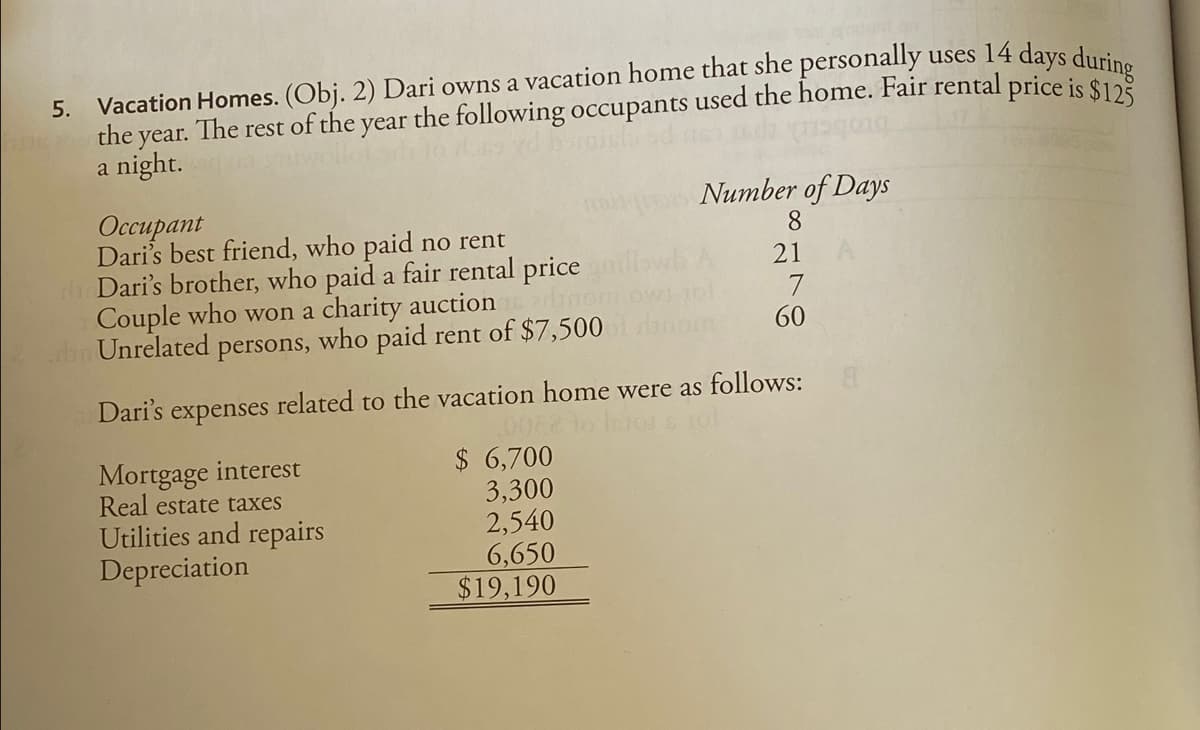

Transcribed Image Text:5. Vacation Homes. (Obj. 2) Dari owns a vacation home that she personally uses 14 days during

the year. The rest of the year the following occupants used the home. Fair rental price is $125

a night.

Occupant

Number of Days

8

21

Dari's best friend, who paid no rent

hr Dari's brother, who paid a fair rental price

Couple who won a charity auctions prin

Unrelated persons, who paid rent of $7,500

7

60

Dari's expenses related to the vacation home were as follows:

008

Mortgage interest

$ 6,700

Real estate taxes

3,300

Utilities and repairs

2,540

Depreciation

6,650

$19,190

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT