a. December revenue totaled $130,000; and, in addition, Sea Breeze collected sales tax of 5%. The tax amount will be sent to the state of Massachusetts early in January. b. On August 31, Sea Breeze signed a six-month, 12% note payable to purchase a boat costing $94,000. The note requires payment of principal and interest at maturity. c. On August 31, Sea Breeze received cash of $3,000 in advance for service revenue. This revenue will be earned evenly over six months. d. Revenues of $750,000 were covered by Sea Breeze's service warranty. At January 1, accrued warranty payable was $11,300. During the year, Sea Breeze recorded warranty expense of $30,000 and paid warranty claims of $34,600. e. Sea Breeze owes $70,000 on a long-term note payable. At December 31, 12% interest for the year plus $45,000 of this principal are payable within one year.

a. December revenue totaled $130,000; and, in addition, Sea Breeze collected sales tax of 5%. The tax amount will be sent to the state of Massachusetts early in January. b. On August 31, Sea Breeze signed a six-month, 12% note payable to purchase a boat costing $94,000. The note requires payment of principal and interest at maturity. c. On August 31, Sea Breeze received cash of $3,000 in advance for service revenue. This revenue will be earned evenly over six months. d. Revenues of $750,000 were covered by Sea Breeze's service warranty. At January 1, accrued warranty payable was $11,300. During the year, Sea Breeze recorded warranty expense of $30,000 and paid warranty claims of $34,600. e. Sea Breeze owes $70,000 on a long-term note payable. At December 31, 12% interest for the year plus $45,000 of this principal are payable within one year.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 1MP

Related questions

Question

attacinhed in the screneh sto thankas for help

appreicatei ti

4

p626pi24j6

pi2j4

62ip

62jp64ip

26j4i64p

ji

2ji

4pij4p

hji

b

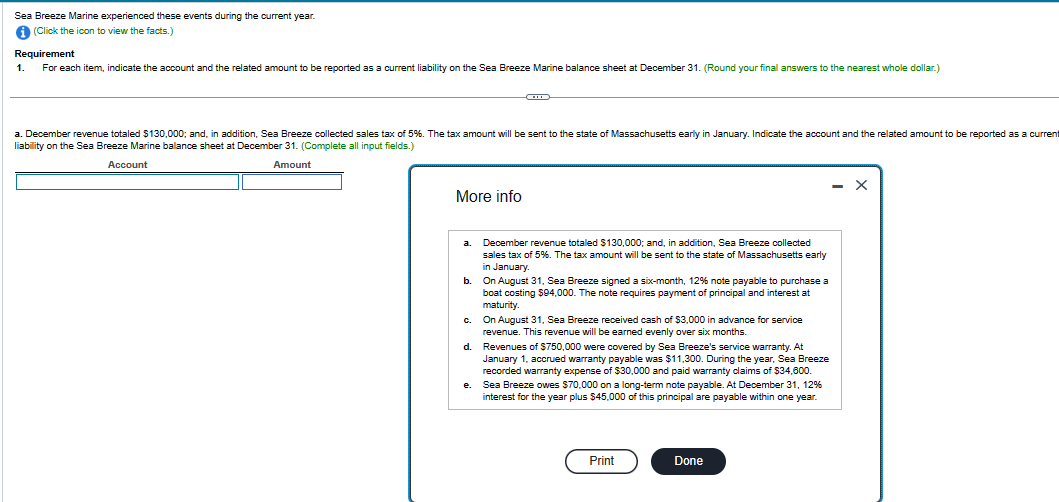

Transcribed Image Text:Sea Breeze Marine experienced these events during the current year.

i (Click the icon to view the facts.)

Requirement

1. For each item, indicate the account and the related amount to be reported as a current liability on the Sea Breeze Marine balance sheet at December 31. (Round your final answers to the nearest whole dollar.)

a. December revenue totaled $130,000; and, in addition, Sea Breeze collected sales tax of 5%. The tax amount will be sent to the state of Massachusetts early in January. Indicate the account and the related amount to be reported as a current

liability on the Sea Breeze Marine balance sheet at December 31. (Complete all input fields.)

Account

Amount

More info

a.

b. On August 31, Sea Breeze signed a six-month, 12% note payable to purchase a

boat costing $94,000. The note requires payment of principal and interest at

maturity.

C

December revenue totaled $130,000; and, in addition, Sea Breeze collected

sales tax of 5%. The tax amount will be sent to the state of Massachusetts early

in January.

d.

On August 31, Sea Breeze received cash of $3,000 in advance for service

revenue. This revenue will be earned evenly over six months.

Revenues of $750,000 were covered by Sea Breeze's service warranty. At

January 1, accrued warranty payable was $11,300. During the year, Sea Breeze

recorded warranty expense of $30,000 and paid warranty claims of $34,600.

e. Sea Breeze owes $70,000 on a long-term note payable. At December 31, 12%

interest for the year plus $45,000 of this principal are payable within one year.

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning