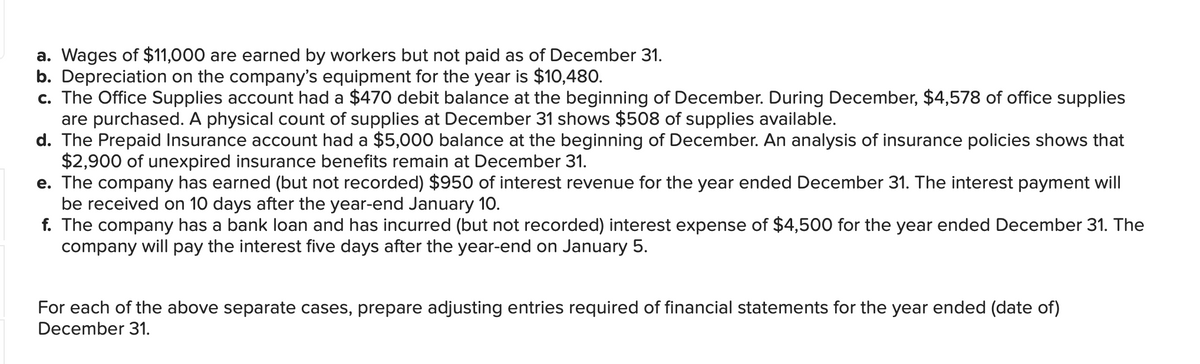

a. Wages of $11,000 are earned by workers but not paid as of December 31. b. Depreciation on the company's equipment for the year is $10,480. c. The Office Supplies account had a $470 debit balance at the beginning of December. During December, $4,578 of office supplies are purchased. A physical count of supplies at December 31 shows $508 of supplies available. d. The Prepaid Insurance account had a $5,000 balance at the beginning of December. An analysis of insurance policies shows that $2,900 of unexpired insurance benefits remain at December 31. e. The company has earned (but not recorded) $950 of interest revenue for the year ended December 31. The interest payment will be received on 10 days after the year-end January 10. f. The company has a bank loan and has incurred (but not recorded) interest expense of $4,500 for the year ended December 31. The company will pay the interest five days after the year-end on January 5. For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31.

a. Wages of $11,000 are earned by workers but not paid as of December 31. b. Depreciation on the company's equipment for the year is $10,480. c. The Office Supplies account had a $470 debit balance at the beginning of December. During December, $4,578 of office supplies are purchased. A physical count of supplies at December 31 shows $508 of supplies available. d. The Prepaid Insurance account had a $5,000 balance at the beginning of December. An analysis of insurance policies shows that $2,900 of unexpired insurance benefits remain at December 31. e. The company has earned (but not recorded) $950 of interest revenue for the year ended December 31. The interest payment will be received on 10 days after the year-end January 10. f. The company has a bank loan and has incurred (but not recorded) interest expense of $4,500 for the year ended December 31. The company will pay the interest five days after the year-end on January 5. For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2PA: The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal...

Related questions

Question

Transcribed Image Text:a. Wages of $11,000 are earned by workers but not paid as of December 31.

b. Depreciation on the company's equipment for the year is $10,480.

c. The Office Supplies account had a $470 debit balance at the beginning of December. During December, $4,578 of office supplies

are purchased. A physical count of supplies at December 31 shows $508 of supplies available.

d. The Prepaid Insurance account had a $5,000 balance at the beginning of December. An analysis of insurance policies shows that

$2,900 of unexpired insurance benefits remain at December 31.

e. The company has earned (but not recorded) $950 of interest revenue for the year ended December 31. The interest payment will

be received on 10 days after the year-end January 10.

f. The company has a bank loan and has incurred (but not recorded) interest expense of $4,500 for the year ended December 31. The

company will pay the interest five days after the year-end on January 5.

For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of)

December 31.

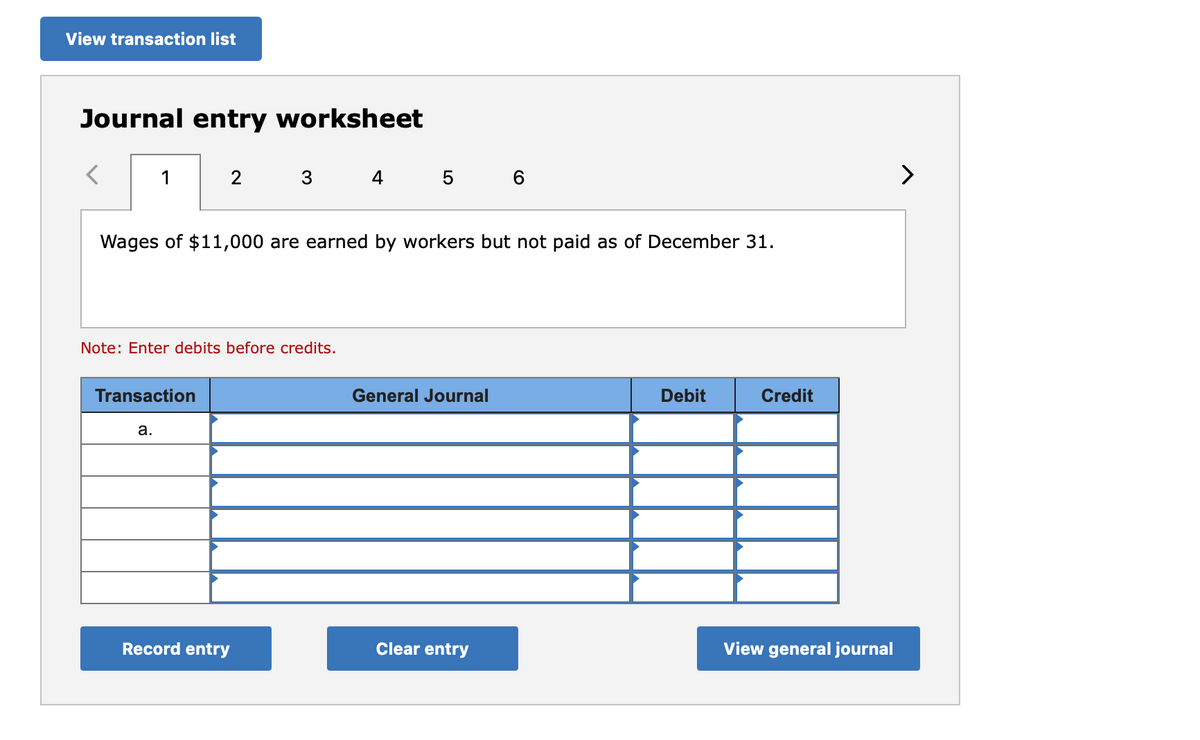

Transcribed Image Text:View transaction list

Journal entry worksheet

1

4

6

>

Wages of $11,000 are earned by workers but not paid as of December 31.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

а.

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage