a. $600 interest from a savings account at a Florida bank. b. $5,000 dividend from U.S. Flower Company, a U.S. corporation that operates solely in the eastern United States. C. Transaction d. e. $7,000 dividend from Stern Corporation, a U.S. corporation that generated total gross income of $4,000,000 from the active conduct of a foreign trade or business for the immediately preceding three tax years. Stern's total gross income for the same period was $5,000,000. $10,000 dividend from International Consolidated, Inc. a foreign corporation that reported gross income of $4,000,000 effectively connected with the conduct of a U.S. trade or business for the immediately preceding three tax years. International's total gross income for the same period was $12,000,000. $5,000 interest on Warren Corporation bonds. Warren is a U.S. corporation that derived $6,000,000 of its gross income for the immediately preceding three tax years from operation of an active foreign business, and Warren's total gross income for this same period was $7,200,000. U.S.-Source Income Foreign-Source Income $ $ I

a. $600 interest from a savings account at a Florida bank. b. $5,000 dividend from U.S. Flower Company, a U.S. corporation that operates solely in the eastern United States. C. Transaction d. e. $7,000 dividend from Stern Corporation, a U.S. corporation that generated total gross income of $4,000,000 from the active conduct of a foreign trade or business for the immediately preceding three tax years. Stern's total gross income for the same period was $5,000,000. $10,000 dividend from International Consolidated, Inc. a foreign corporation that reported gross income of $4,000,000 effectively connected with the conduct of a U.S. trade or business for the immediately preceding three tax years. International's total gross income for the same period was $12,000,000. $5,000 interest on Warren Corporation bonds. Warren is a U.S. corporation that derived $6,000,000 of its gross income for the immediately preceding three tax years from operation of an active foreign business, and Warren's total gross income for this same period was $7,200,000. U.S.-Source Income Foreign-Source Income $ $ I

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 9E

Related questions

Question

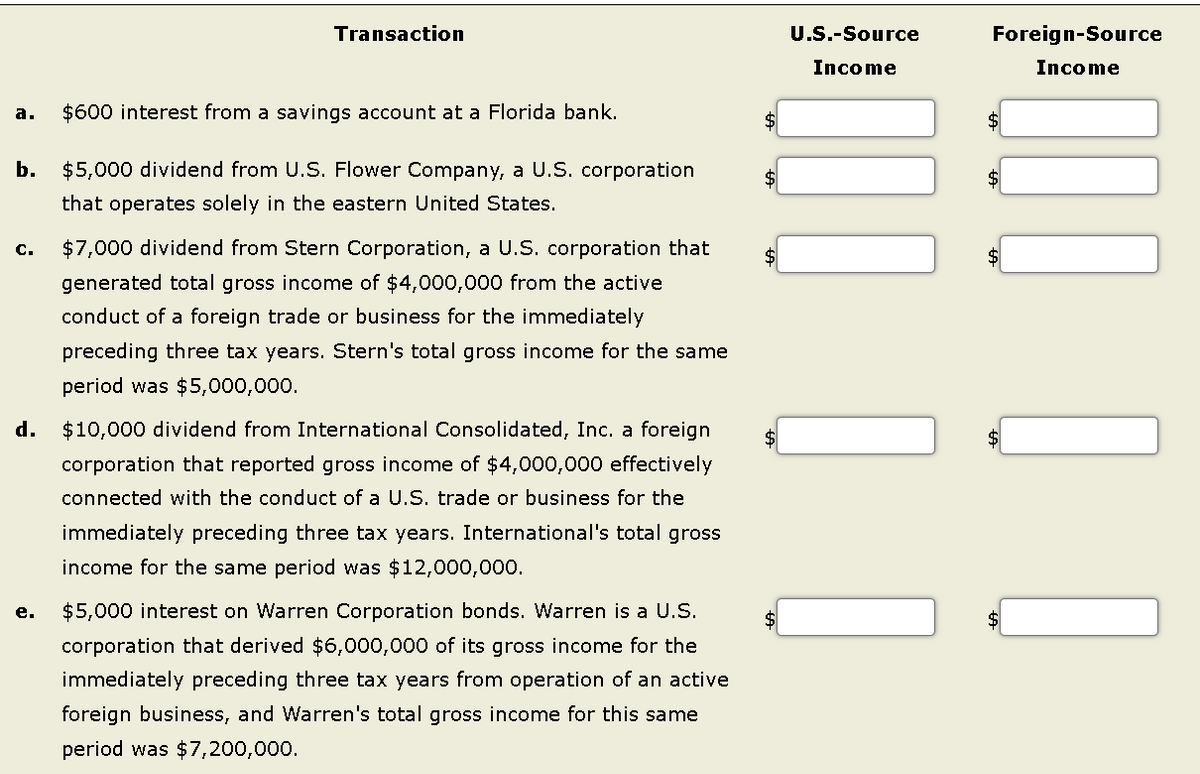

Emma, a U.S. resident, received the following income items for the current tax year. Determine the amount of U.S.-Source Income and Foreign-Source Income for each item.

Transcribed Image Text:a. $600 interest from a savings account at a Florida bank.

b. $5,000 dividend from U.S. Flower Company, a U.S. corporation

that operates solely in the eastern United States.

C.

Transaction

d.

e.

$7,000 dividend from Stern Corporation, a U.S. corporation that

generated total gross income of $4,000,000 from the active

conduct of a foreign trade or business for the immediately

preceding three tax years. Stern's total gross income for the same

period was $5,000,000.

$10,000 dividend from International Consolidated, Inc. a foreign

corporation that reported gross income of $4,000,000 effectively

connected with the conduct of a U.S. trade or business for the

immediately preceding three tax years. International's total gross

income for the same period was $12,000,000.

$5,000 interest on Warren Corporation bonds. Warren is a U.S.

corporation that derived $6,000,000 of its gross income for the

immediately preceding three tax years from operation of an active

foreign business, and Warren's total gross income for this same

period was $7,200,000.

$

$

U.S.-Source

Income

Foreign-Source

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning