a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $8,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,220 of unexpired insurance coverage remains. c. The Office Supplies account had a $390 debit balance at the beginning of December; and $2,680 of office supplies were purchased in December. The December 31 physical count showed $460 of supplies available. d. Two-thirds of the work related to $12,000 of cash received in advance was performed this period. e. The Prepaid Rent account had a $5,200 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of rental policies showed that $3,980 of rental coverage had expired. f. Wage expenses of $2,000 have been incurred but are not paid as of December 31. Prepare adjusting journal entries for the year ended (date of) December 31 for each of these separate situations.

a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $8,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,220 of unexpired insurance coverage remains. c. The Office Supplies account had a $390 debit balance at the beginning of December; and $2,680 of office supplies were purchased in December. The December 31 physical count showed $460 of supplies available. d. Two-thirds of the work related to $12,000 of cash received in advance was performed this period. e. The Prepaid Rent account had a $5,200 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of rental policies showed that $3,980 of rental coverage had expired. f. Wage expenses of $2,000 have been incurred but are not paid as of December 31. Prepare adjusting journal entries for the year ended (date of) December 31 for each of these separate situations.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 1P: Adjusting Entries The following information is available for Drake Company, which adjusts and closes...

Related questions

Question

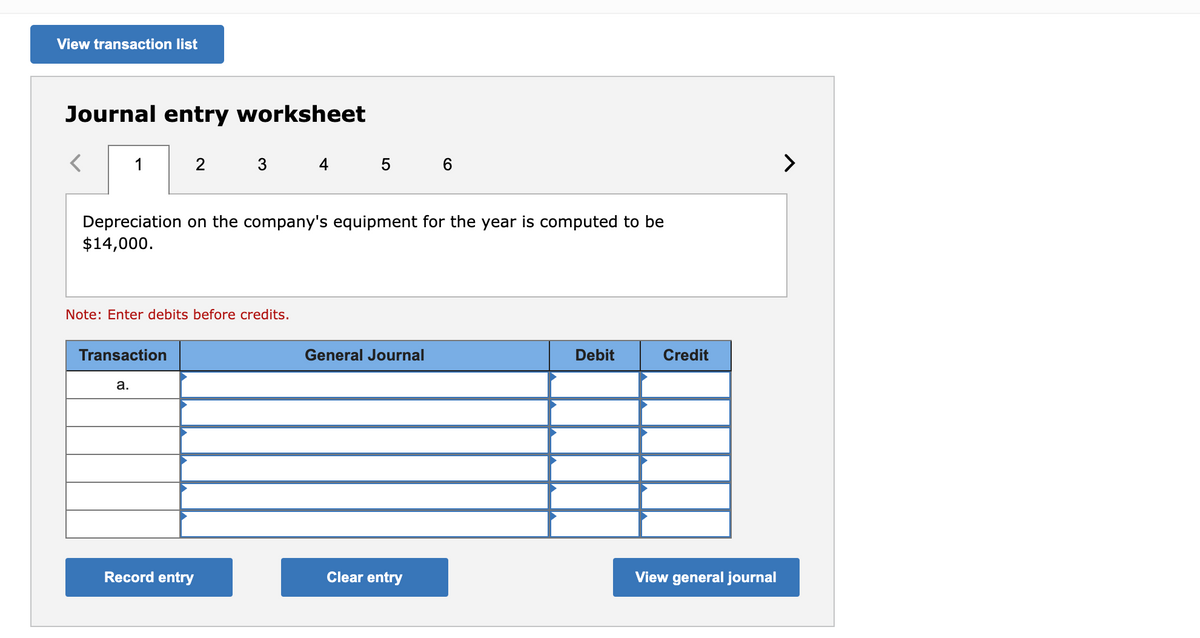

Transcribed Image Text:View transaction list

Journal entry worksheet

1

4 5 6

>

Depreciation on the company's equipment for the year is computed to be

$14,000.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

а.

Record entry

Clear entry

View general journal

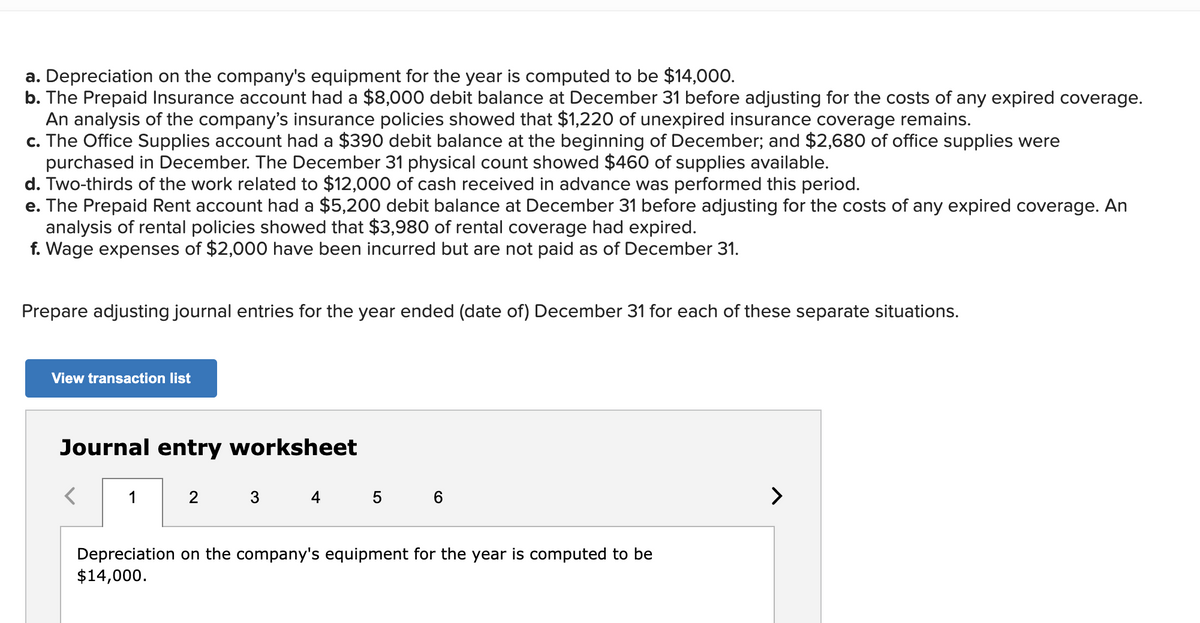

Transcribed Image Text:a. Depreciation on the company's equipment for the year is computed to be $14,000.

b. The Prepaid Insurance account had a $8,000 debit balance at December 31 before adjusting for the costs of any expired coverage.

An analysis of the company's insurance policies showed that $1,220 of unexpired insurance coverage remains.

c. The Office Supplies account had a $390 debit balance at the beginning of December; and $2,680 of office supplies were

purchased in December. The December 31 physical count showed $460 of supplies available.

d. Two-thirds of the work related to $12,000 of cash received in advance was performed this period.

e. The Prepaid Rent account had a $5,200 debit balance at December 31 before adjusting for the costs of any expired coverage. An

analysis of rental policies showed that $3,980 of rental coverage had expired.

f. Wage expenses of $2,000 have been incurred but are not paid as of December 31.

Prepare adjusting journal entries for the year ended (date of) December 31 for each of these separate situations.

View transaction list

Journal entry worksheet

1

2

4 5

>

Depreciation on the company's equipment for the year is computed to be

$14,000.

CO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage